Online banking - Our key features and how to use them

Mobile banking - Our key features and how to use them

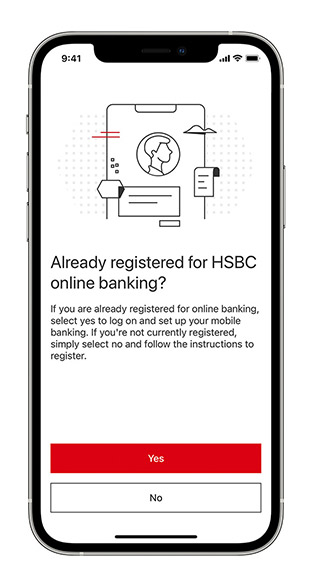

Activation and Log On

The new HSBC UAE app offers you the ease of banking securely at your fingertips.

Launch your HSBC Mobile Banking app and follow the instructions on your screen.

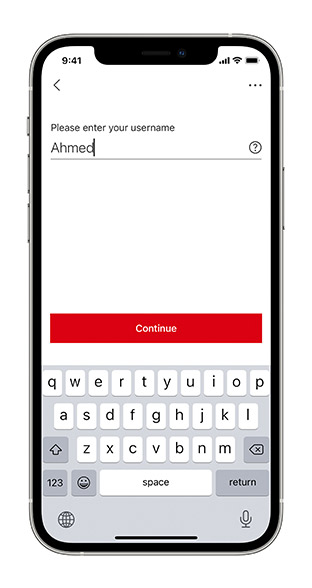

Step 1:

Type in your username and select 'Continue'.

Step 2:

Enter your password and proceed to the next step by clicking on 'Continue'.

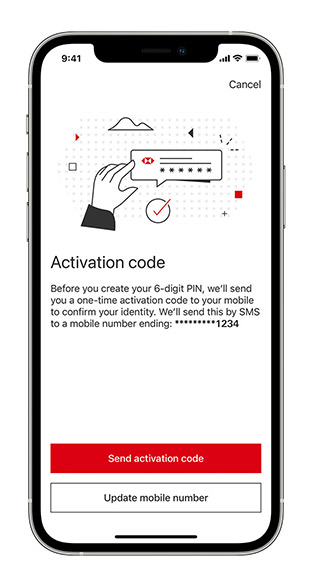

Step 3:

Click on 'Send activation code' to receive a text message of your One Time Activation Code on the registered mobile number.

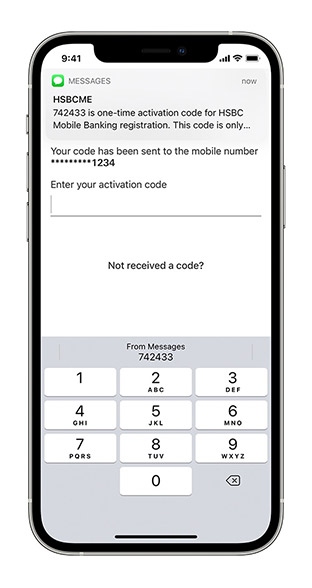

Step 4:

Enter your One Time Activation Code on the screen once received.

Step 5:

Create a new 6-digit PIN which you can use to log in.

Step 6:

Finally, enter your chosen PIN to activate your new mobile banking journey. You're ready to start Mobile Banking.

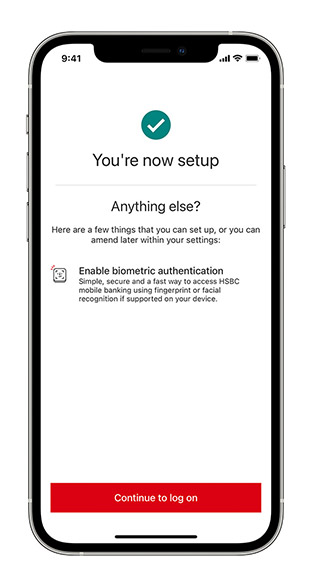

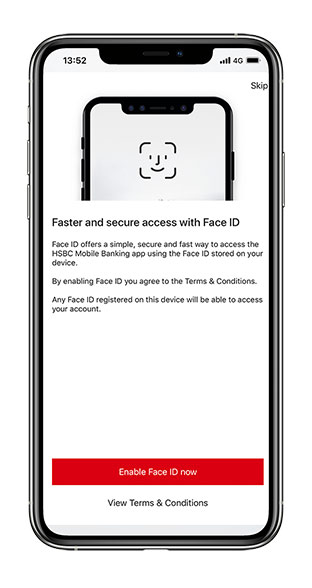

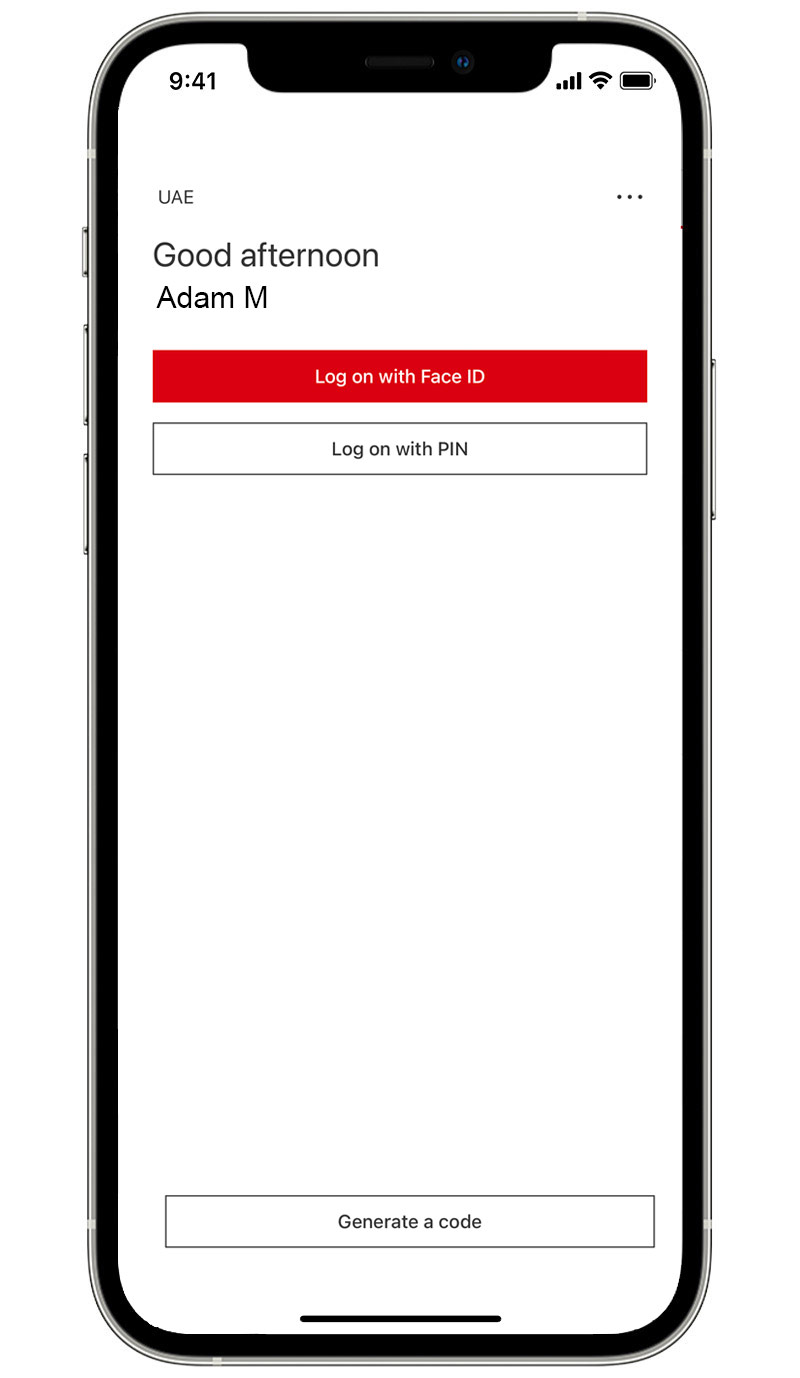

Step 7:

Additionally, you can also access and secure your account by enabling Face ID on your iOS mobile phones.

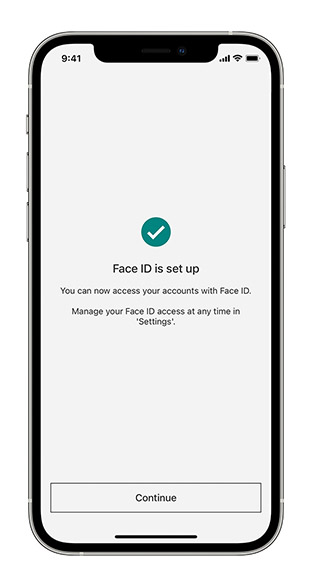

Step 8:

Click 'Enable Face ID' to finish the set up.

Step 9:

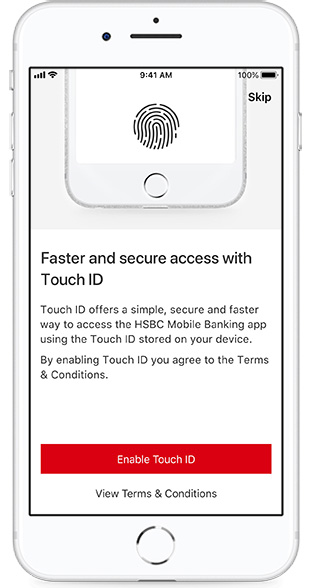

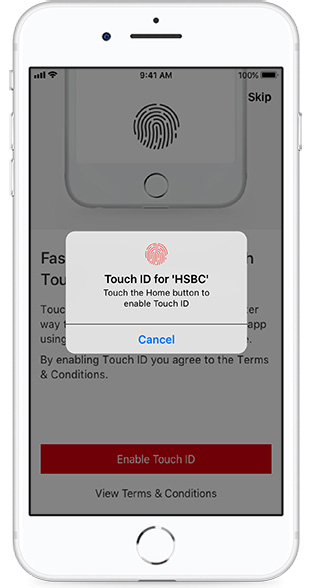

You can also access and secure your account with biometrics. Select 'Enable Touch ID' to complete your fingerprint authentication with iOS Touch ID or AndroidTM Fingerprints.

Step 10:

Simply touch the Home button and you're ready to go.

Step 11:

You have successfully activated your new HSBC Mobile Banking app.

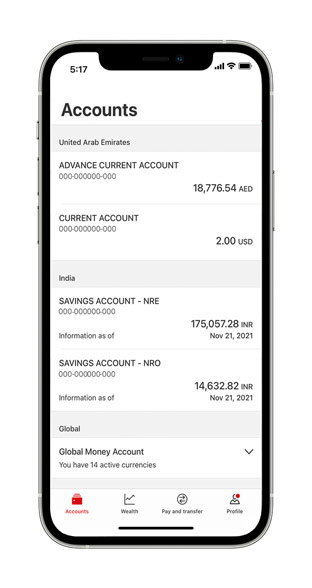

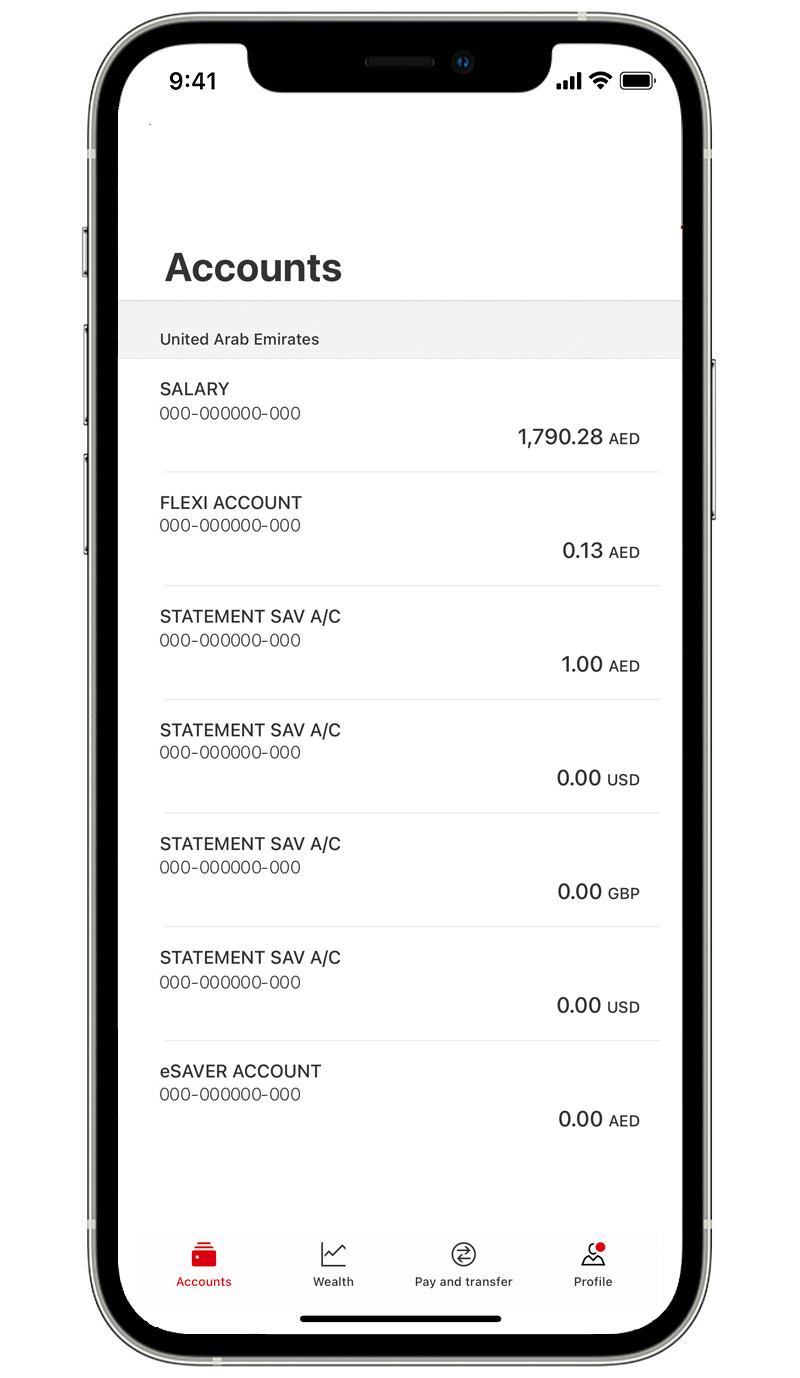

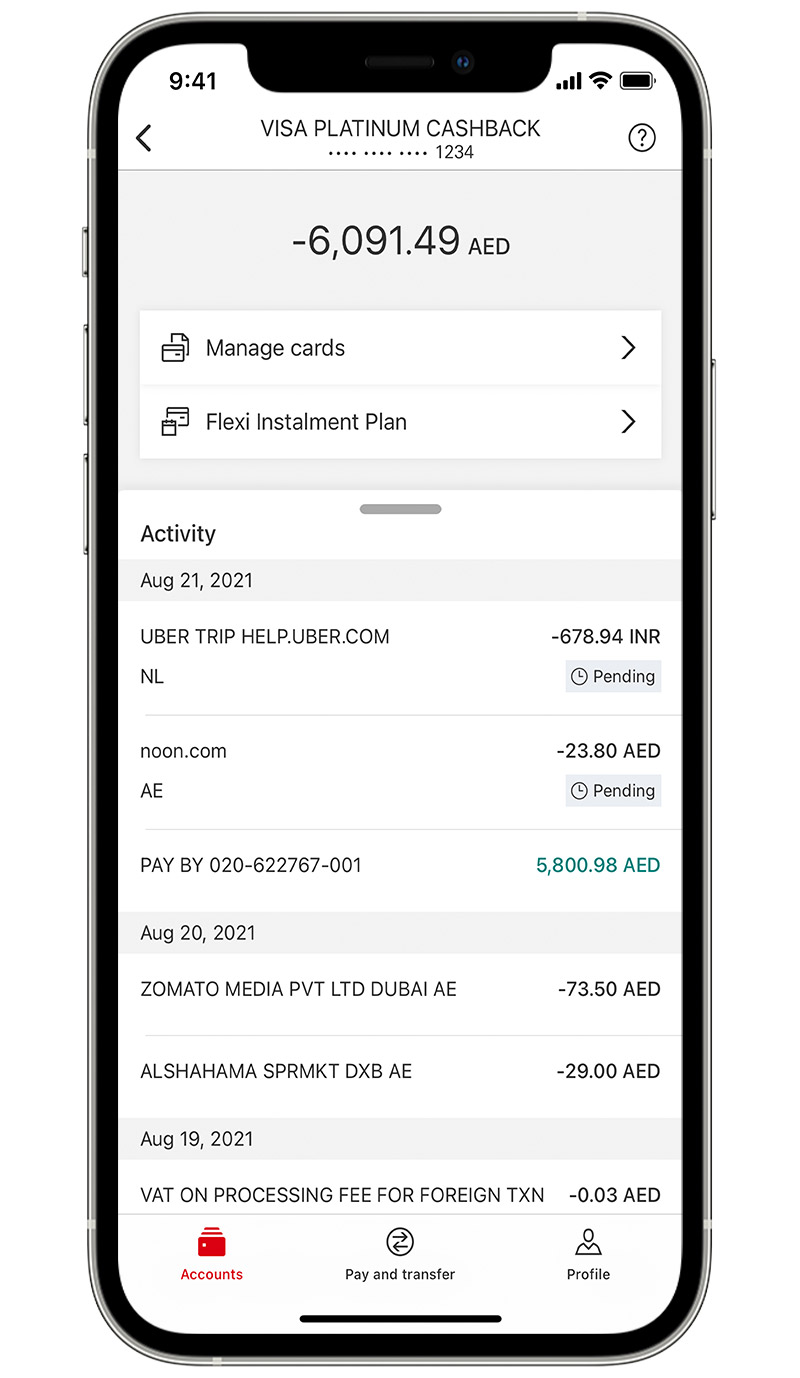

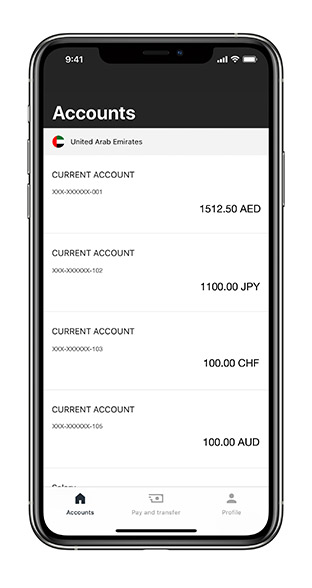

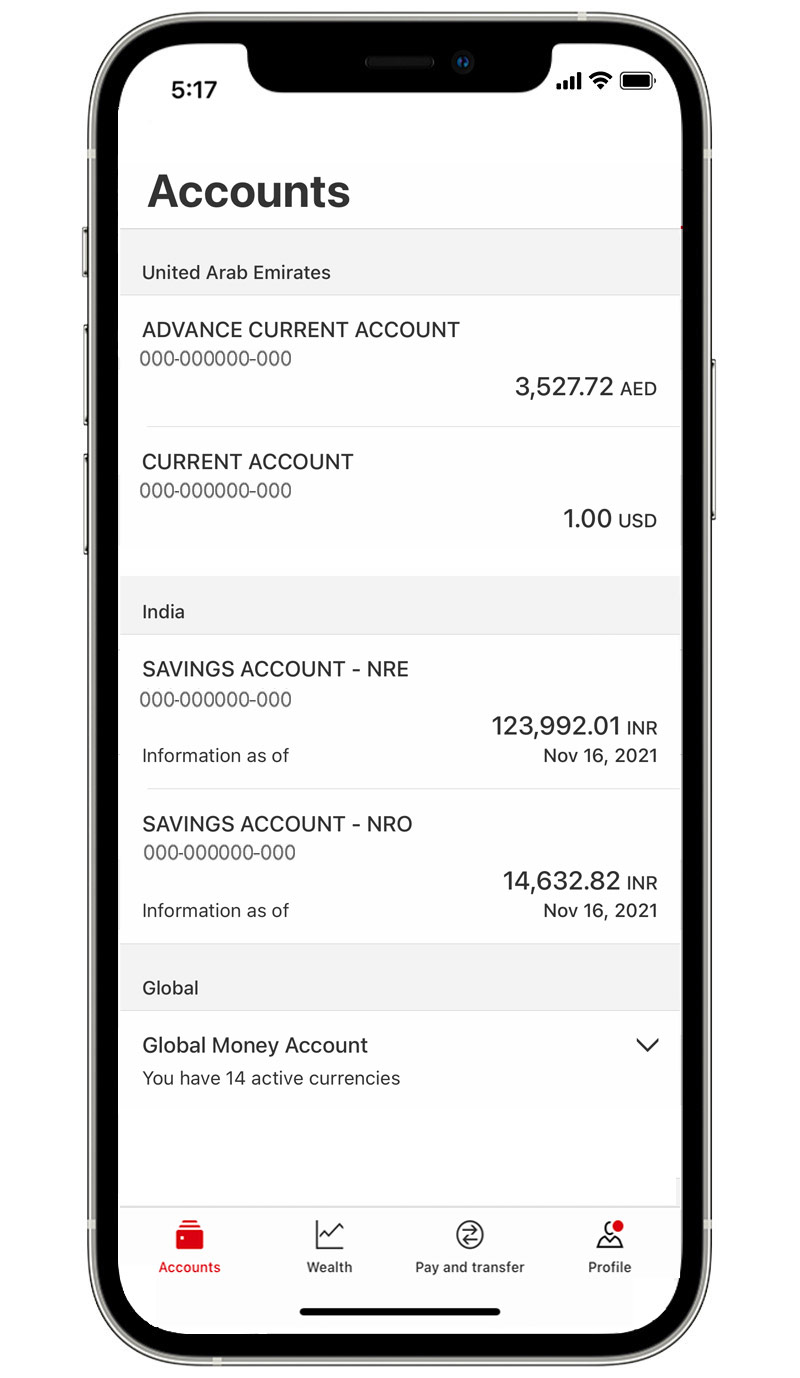

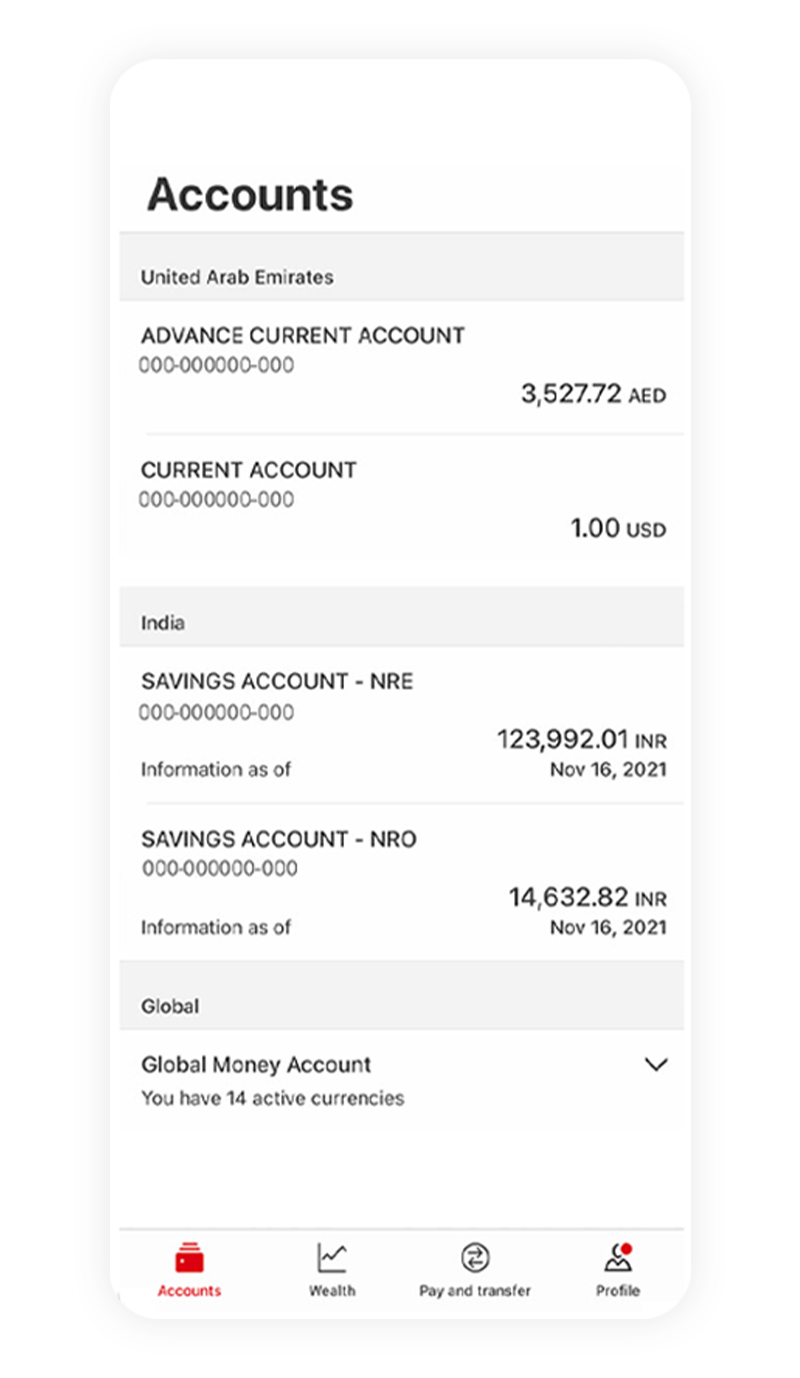

Local/Global View and Account Transactions

You can view and manage all your local and global HSBC accounts on a single screen.

Step 1:

Log in to see all your accounts held in different countries/regions and their balances, all at once.

Step 2:

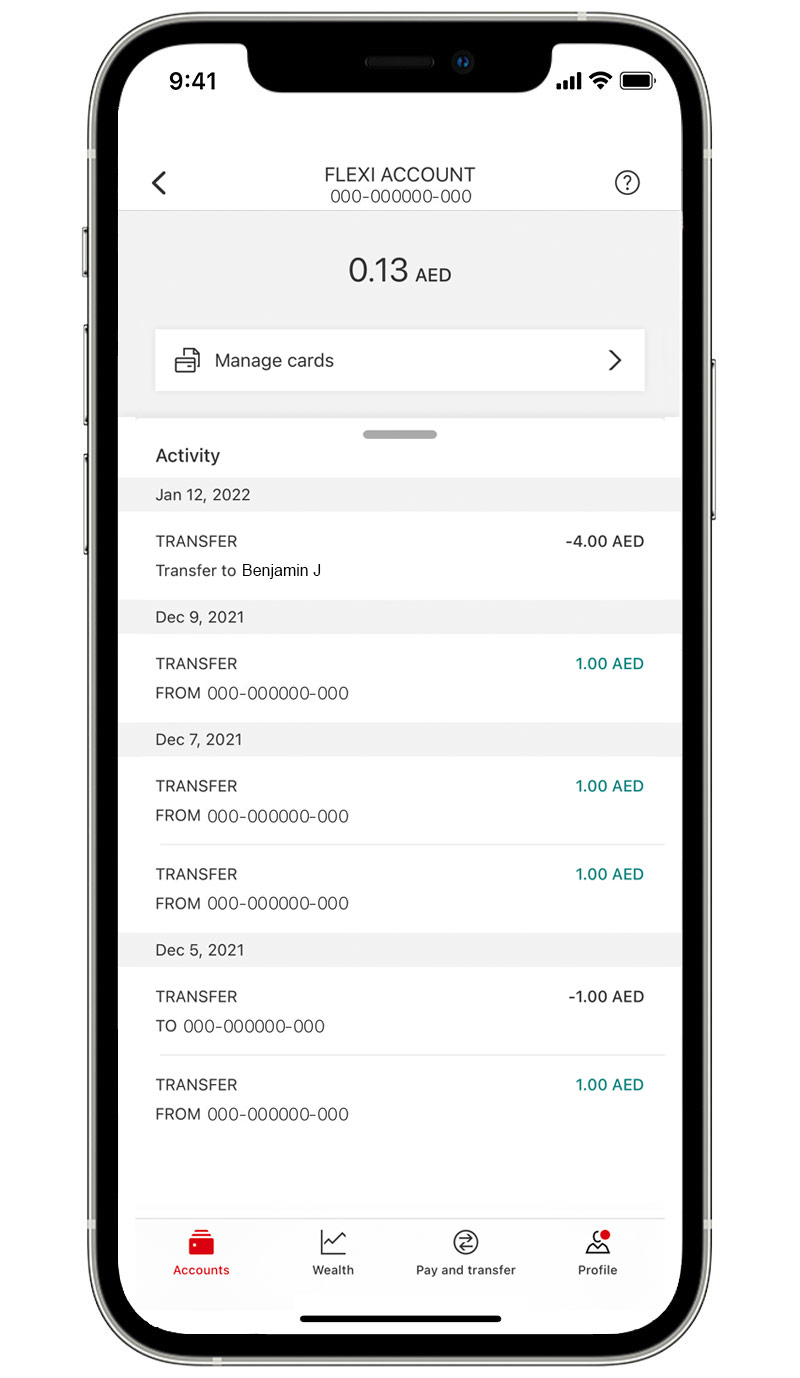

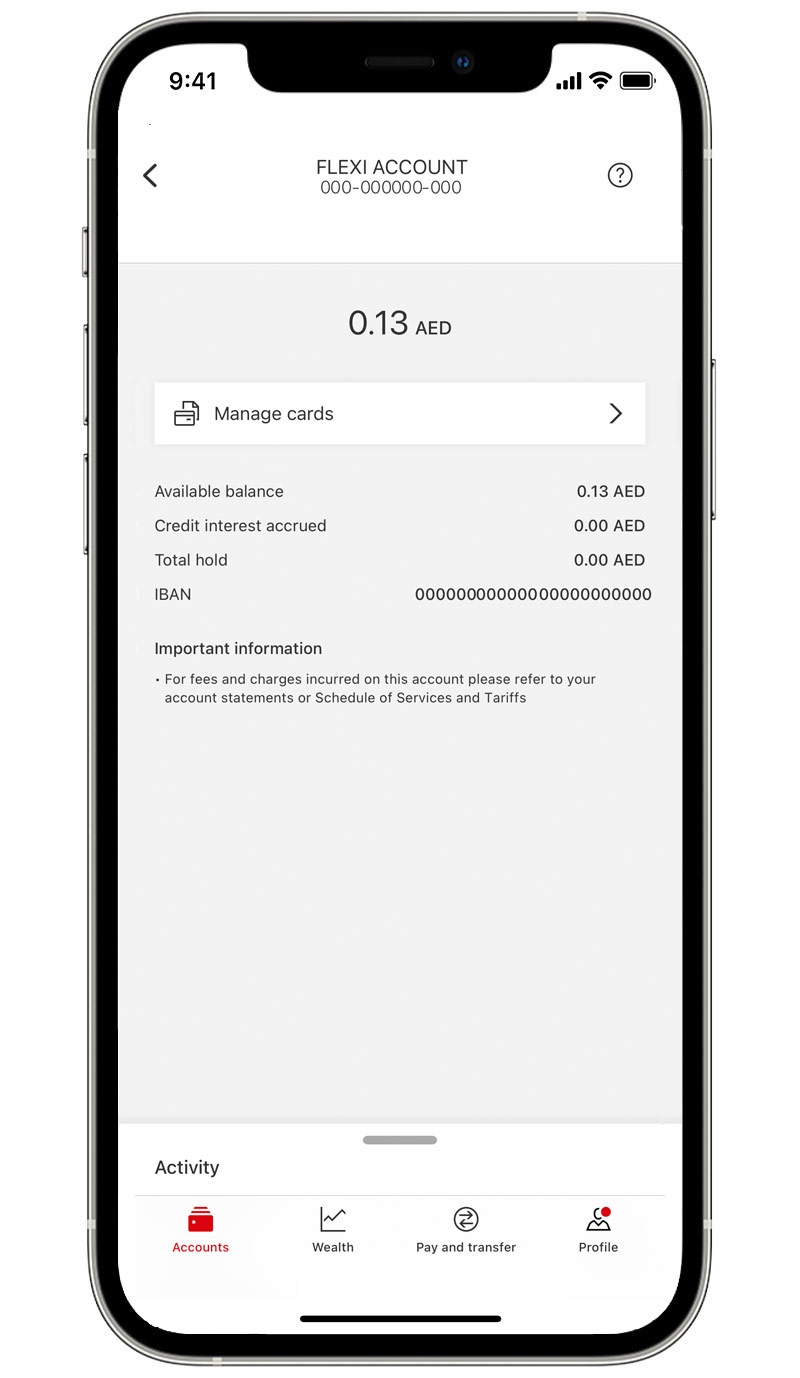

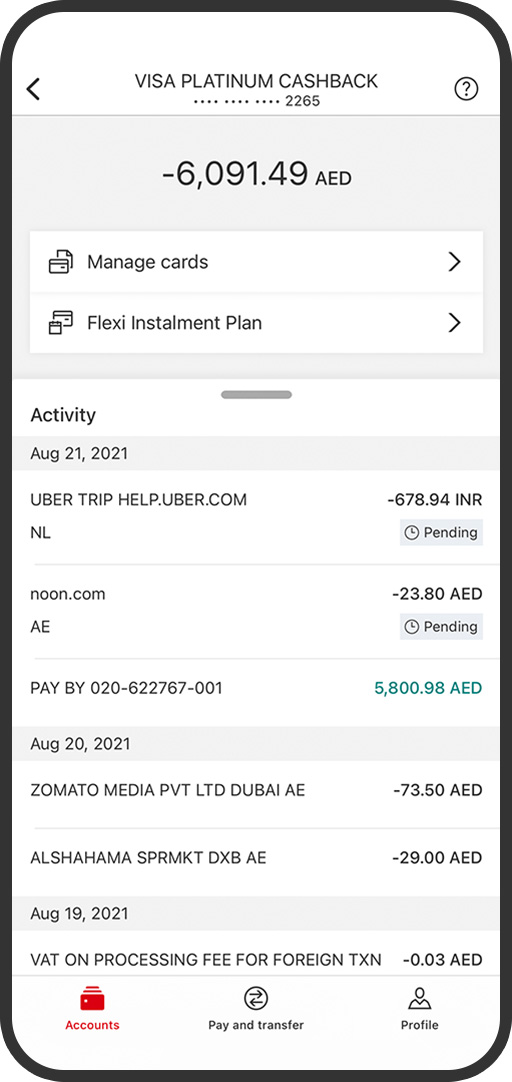

Select an account or credit card to view transaction history.

Step 3:

Pull down the activity drawer to see other account information.

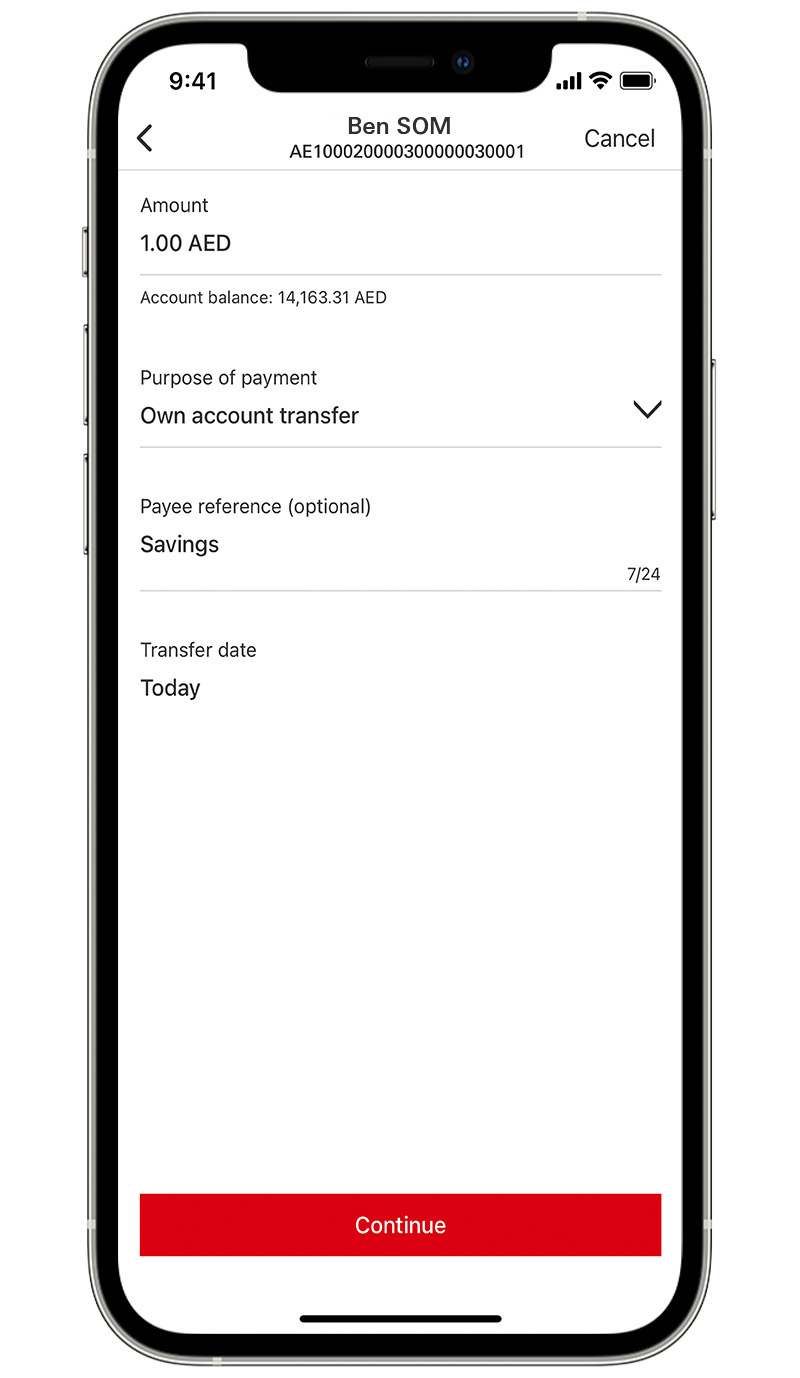

Make a domestic transfer

A simple and convenient way to transfer money anywhere and anytime, with a few clicks.

Step 1:

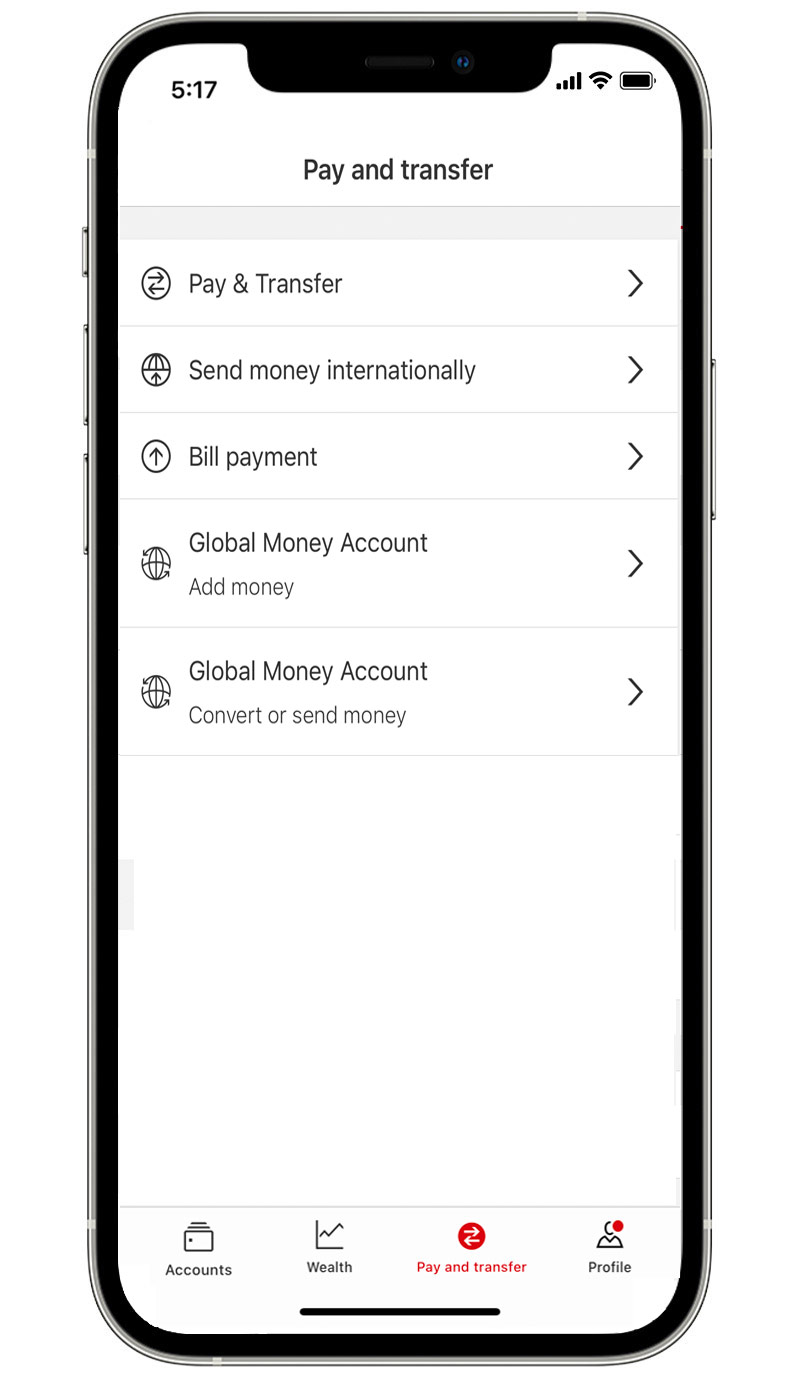

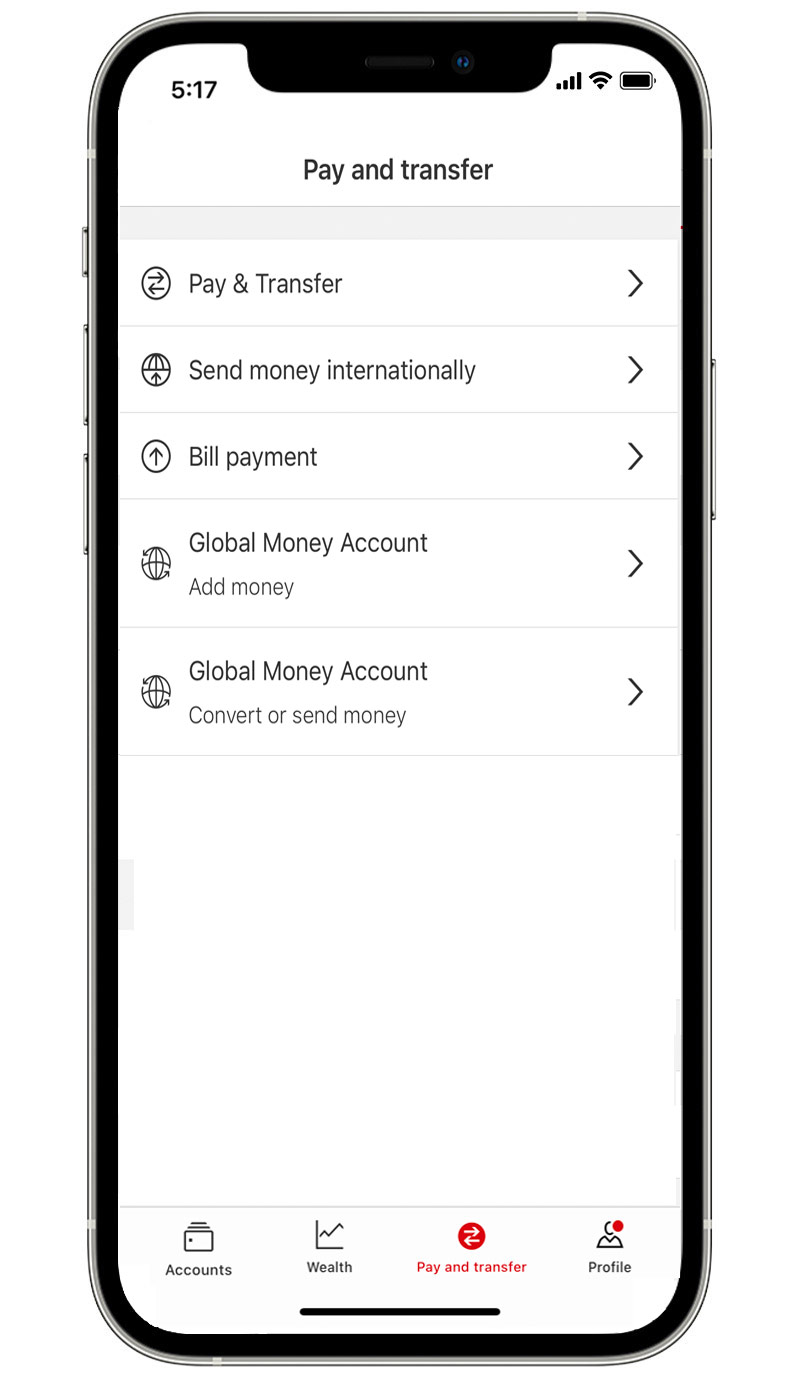

Log on and select 'Pay and Transfer'.

Step 2:

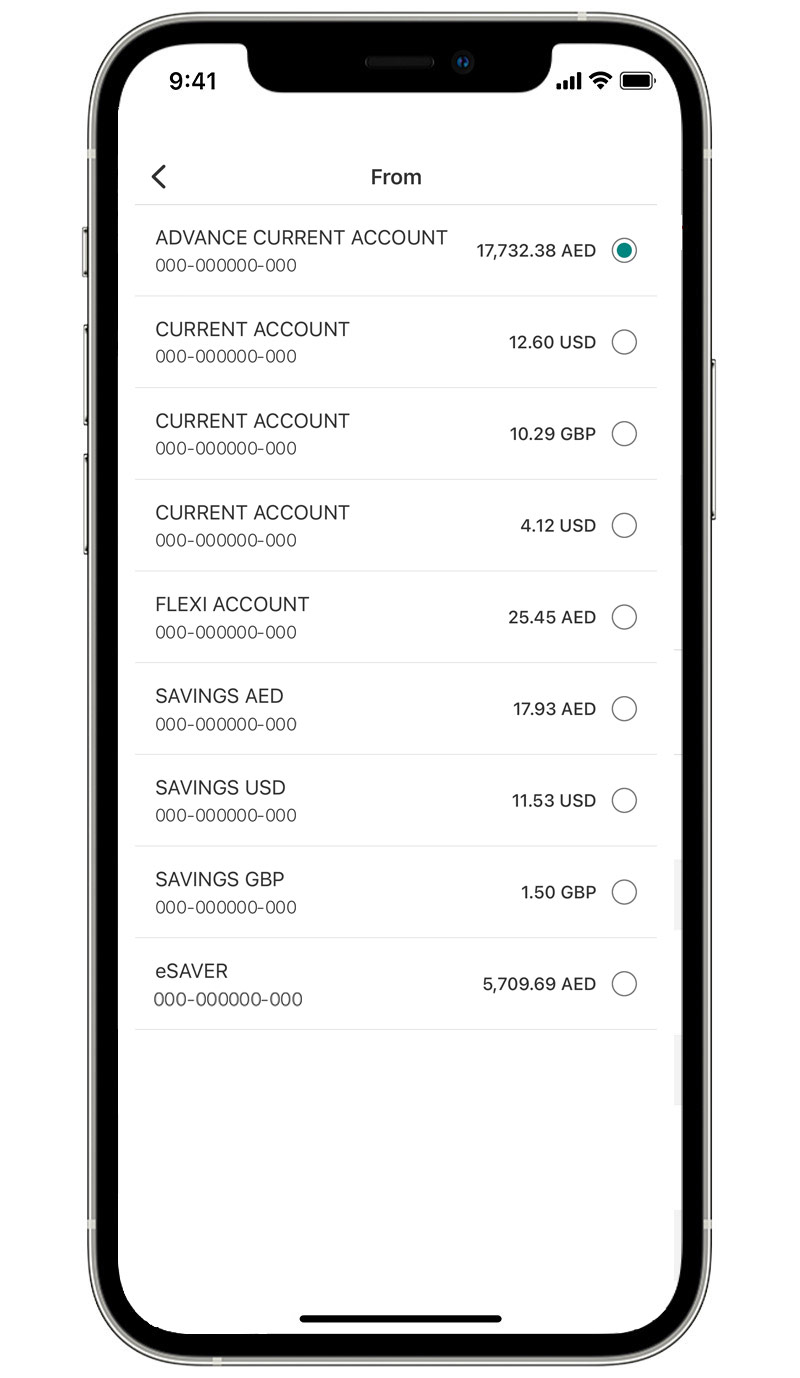

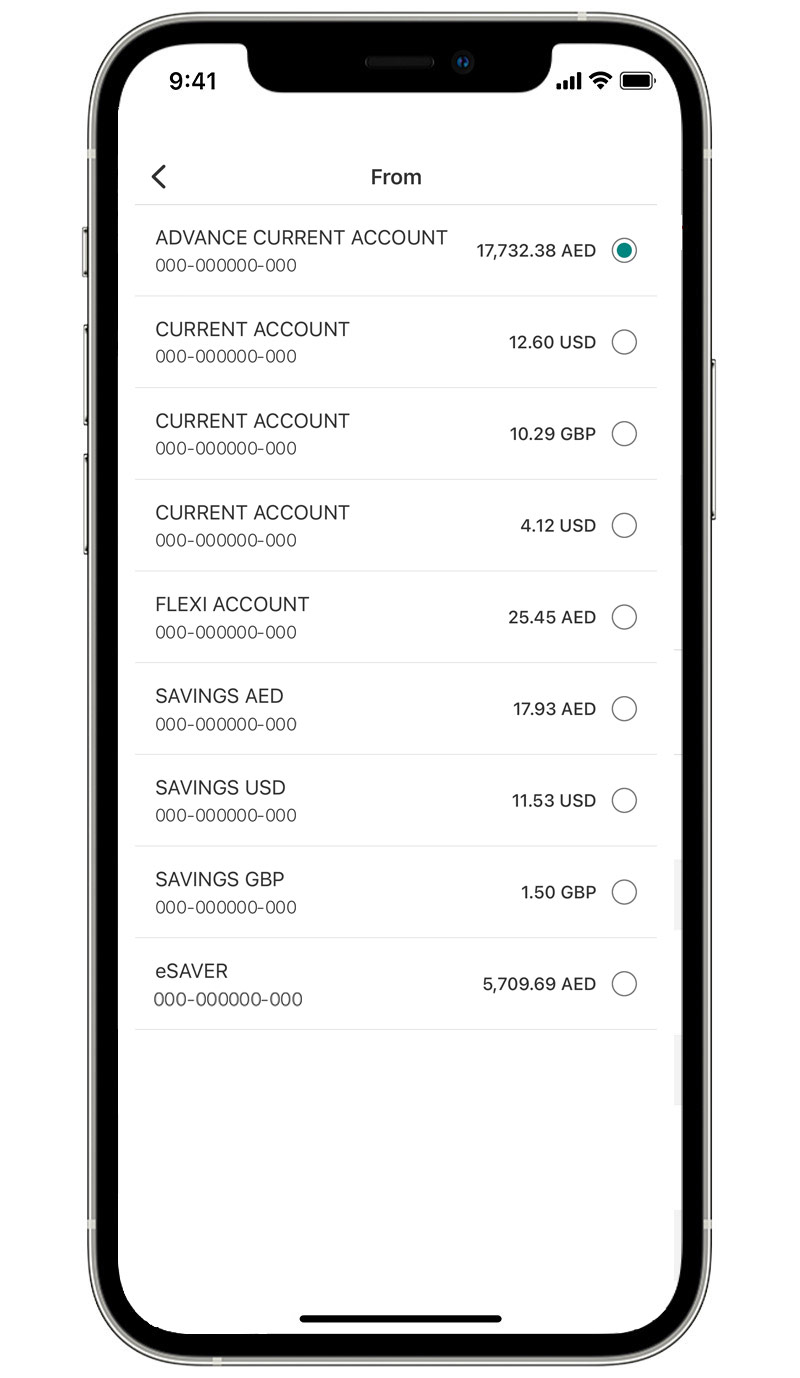

Select the account you'd like to transfer from.

Step 3:

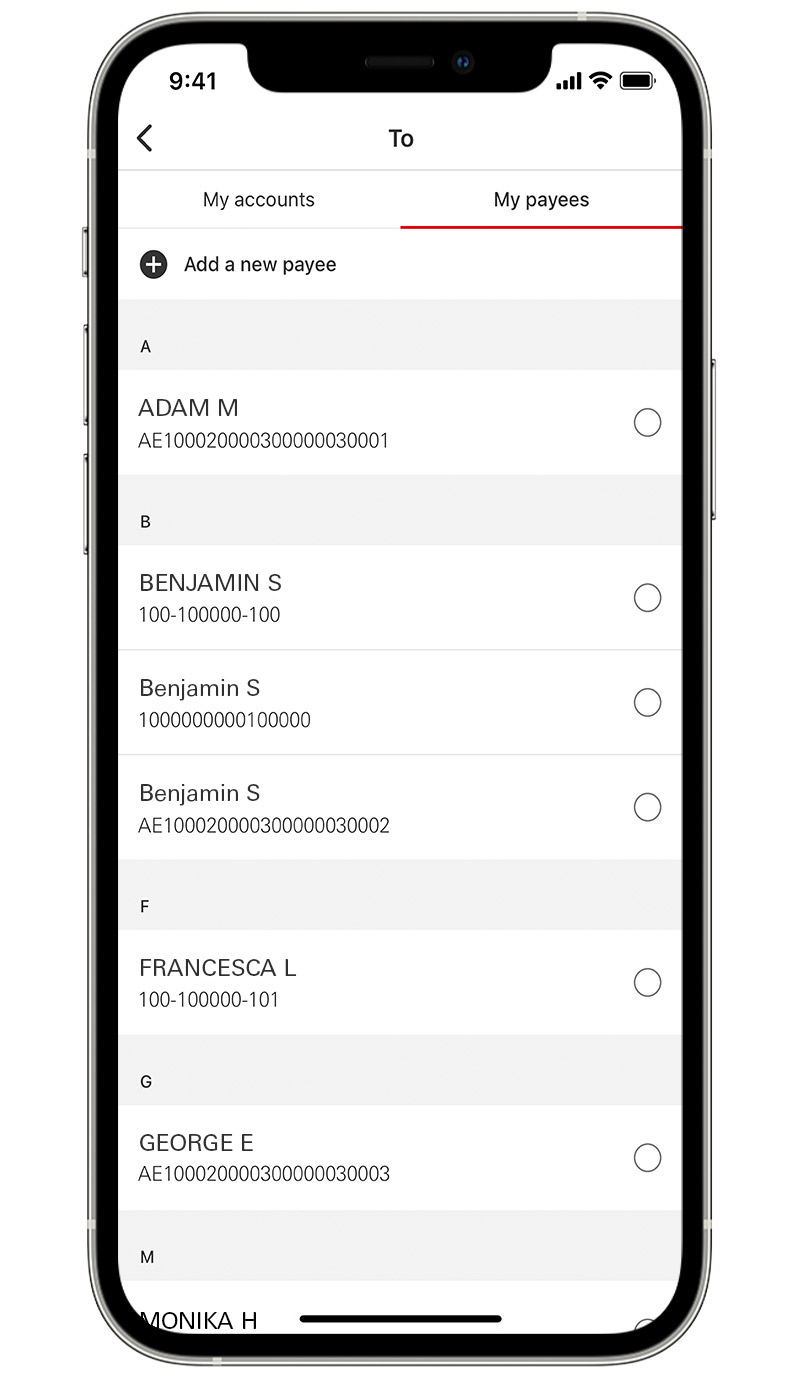

Select 'Add a new payee'.

Step 4:

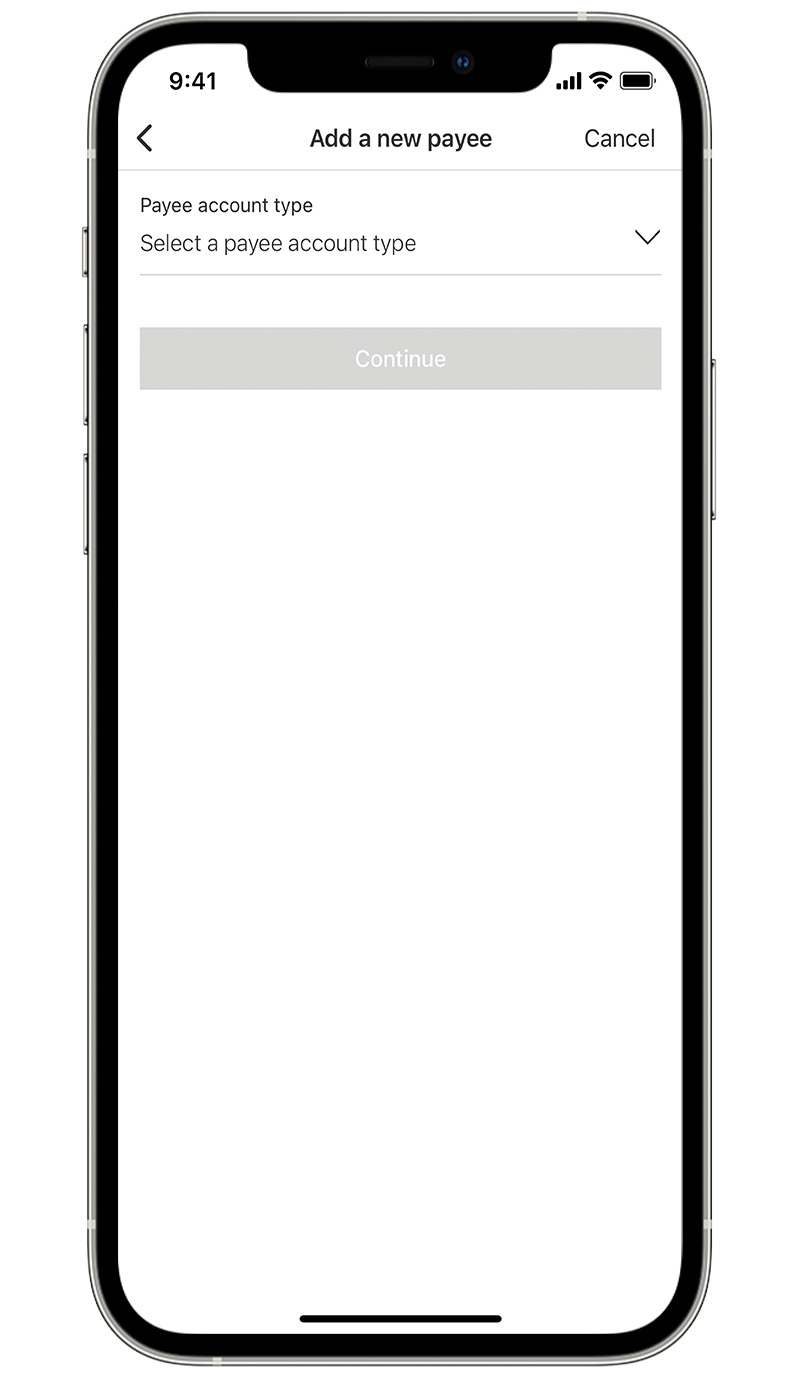

Select 'payee account type'.

Step 5:

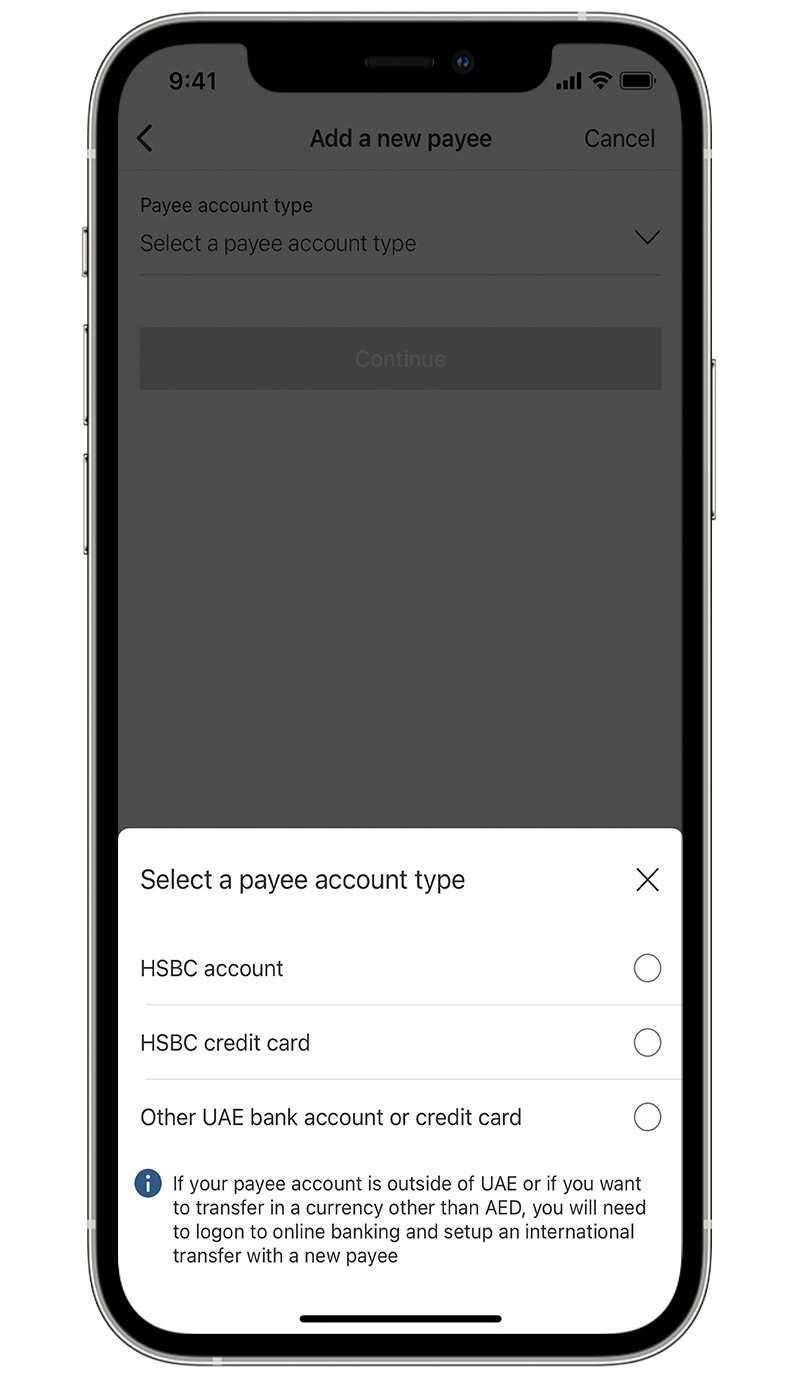

Select the correct payee account type from the list.

Step 6:

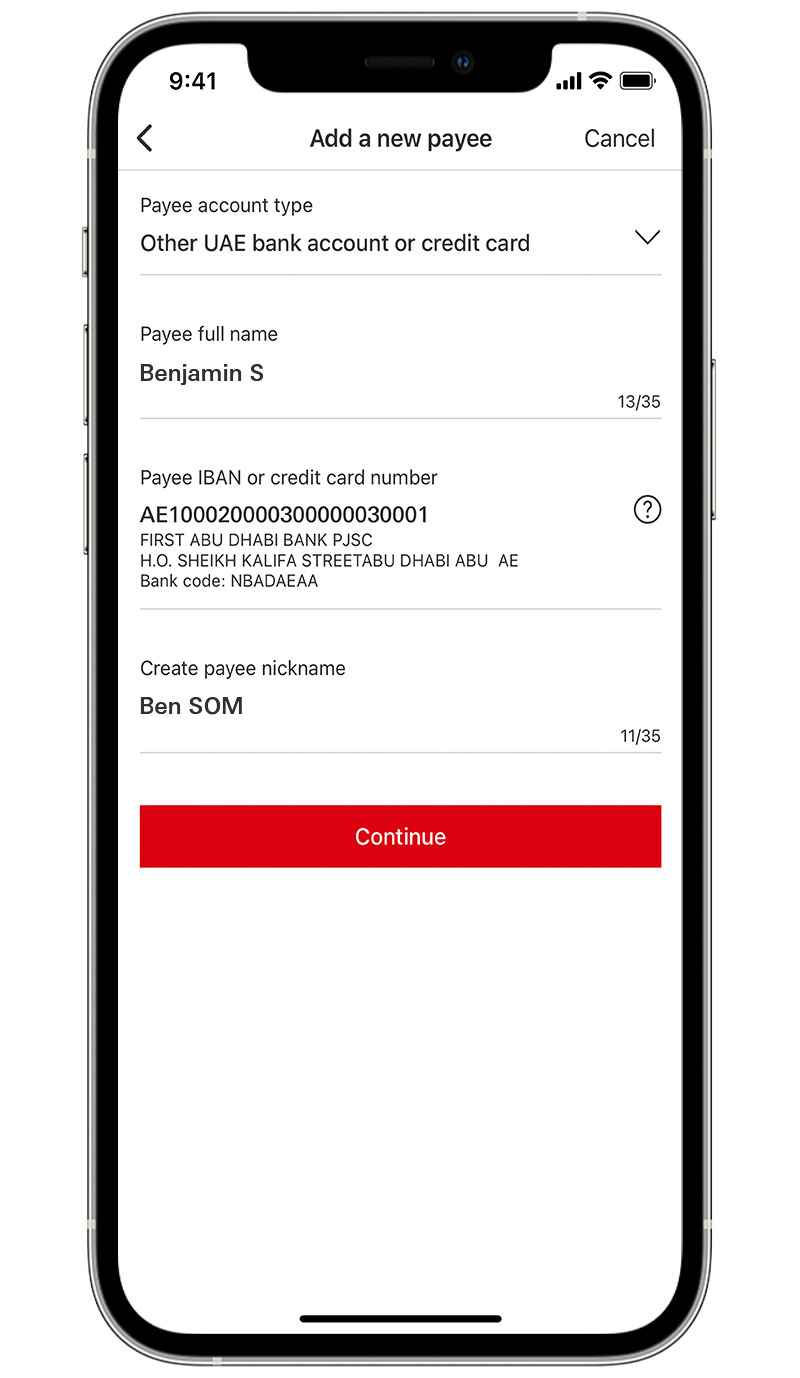

You'll now see the 'Add a new payee' screen where you can add the new payee's details.

Step 7:

Enter the required payee details and select 'Continue'.

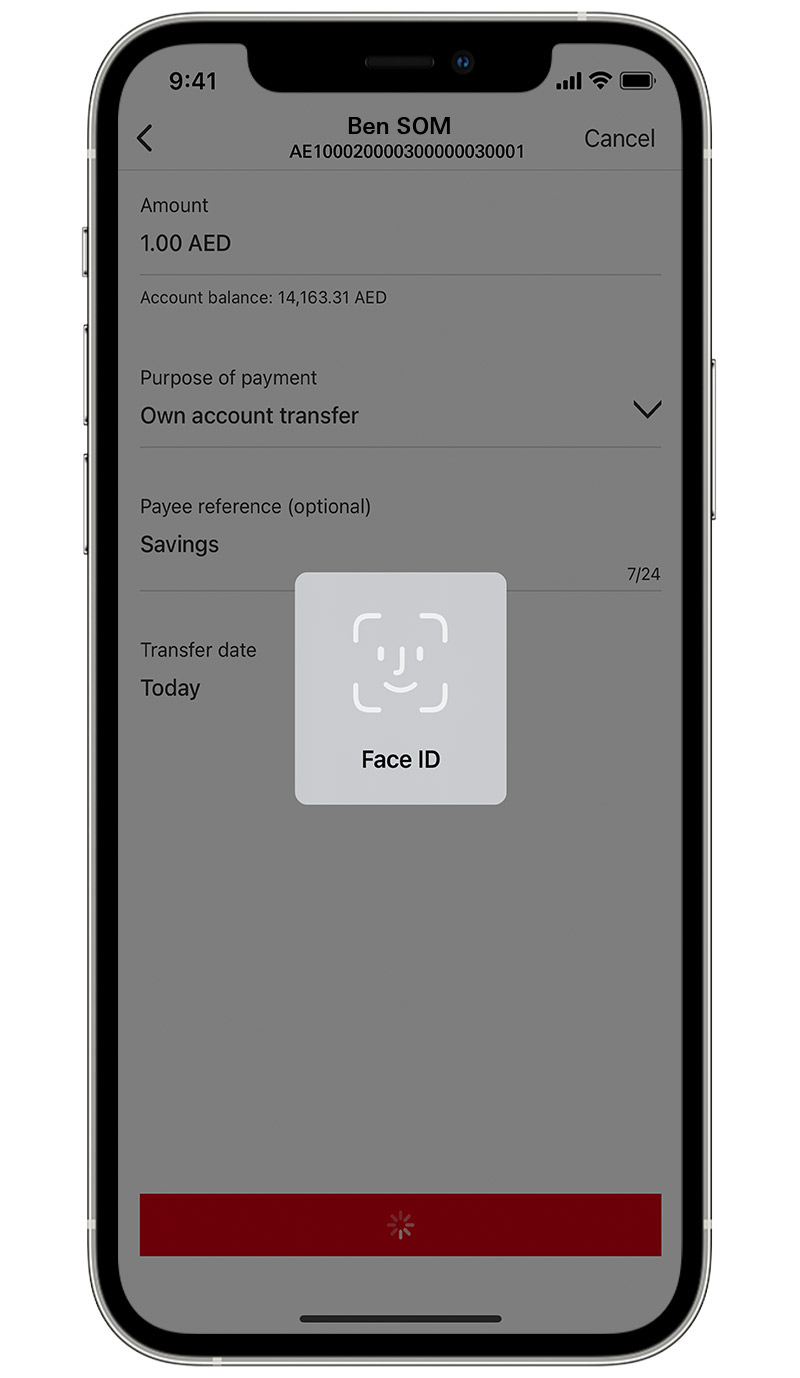

Step 8:

Confirm the new payee using your biometric authentication.

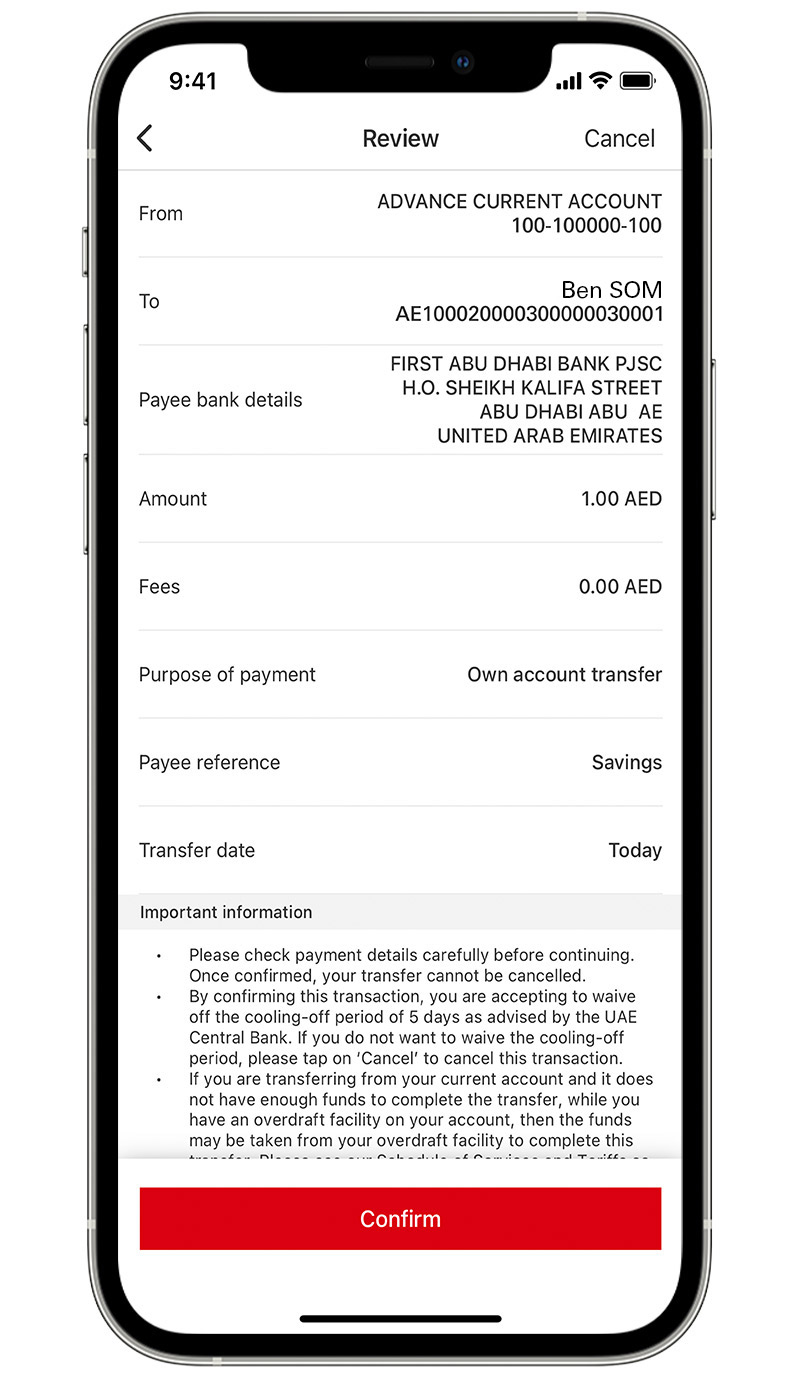

Step 9:

Check your transfer details and select 'Confirm'.

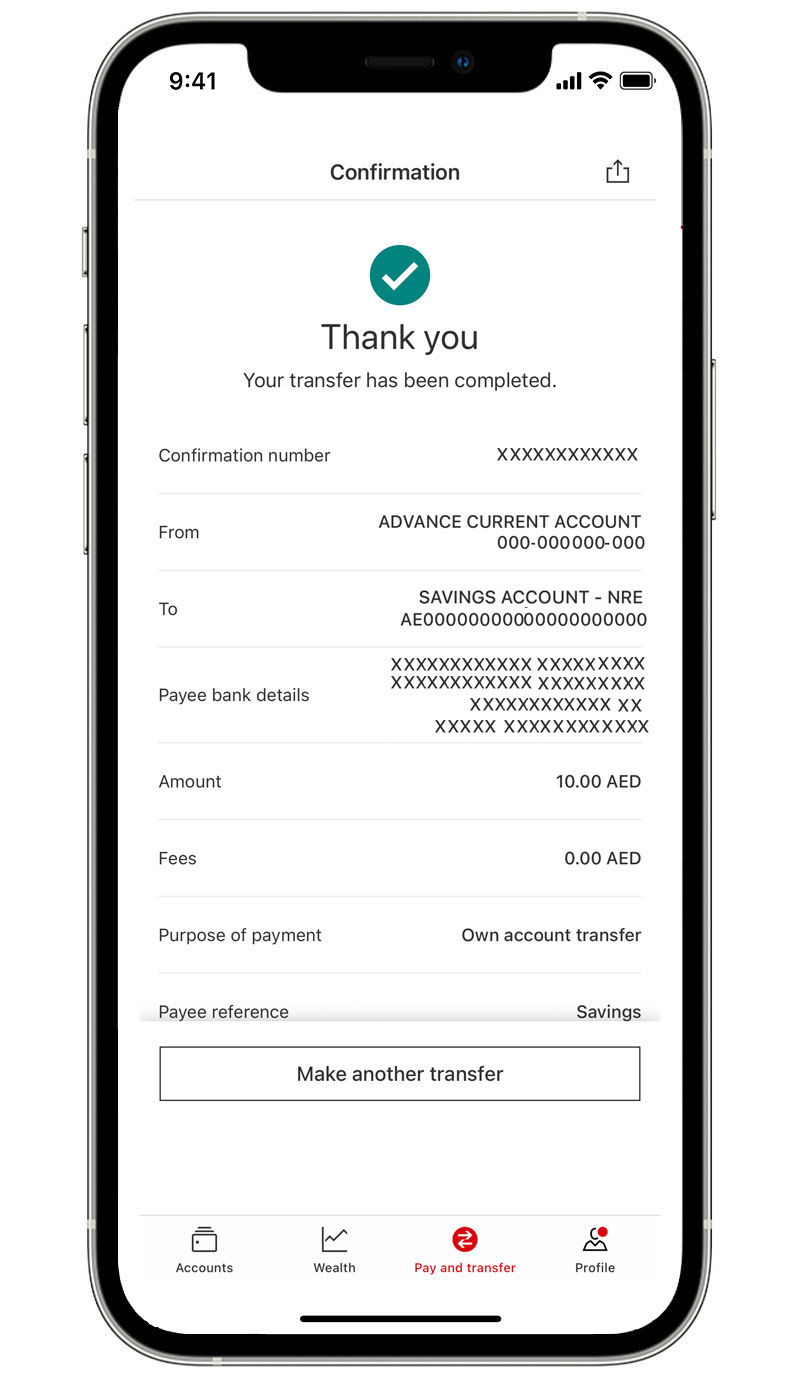

Step 10:

Your transfer is now confirmed.

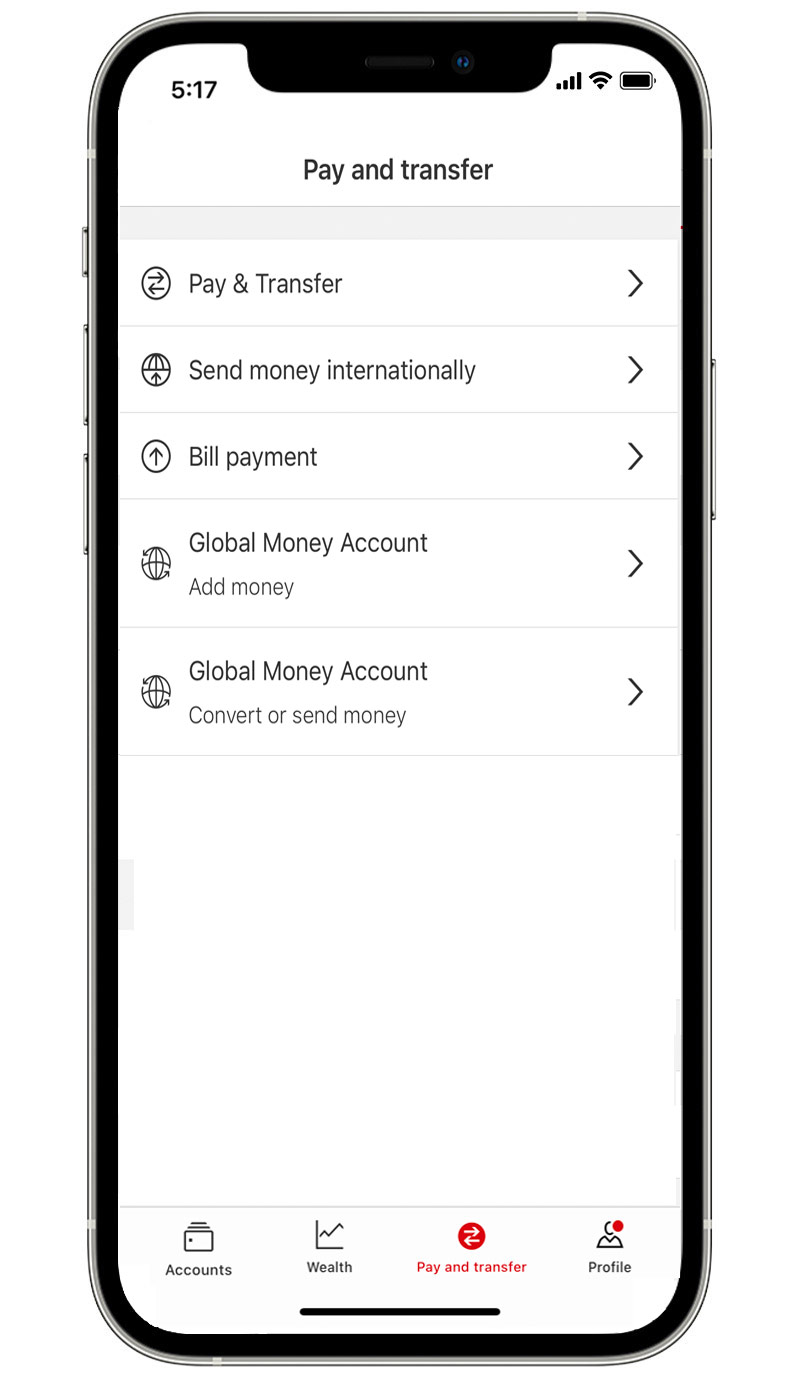

Global Transfer

Step 1:

Log on and select 'Pay and Transfer'.

Step 2:

Select the account you'd like to transfer from.

Step 3:

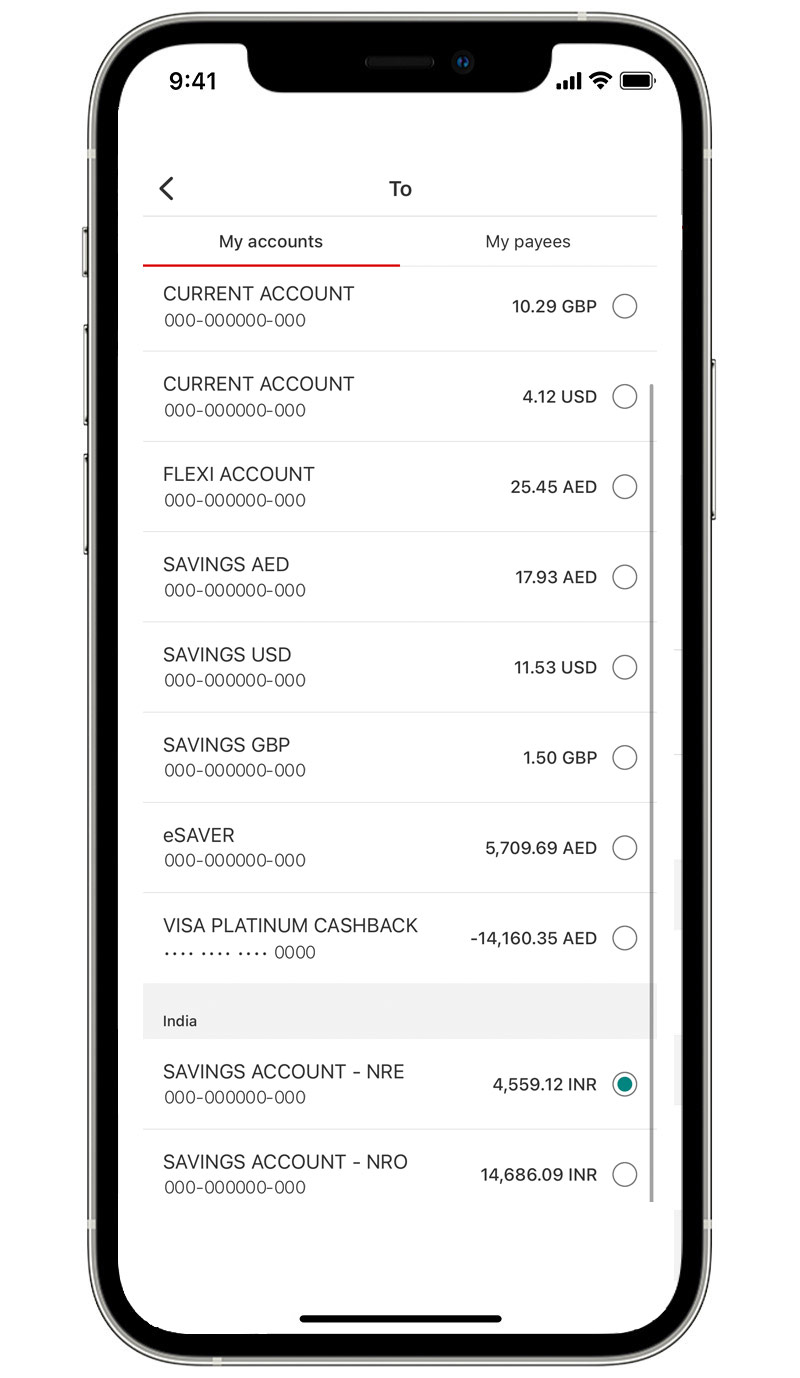

Select one of your already added international accounts as the account you'd like to transfer to.

Step 4:

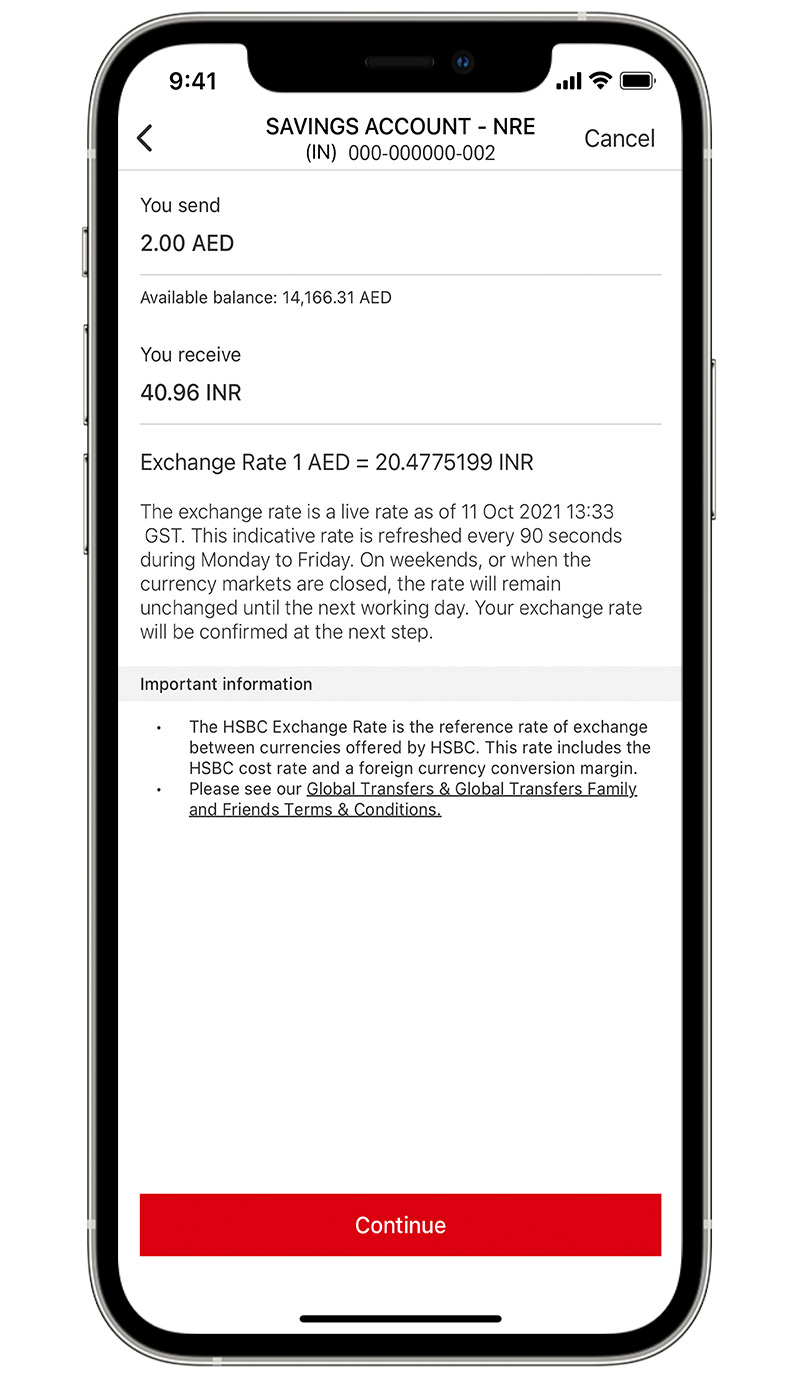

Enter the amount you want to transfer and check the FX rate.

Step 5:

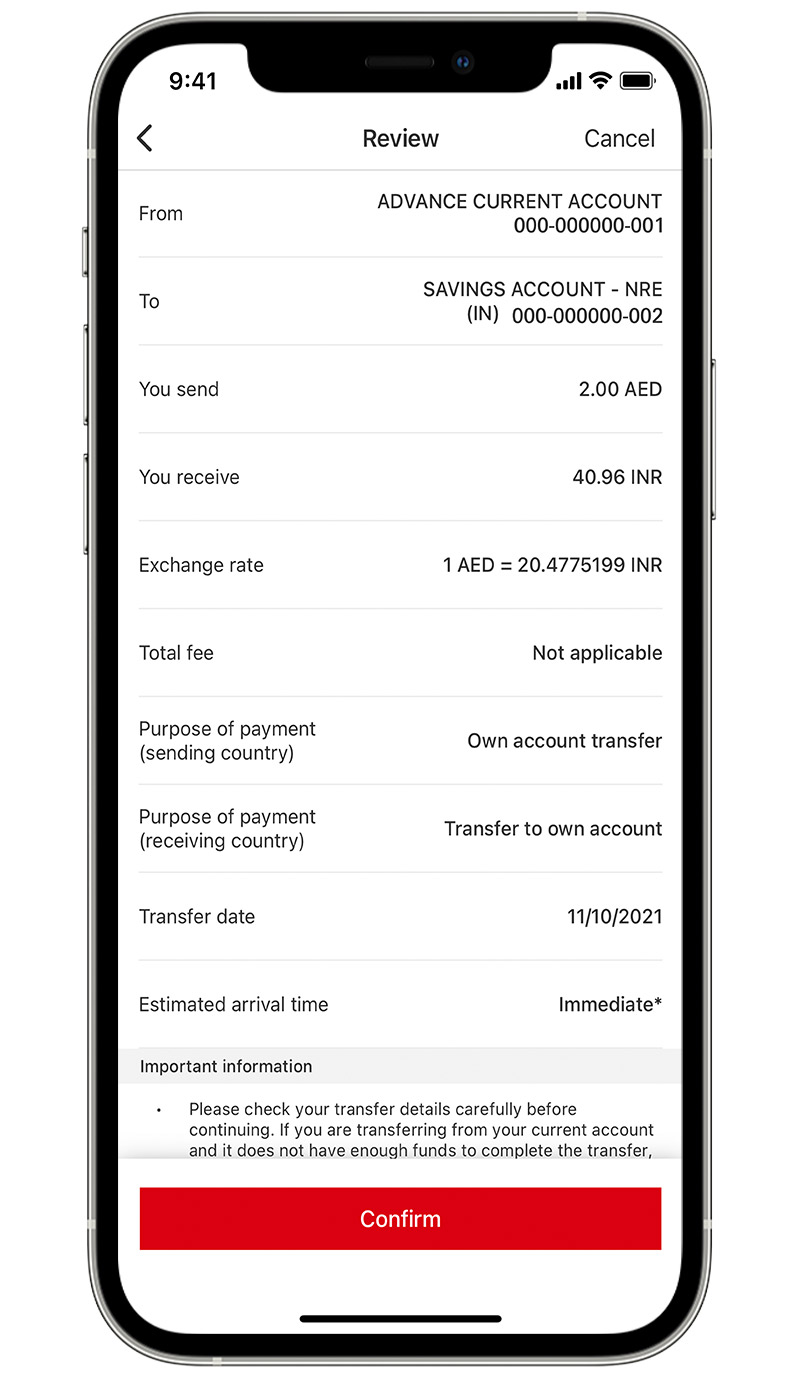

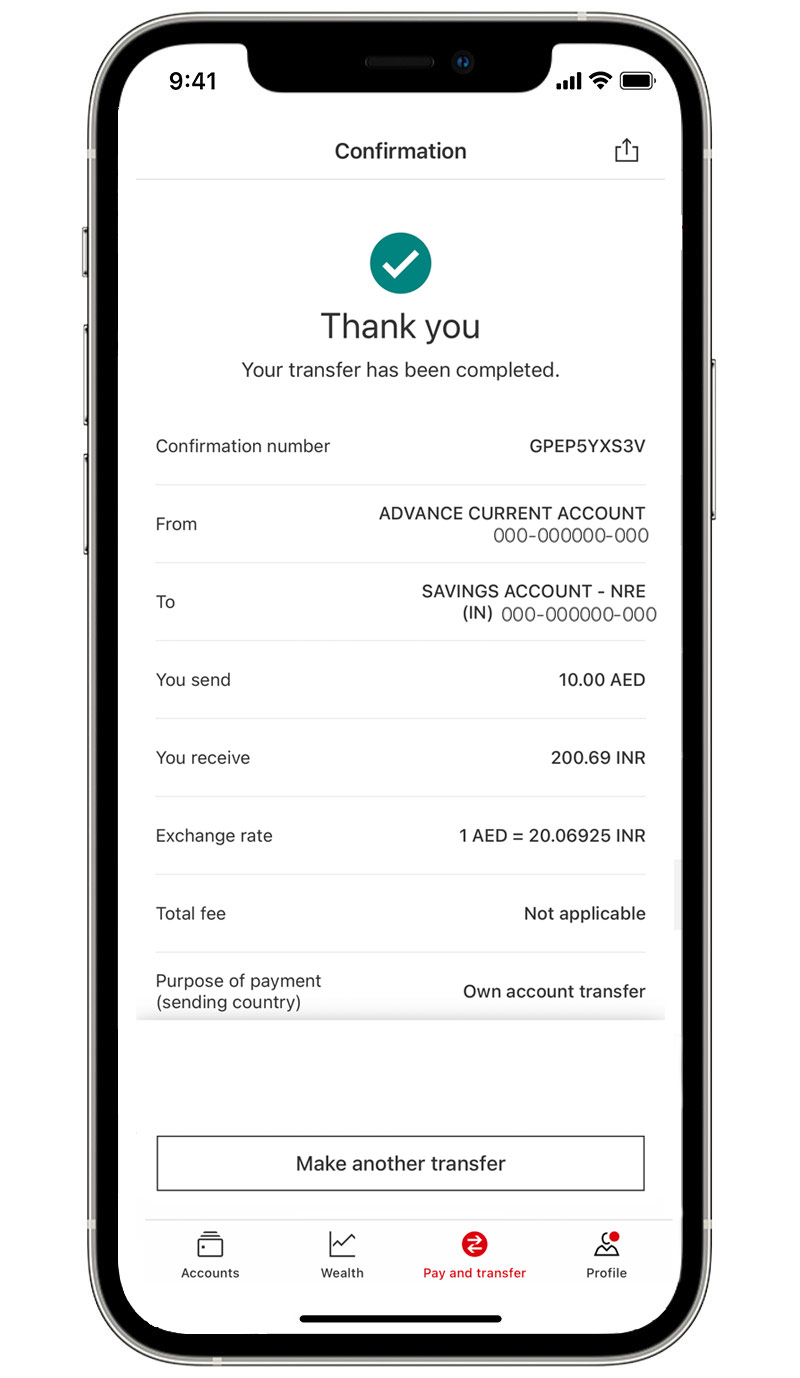

Check your transfer details and select 'Confirm'.

Step 6:

Your transfer is now confirmed.

Step 7:

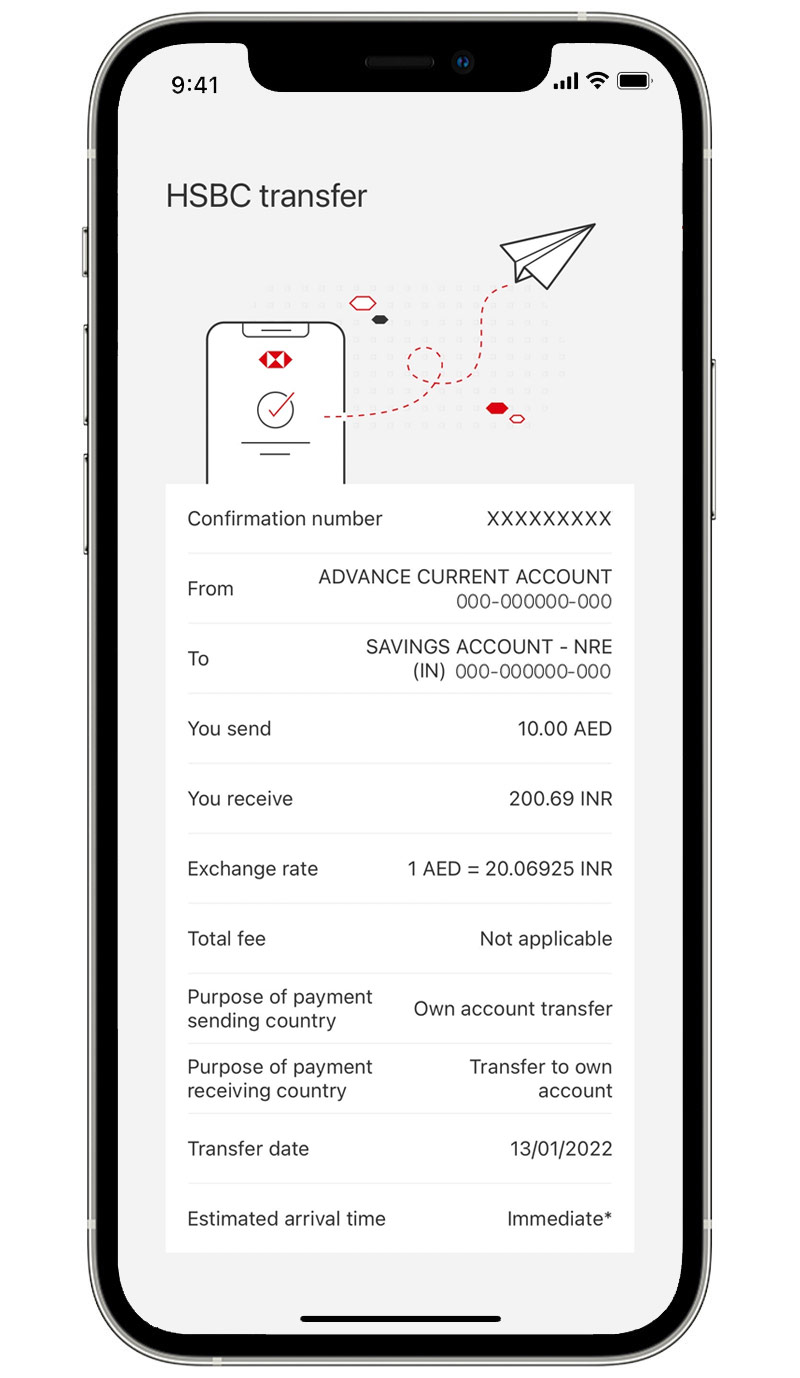

You can also save and share your transfer confirmation.

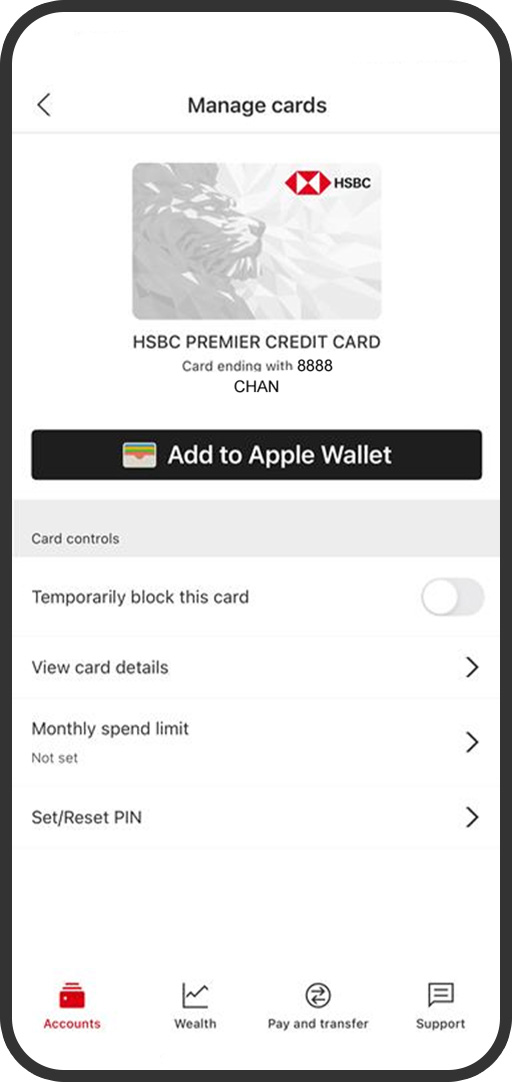

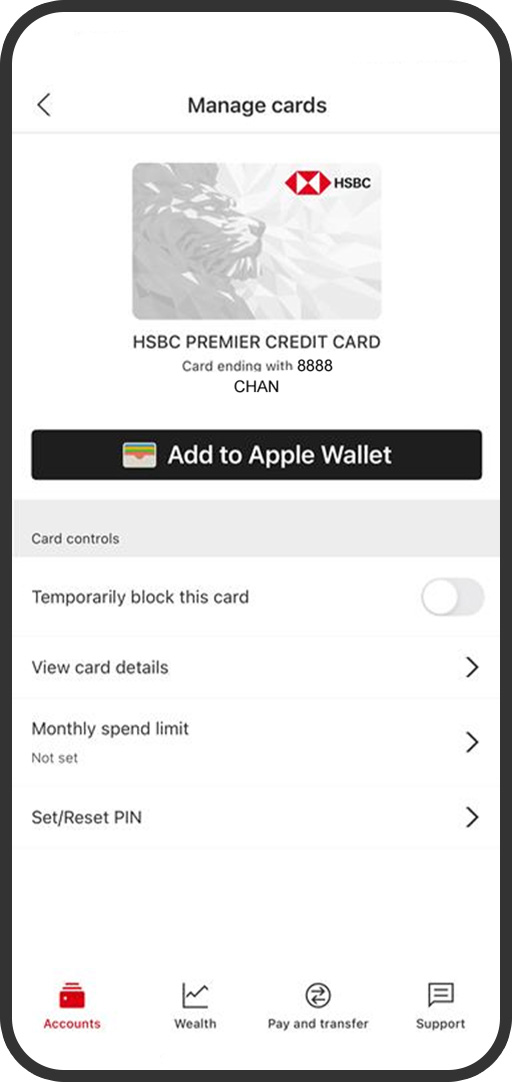

Manage Cards

Manage your cards

Log on to the HSBC UAE app, select the relevant card and then ‘Manage cards’ to temporarily block a card, create a travel plan or set a monthly spend limit.

Temporarily block your card

Select the toggle to block or unblock your card.

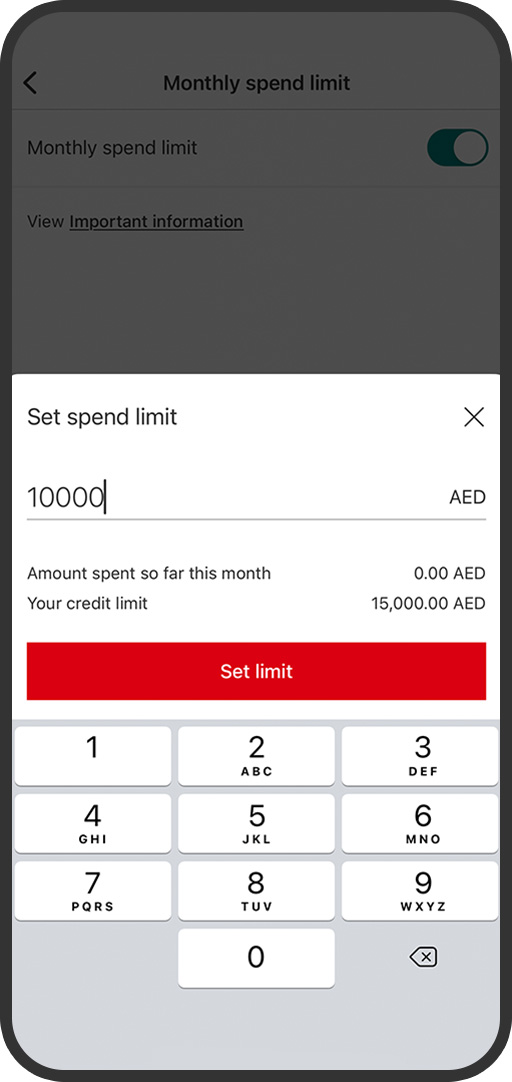

Set monthly spend limit

Select the 'Monthly spend limit' toggle and enter the amount of the spend limit you want to set.

Set or reset PIN

Select 'Set/Reset PIN' then enter a new 6-digit PIN and select 'Confirm'.

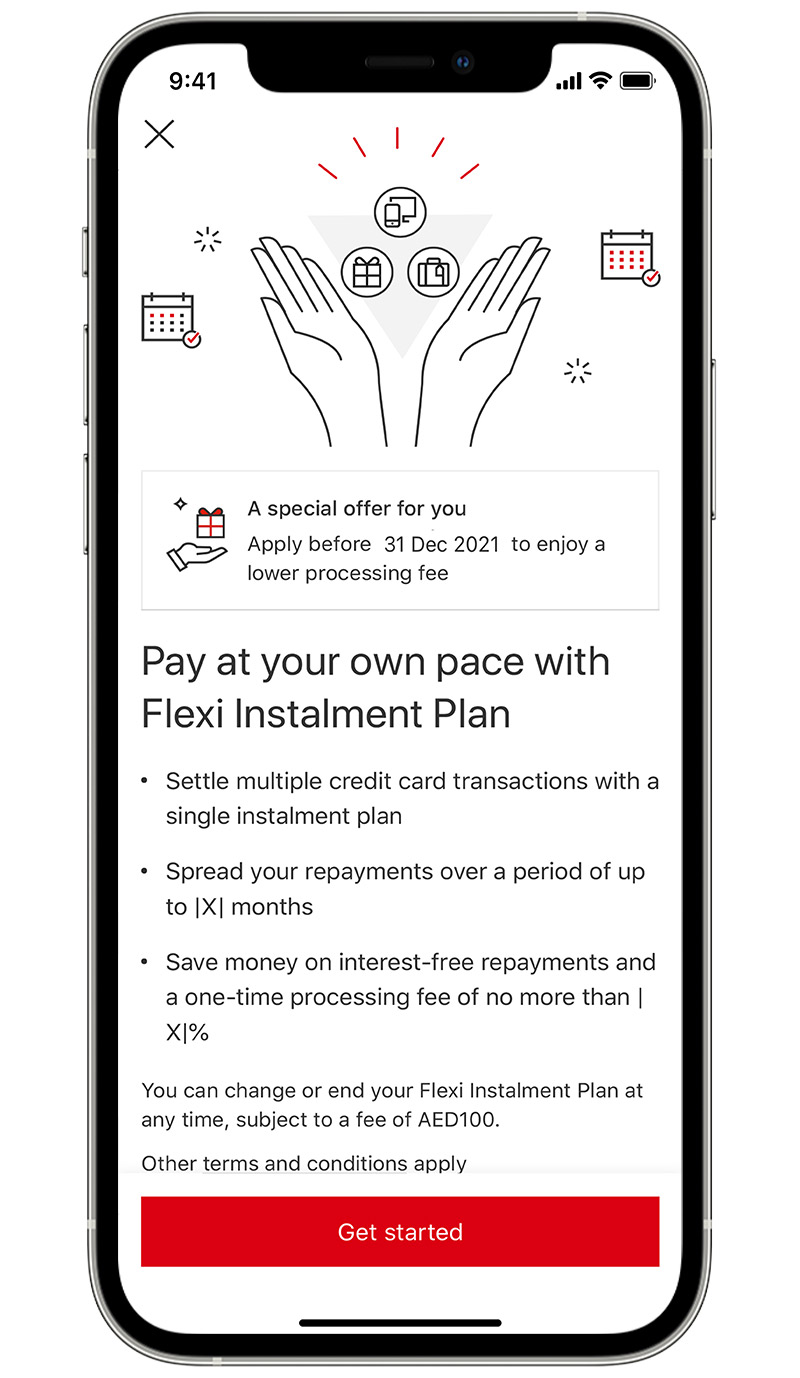

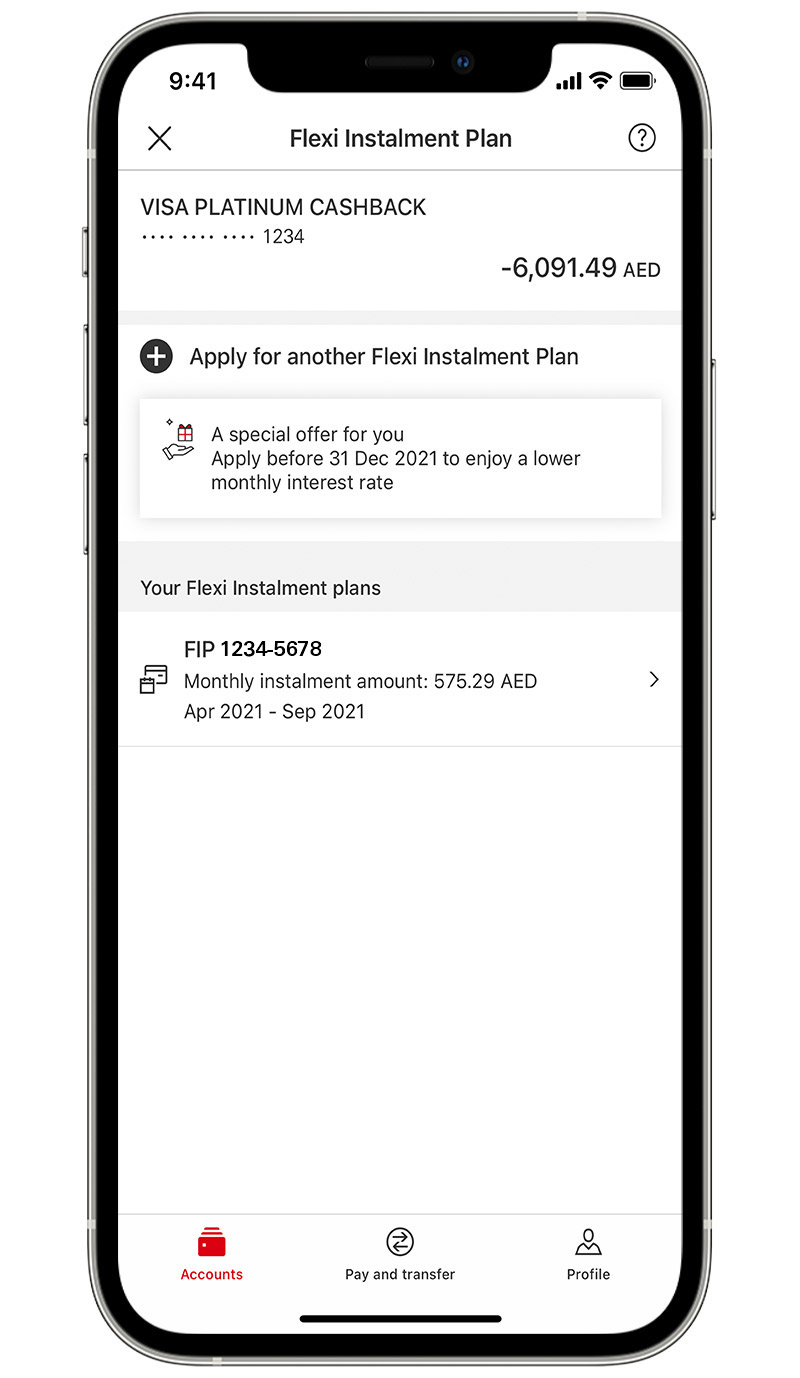

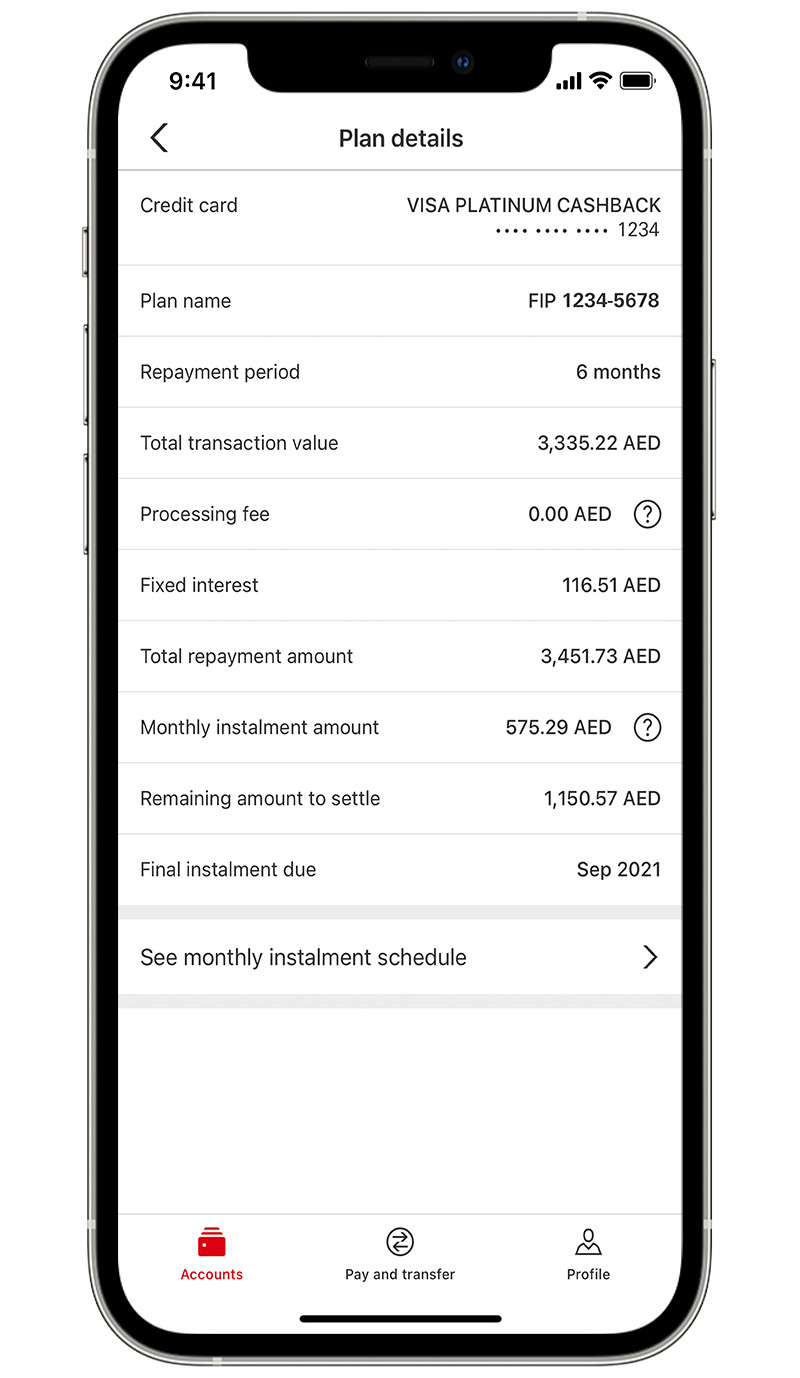

Flexi Instalment Plan

Step 1:

Log on to the HSBC UAE app, select the relevant card and then ‘Flexi Instalment Plan’.

Step 2:

Select ‘Get started’ and follow the steps to create a Flexi Instalment Plan.

Step 3:

When it's approved your new Flexi Instalment Plan will appear on your dashboard.

Step 4:

You can view your Flexi Instalment Plan details at any time.

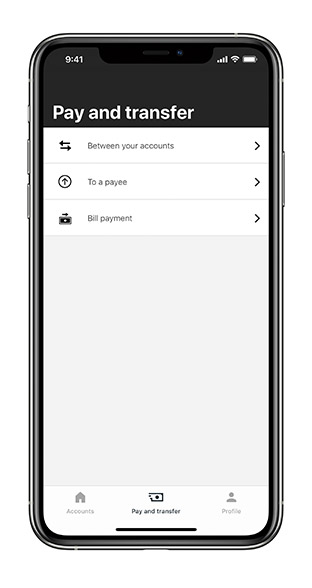

Bill Payment

Quick and easy way to pay bills online without having to wait in a queue.

Step 1:

Launch your HSBC app and tap on ‘Pay and transfer' at the bottom of the screen.

Step 2:

Select ‘Bill payment’

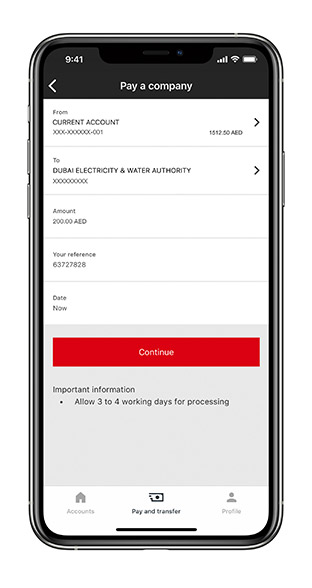

Step 3:

Select the account from where you want to pay the bill. Choose a biller from the saved list.

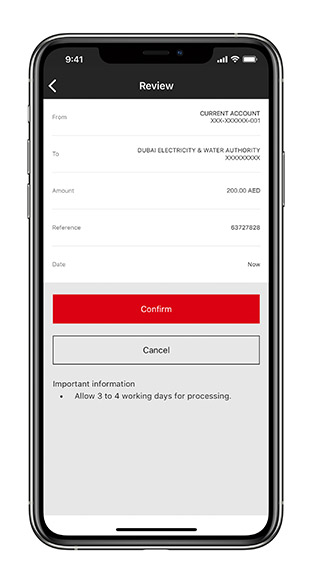

Step 4:

Enter the amount and other details on the screen. Select 'Confirm' and it's done.

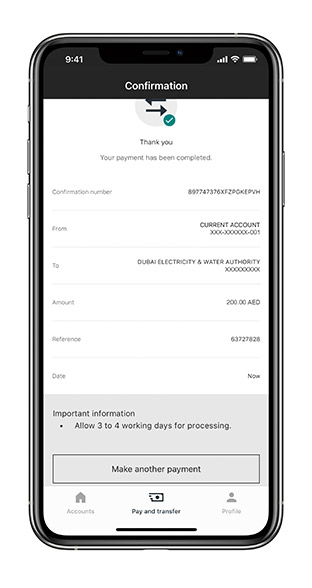

Step 5:

Once completed, view details of your transaction.

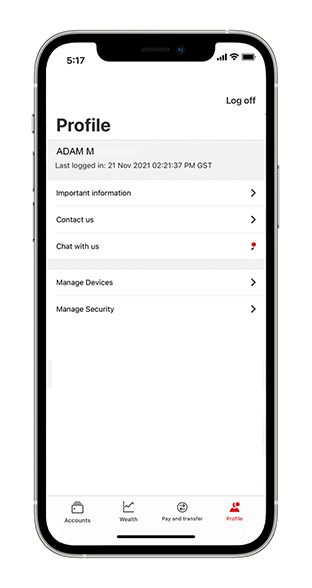

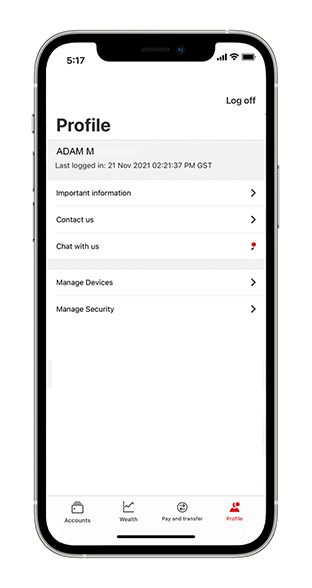

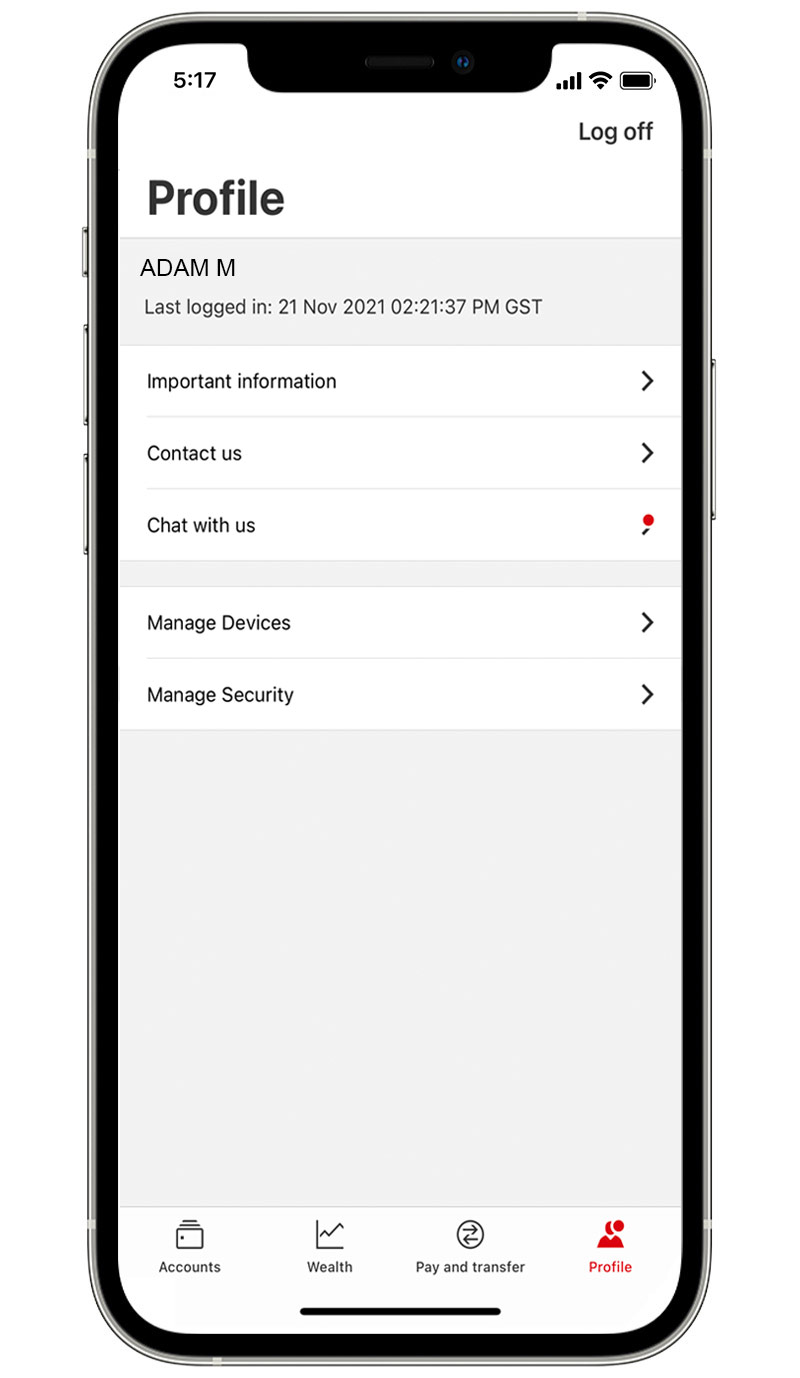

Manage your security preferences, use mobile chat and contact us

Change log on preferences and manage devices on which you want to allow access to the mobile app.

Step 1:

Log on to the HSBC UAE app and select ‘Profile' at the bottom of the screen, and then tap on ‘Manage Security’.

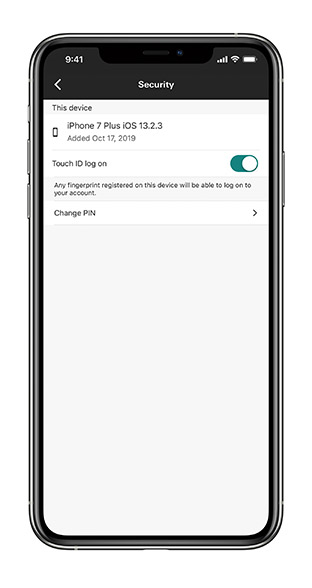

Step 2:

You can enable/disable Fingerprint authentication or Face ID depending upon your device. You can also change the access PIN by clicking on ‘Change PIN’.

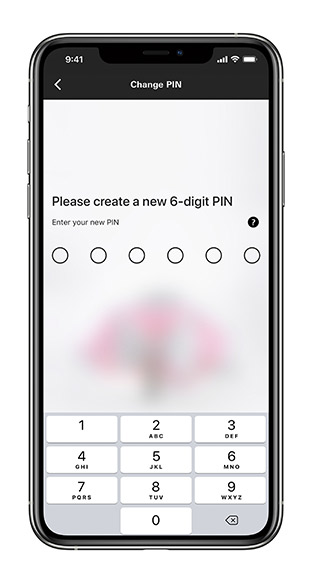

Step 3:

Create your new PIN.

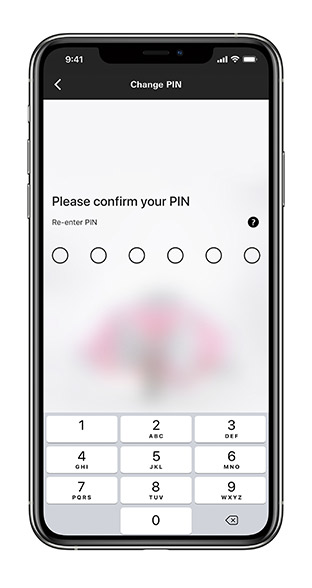

Step 4:

Re-enter your new PIN to confirm.

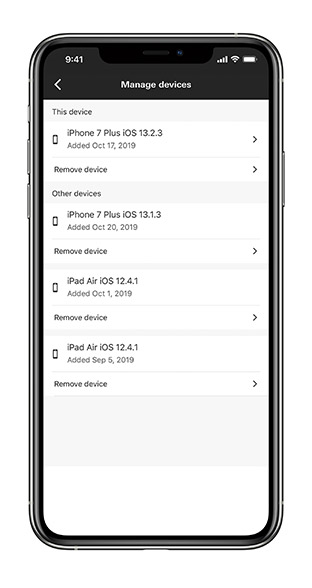

Step 5:

Log on to the HSBC UAE app and select ‘Profile' at the bottom of the screen, and then tap on ‘Manage Devices’.

Step 6:

You will be able to see all devices on which you have activated your Mobile Banking. Select the device which you would like to remove.

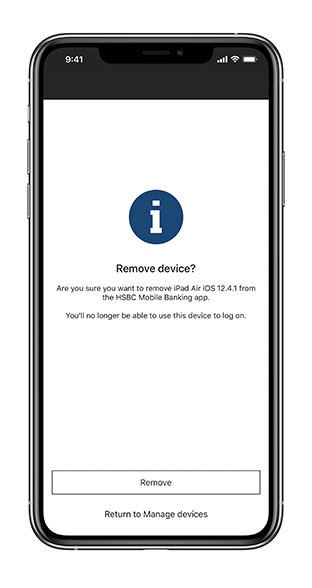

Step 7:

Confirm removal of device. Once you remove a device, you won’t be able to use it to log on to Mobile Banking.

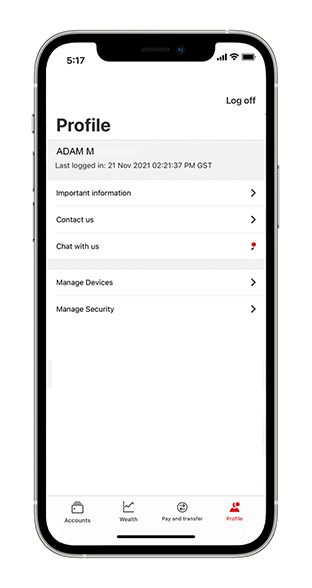

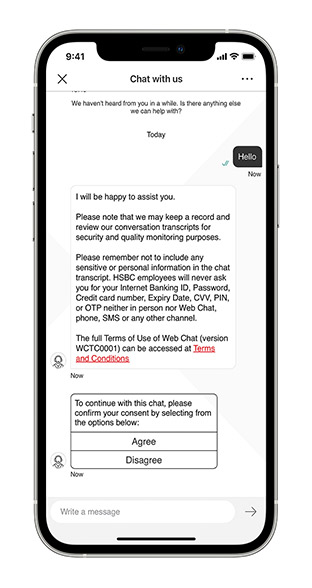

Step 8:

Log on to the HSBC UAE app and select ‘Profile' at the bottom of the screen, and then tap on ‘Chat with us’.

Step 9:

Read the important information and then select 'Agree' to start a chat with us.

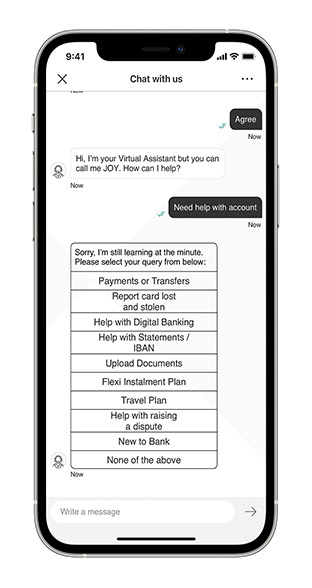

Step 10:

Select the relevant listed option for your query, or select 'None of the above' to be connected with one of our agents.

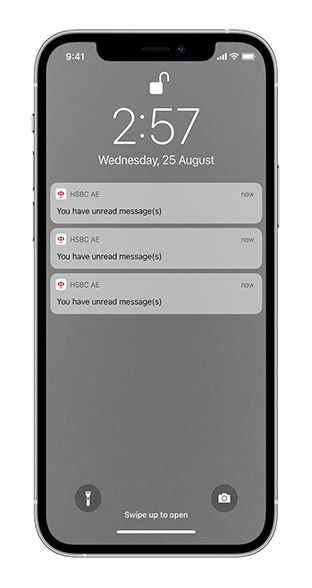

Step 11:

You'll get a push notification when your agent sends you a message and you're not in the active chat window.

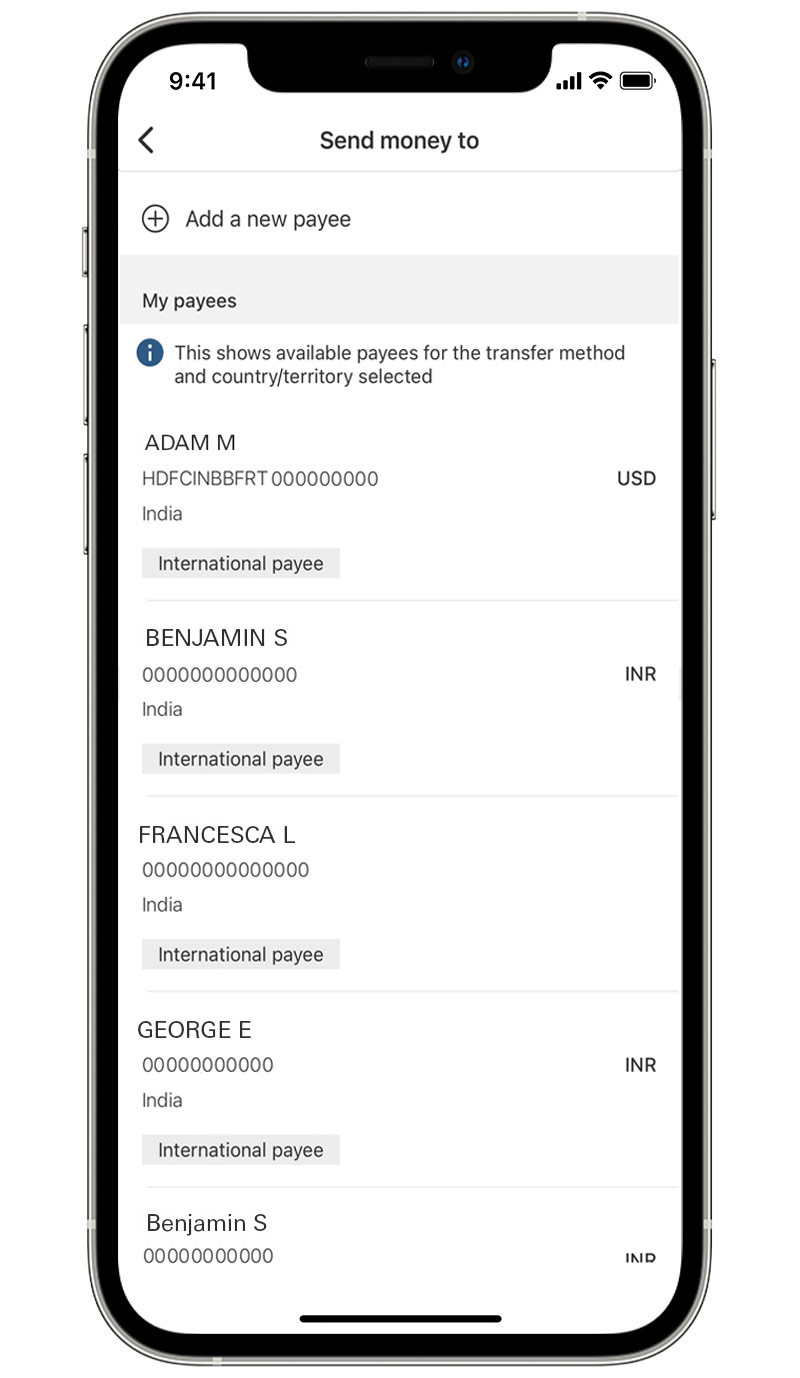

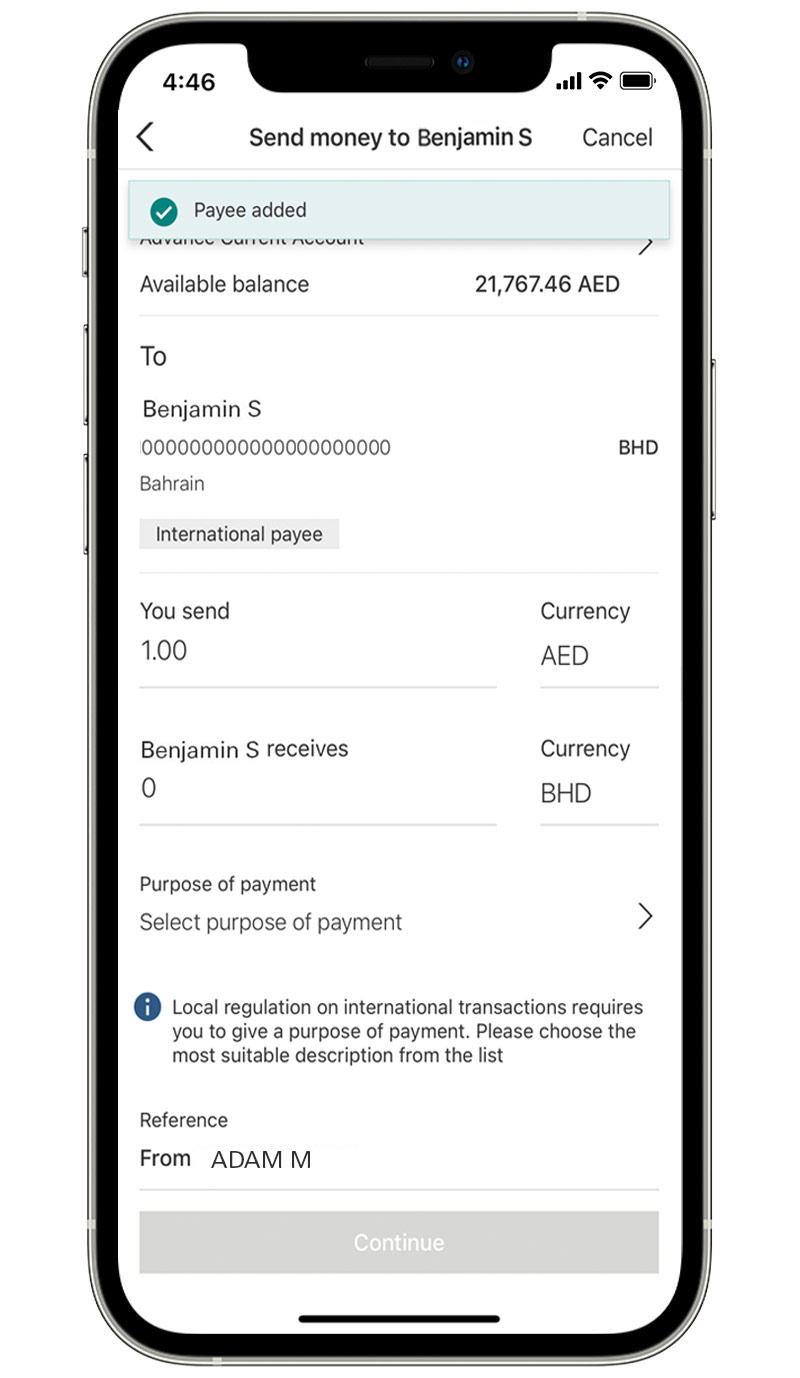

International payments

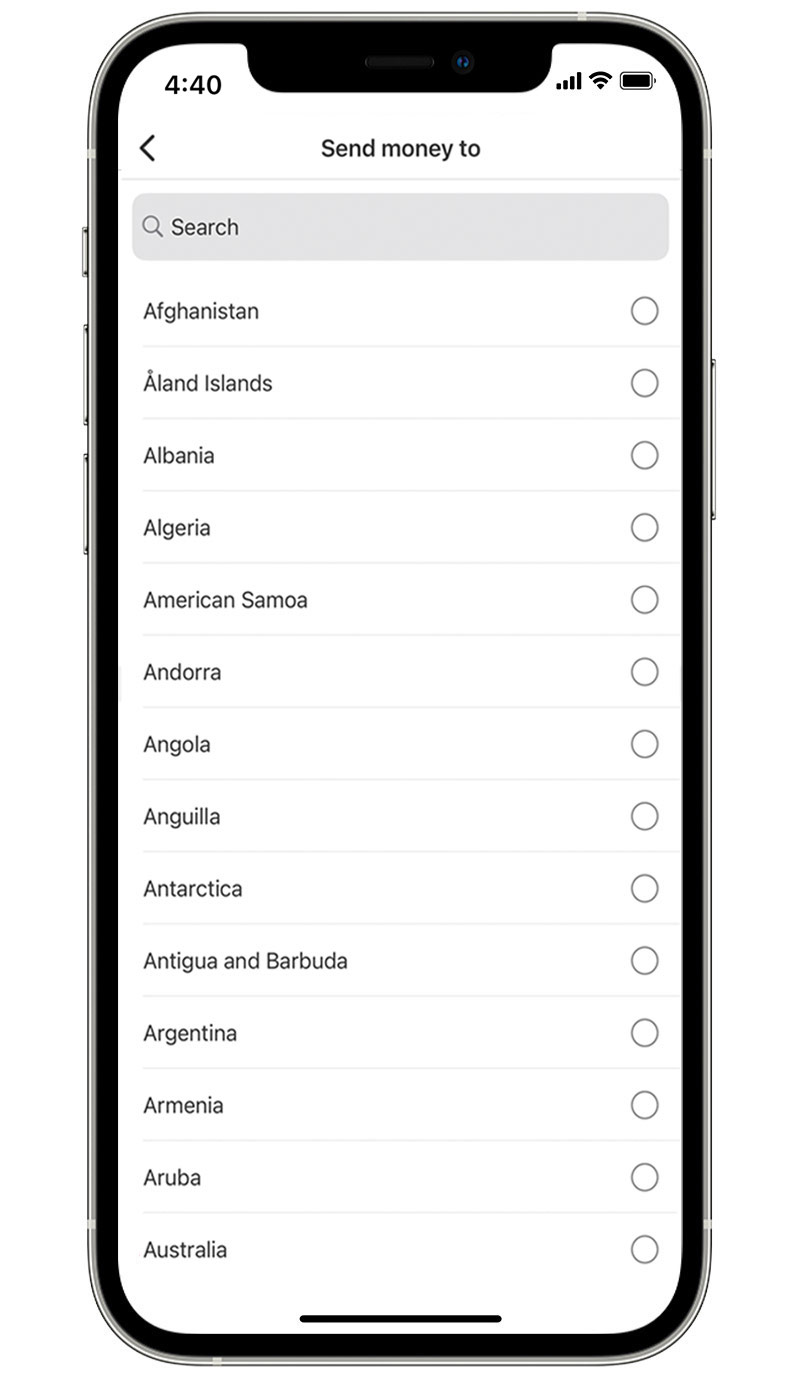

Step 1:

Select 'Send money internationally'.

Step 2:

Select the country you're sending money to.

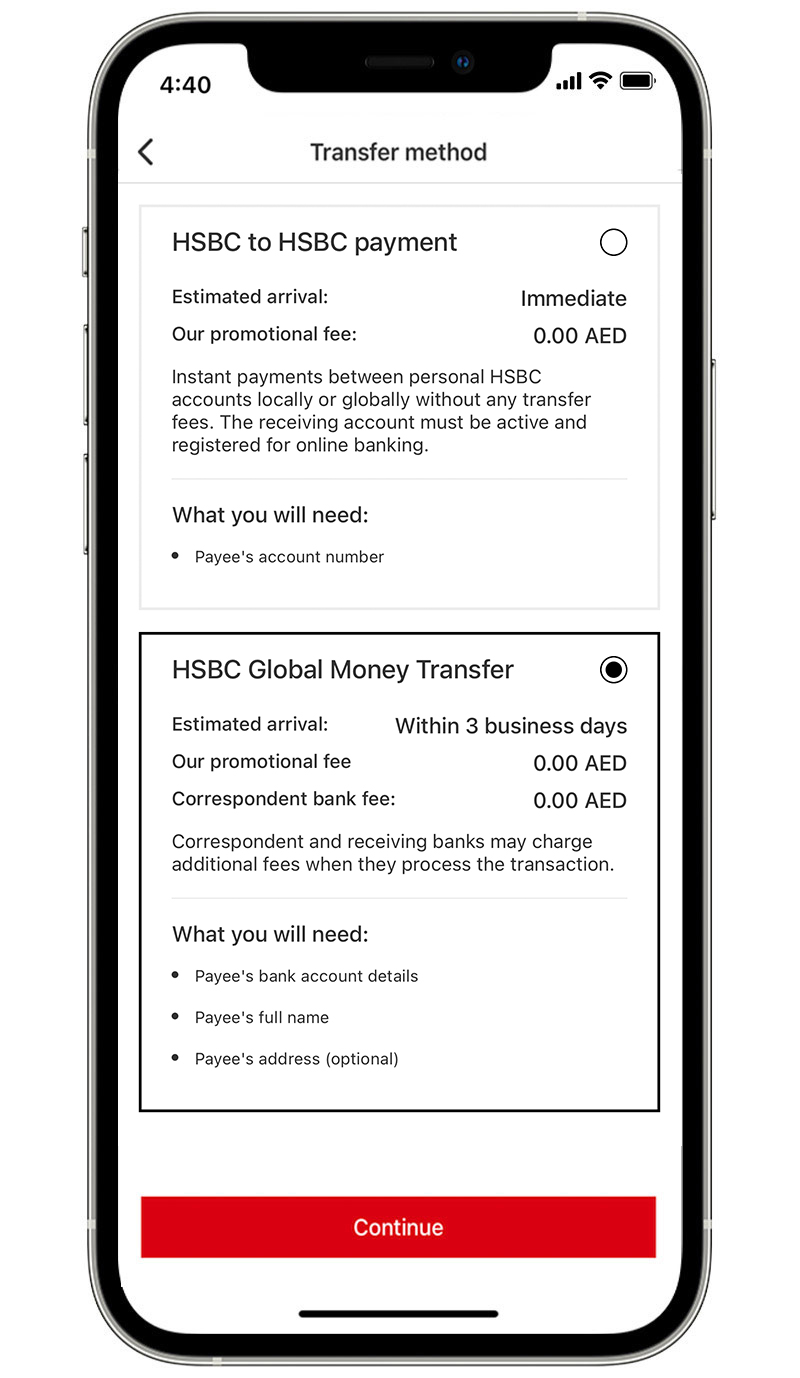

Step 3:

Choose the transfer method details, then select ‘Continue’.

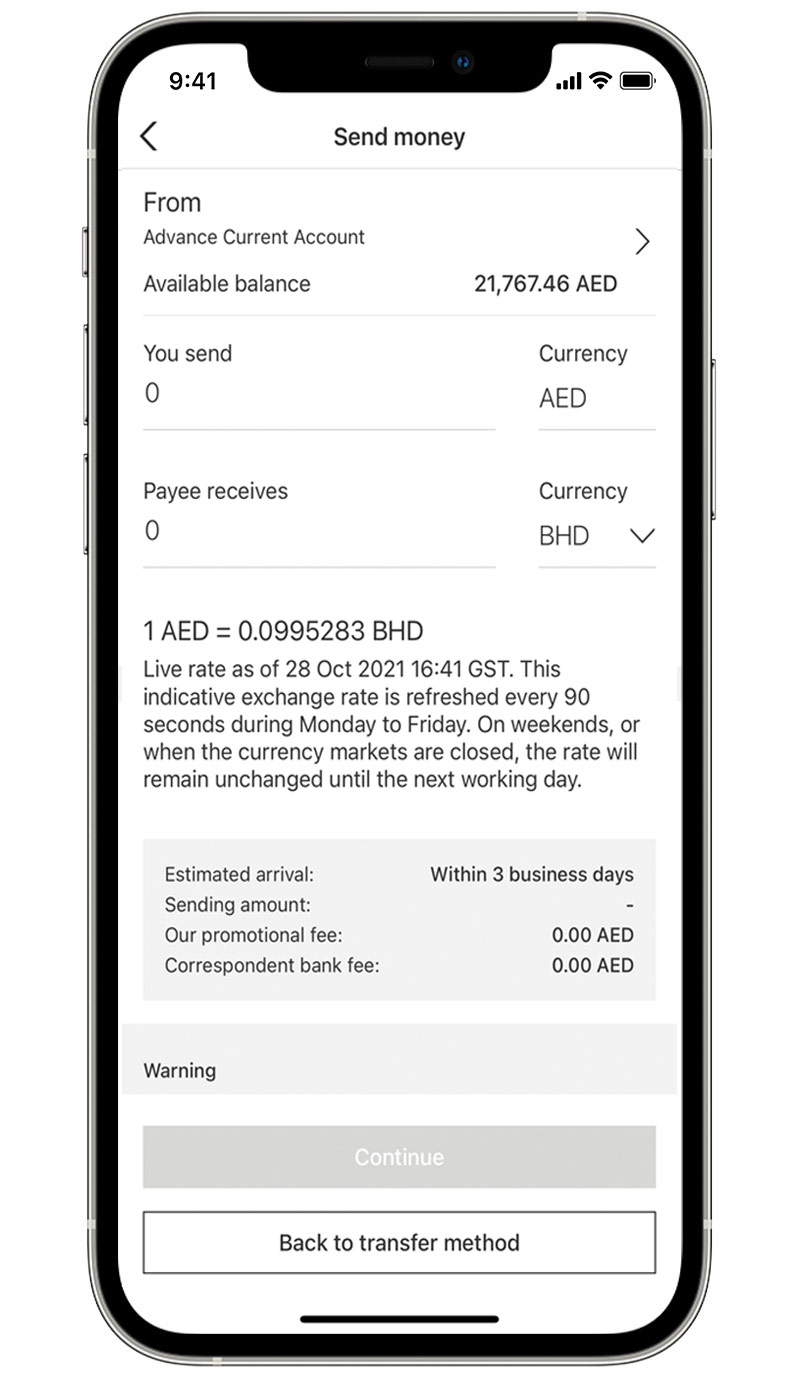

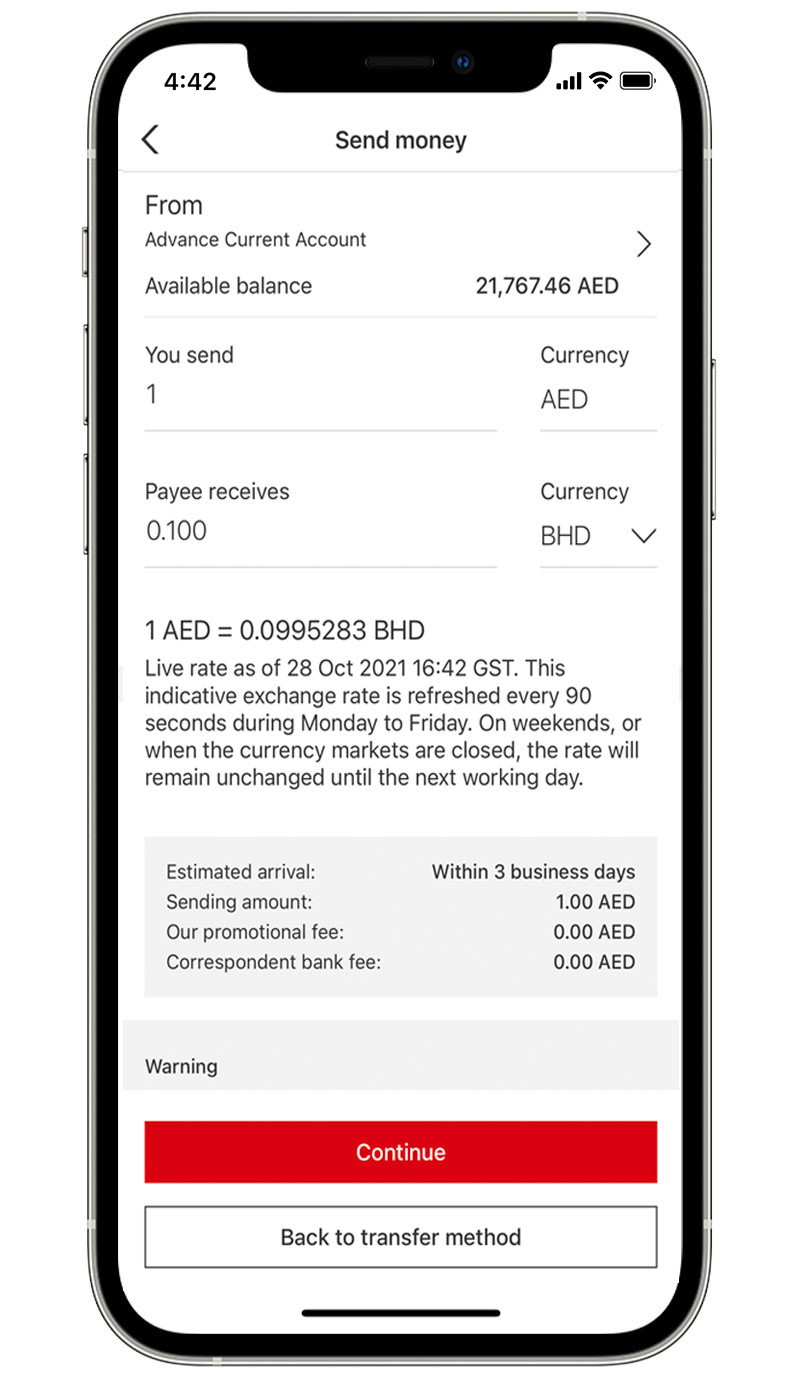

Step 4:

In the 'From' section, select the account you want to send money from, and choose the currency you'd like to use.

Step 5:

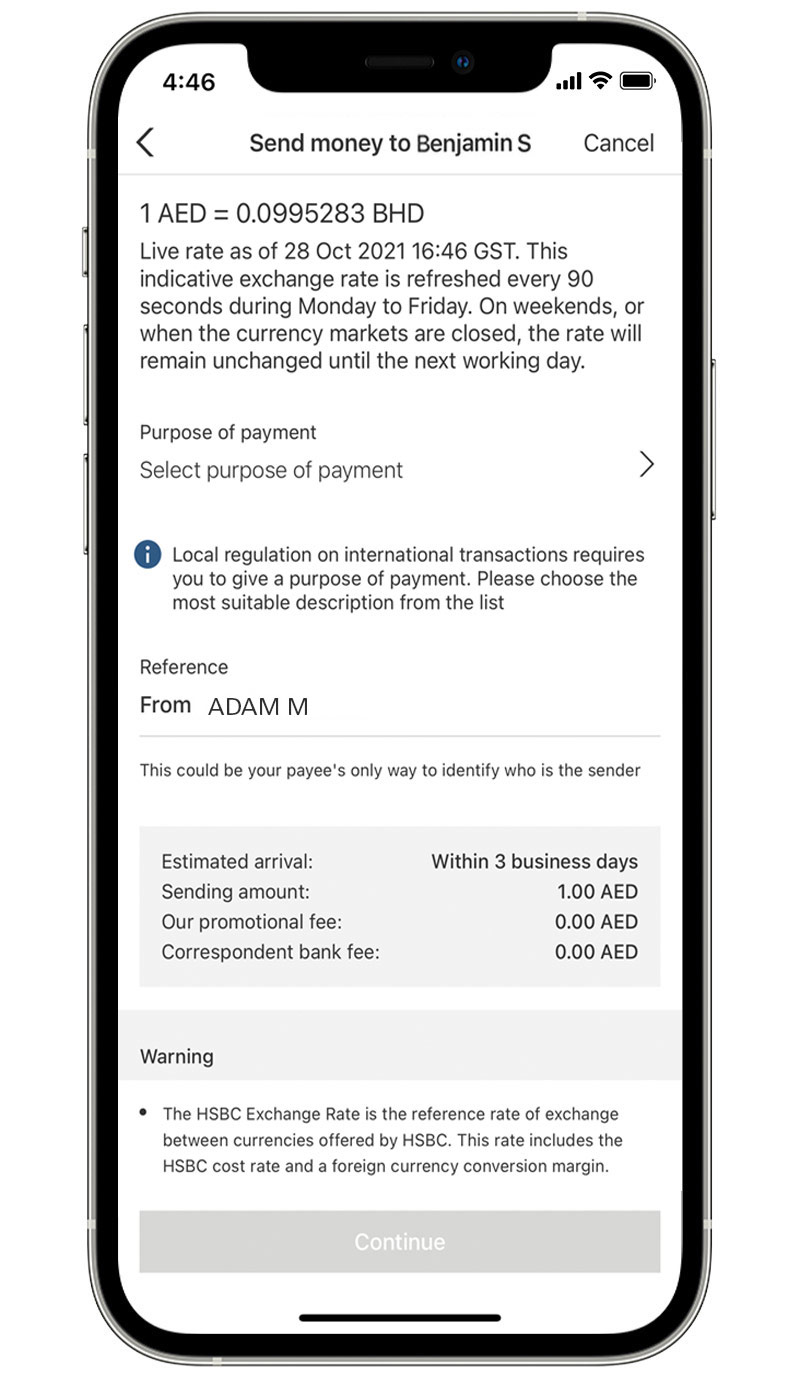

Enter the amount you're sending. Then review the estimated arrival time and applicable fees and ‘Continue’.

Step 6:

Select an existing payee, or tap ‘Add a new payee’ to add someone new.

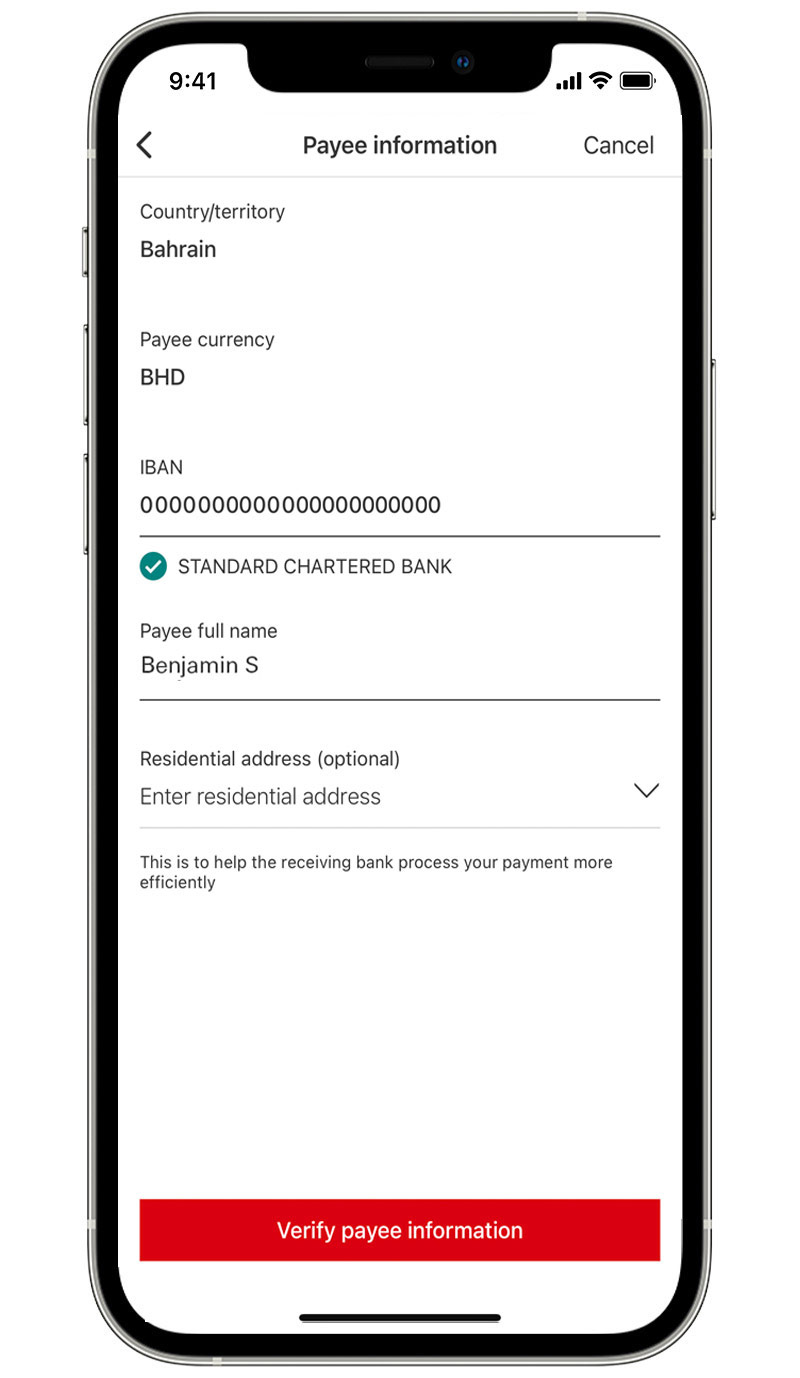

Step 7:

If you're adding a new payee, enter their account details.

Step 8:

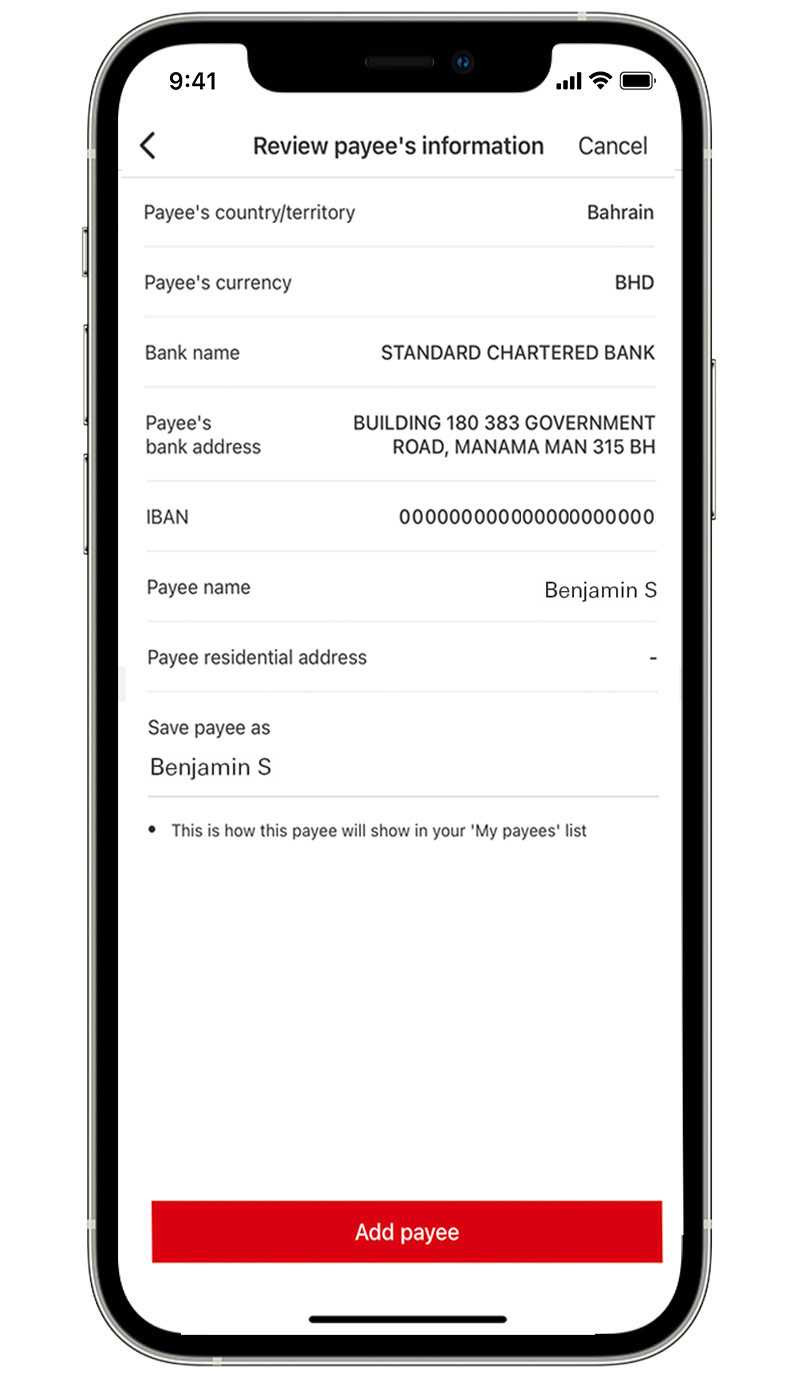

Review the payee details and tap ‘Add payee’.

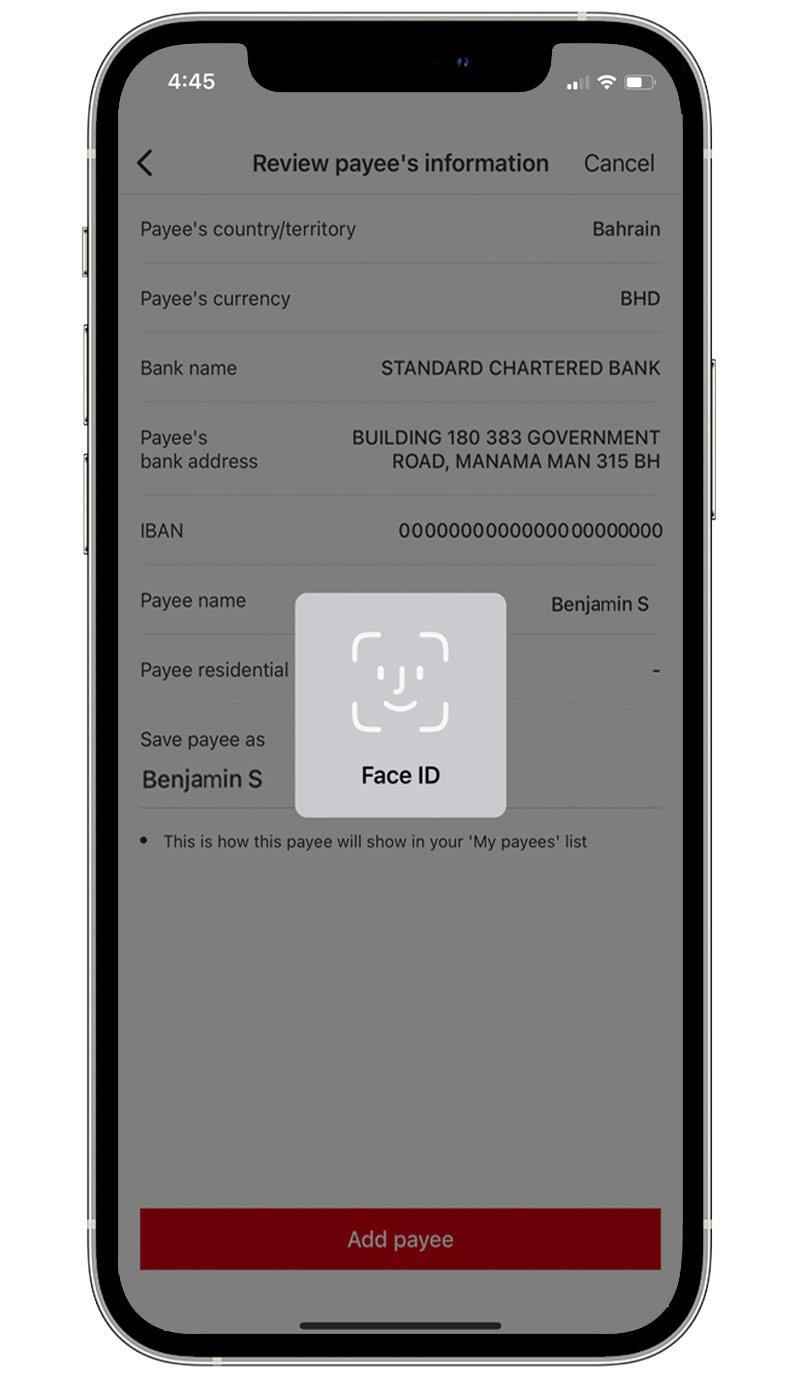

Step 9:

Confirm the new payee using Touch or Face ID, or your 6-digit PIN.

Step 10:

You'll get a notification to confirm the new payee has been added.

Step 11:

Enter the remaining payment details and tap ‘Continue’.

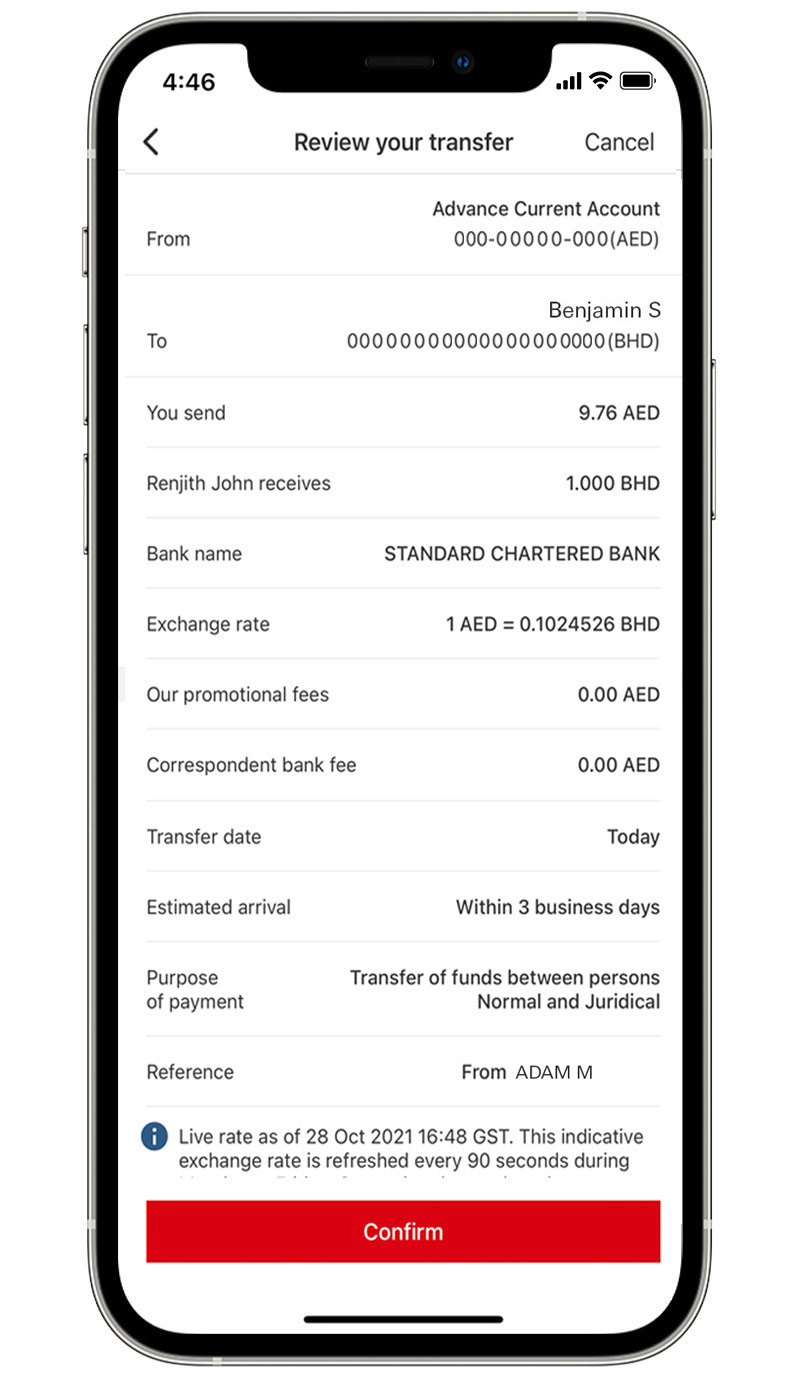

Step 12:

Review your payment details and select ‘Confirm’.

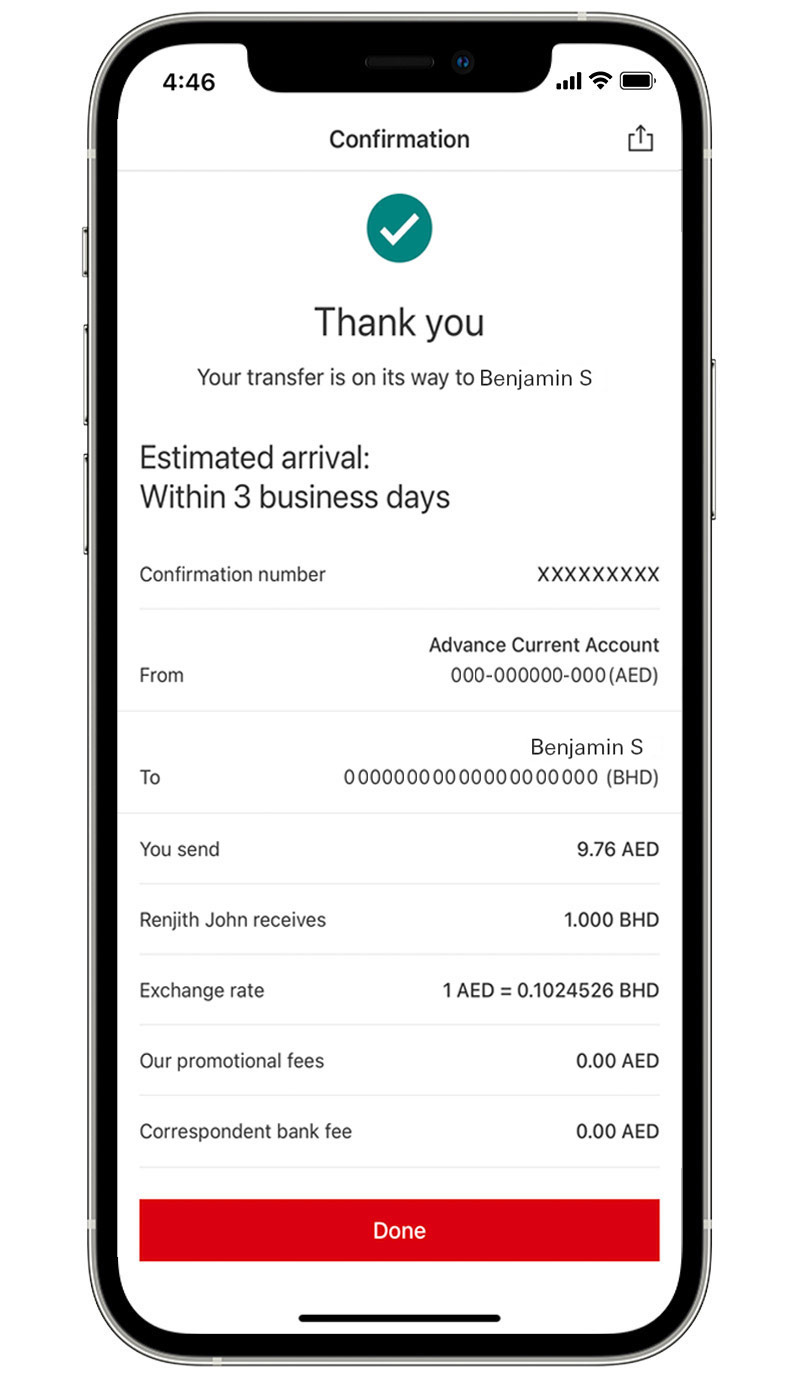

Step 13:

Payment might not be processed immediately and may remain pending while additional checks are made. Your payment will go through within the estimated time given to you at the time of submission.

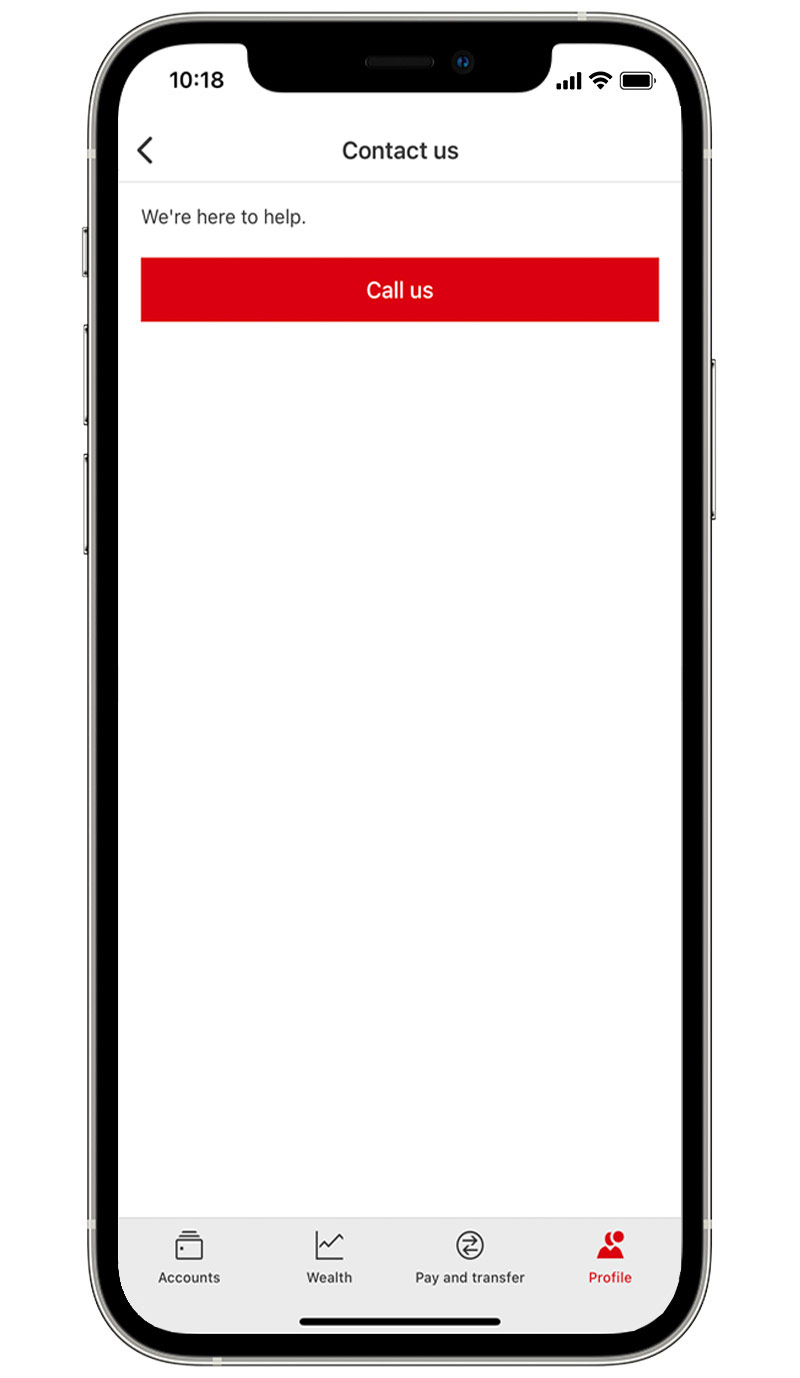

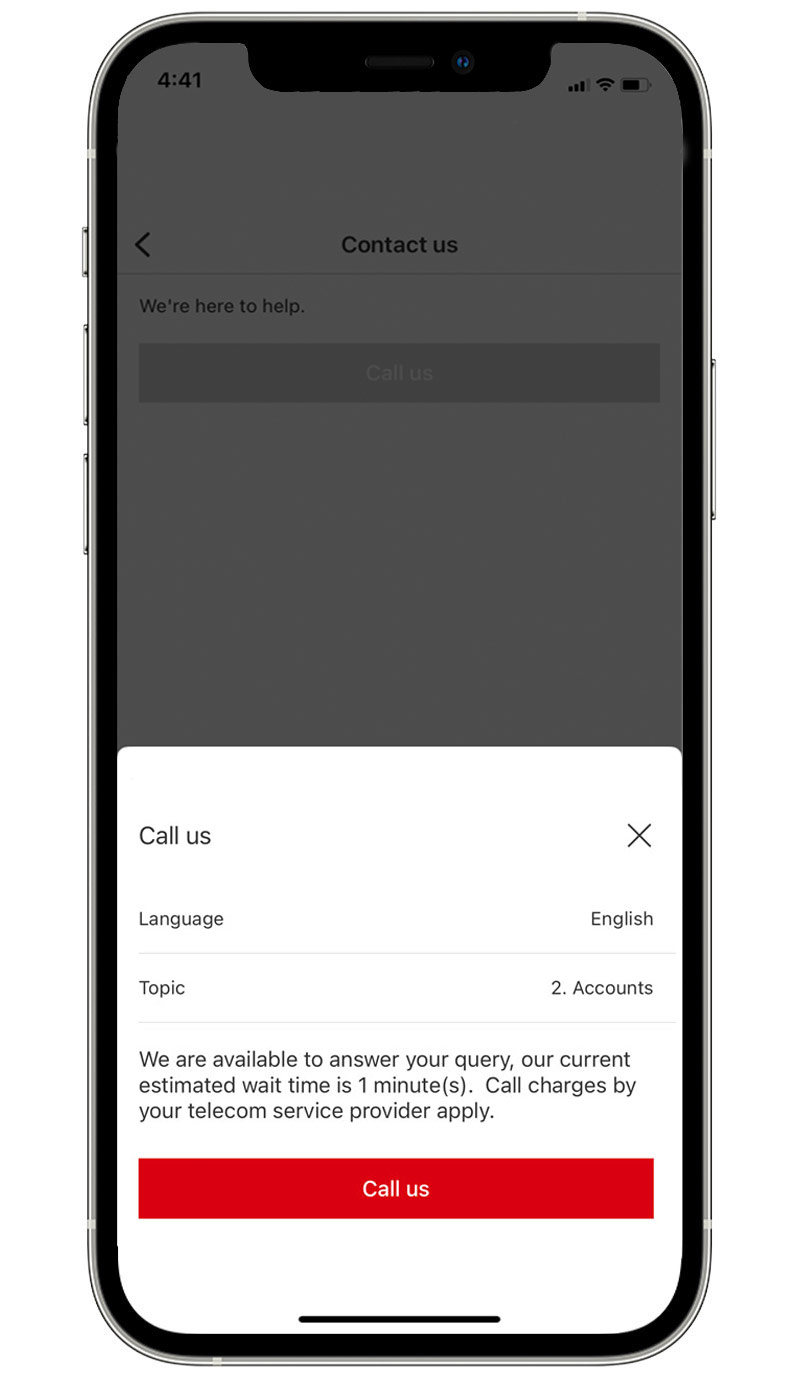

Call us

Step 1:

From your Profile, select 'Contact us'.

Step 2:

Tap 'Call us'.

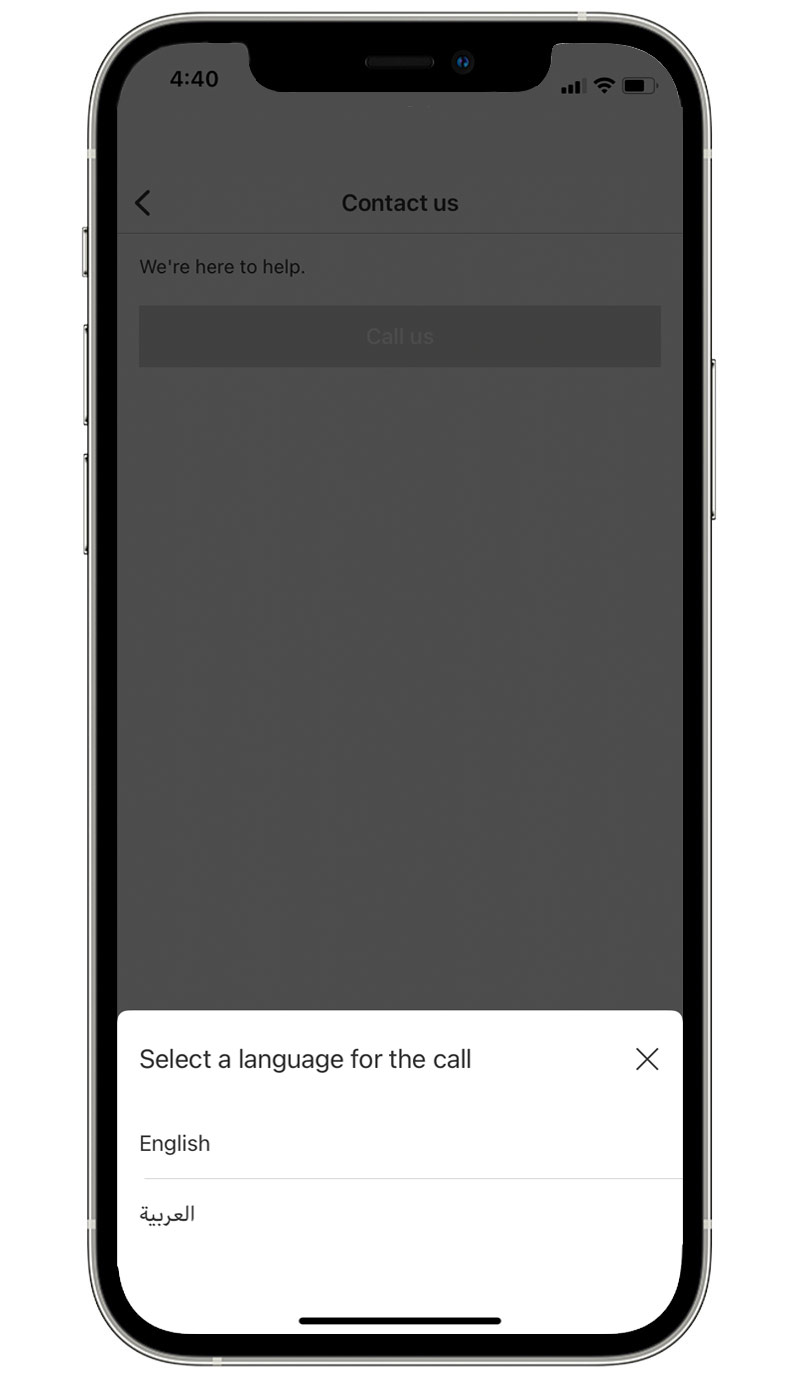

Step 3:

Select your preferred language.

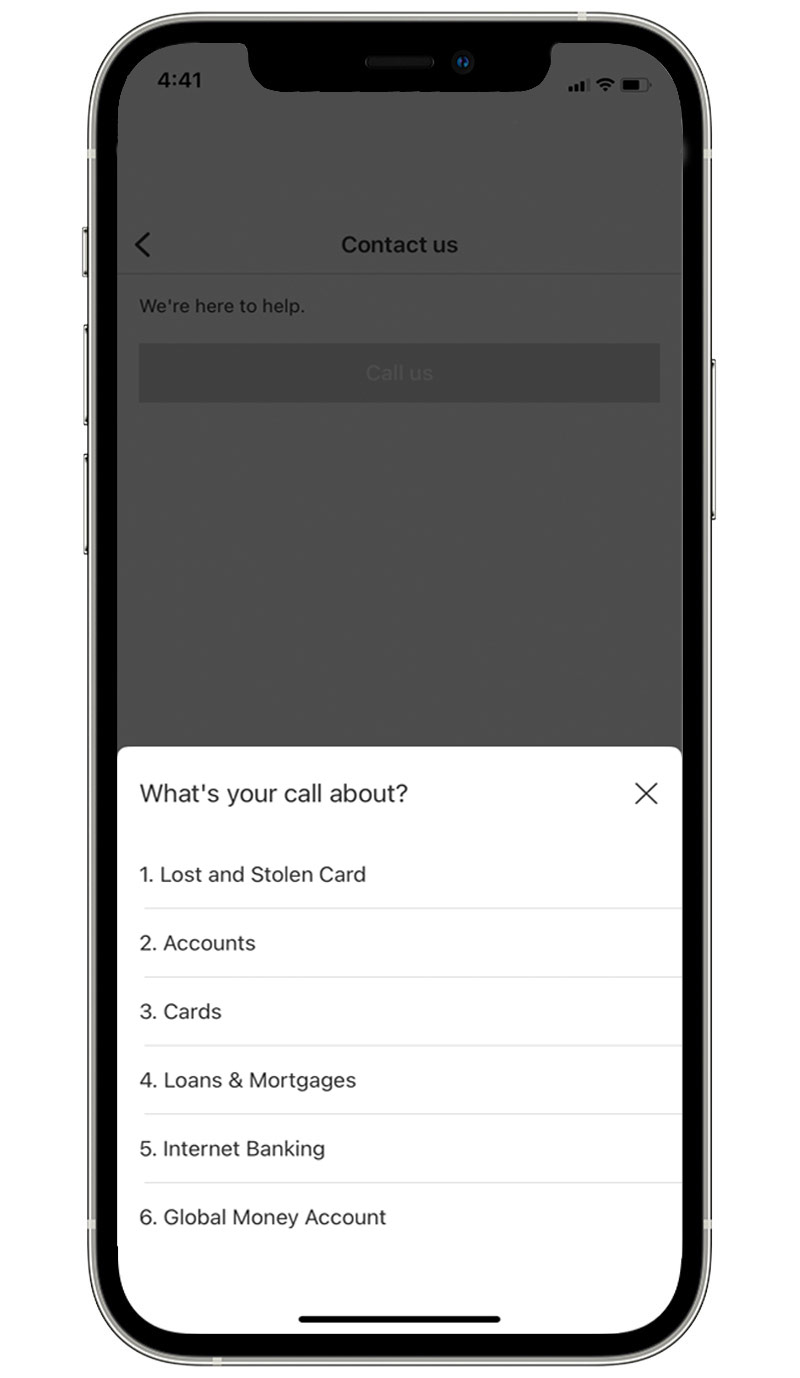

Step 4:

Select what your call is about.

Step 5:

Review your details and how long you may need to wait to speak to someone.

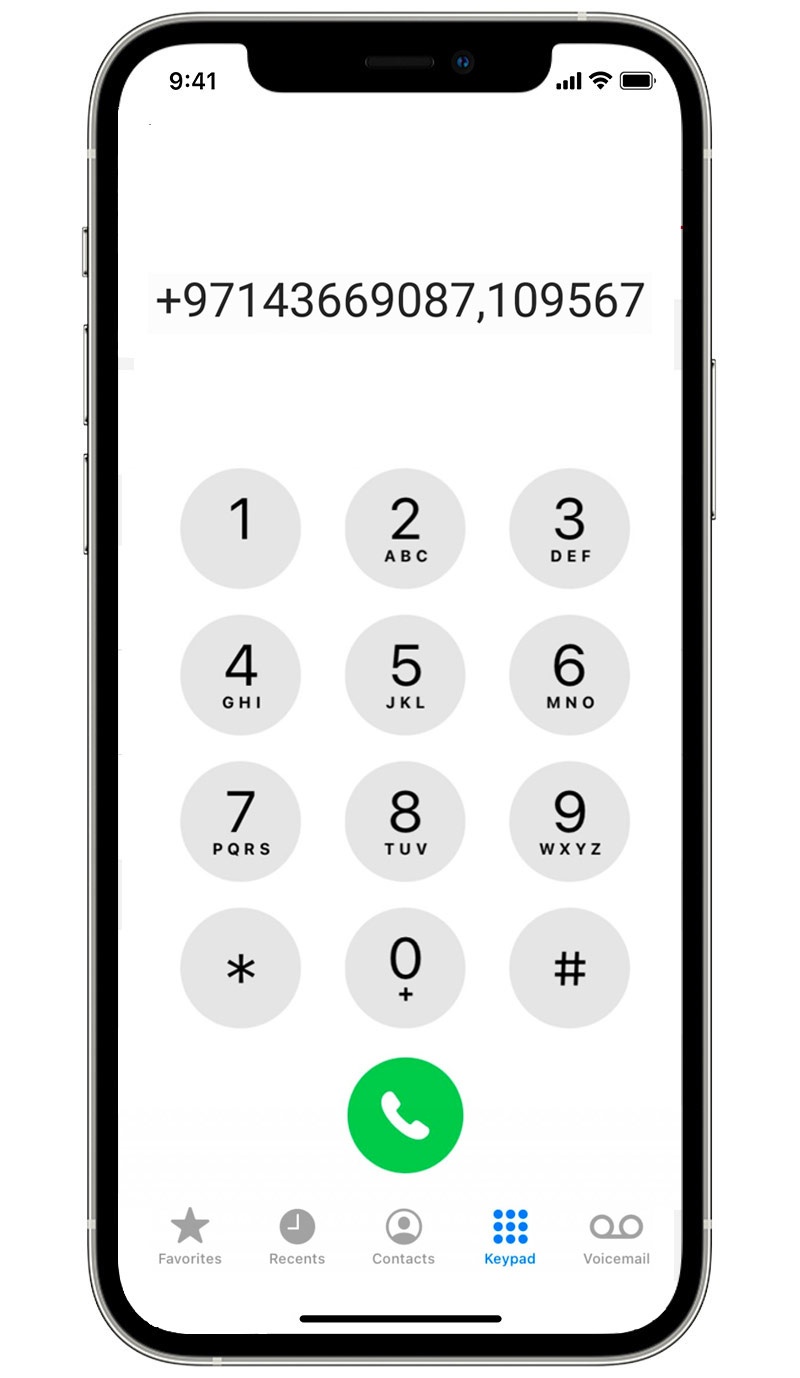

Step 6:

Once an agent is available, you'll be directed to your device's dialler screen with a one-time 6-digit code, which will expire in 30 seconds. Tap on the call button to connect. If the call expires after 30 seconds, you can go back to the app and start again.

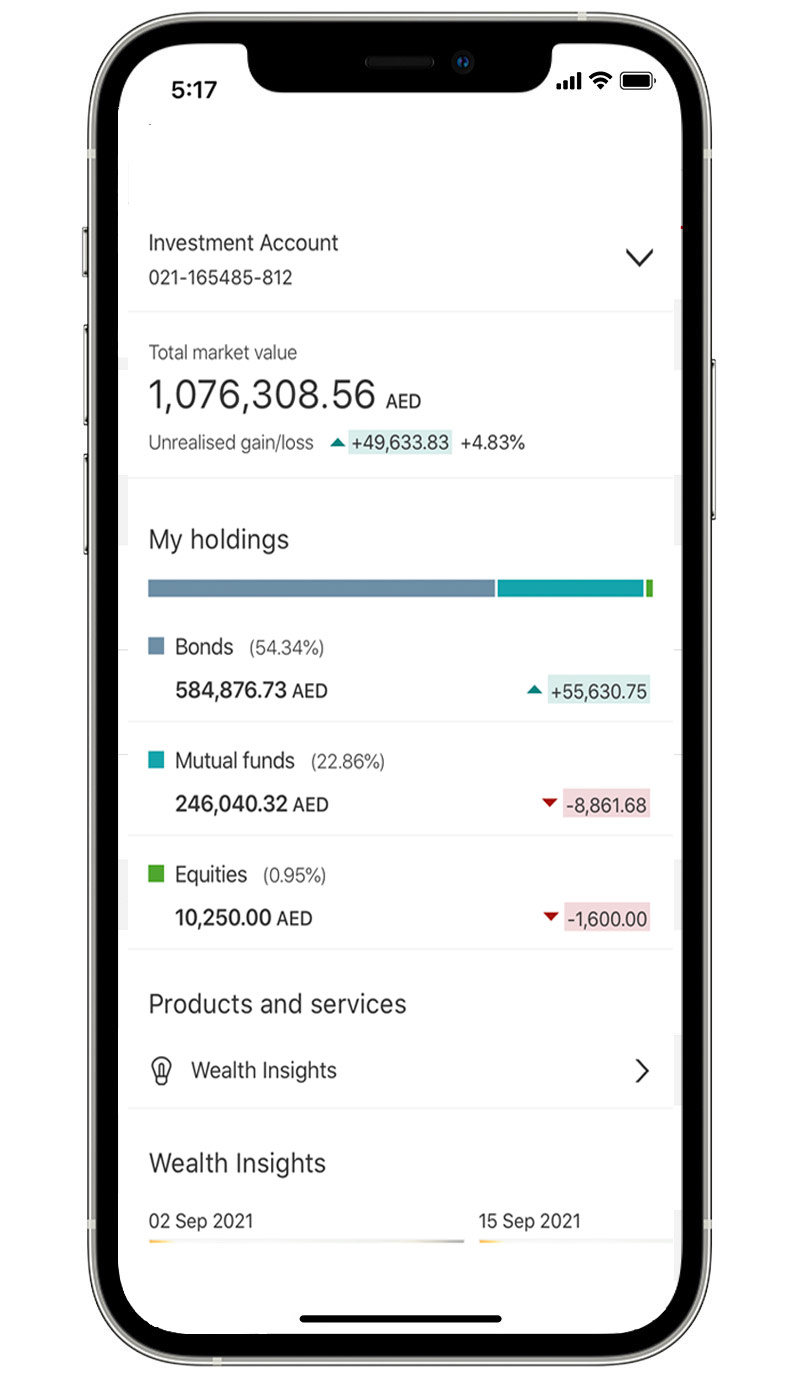

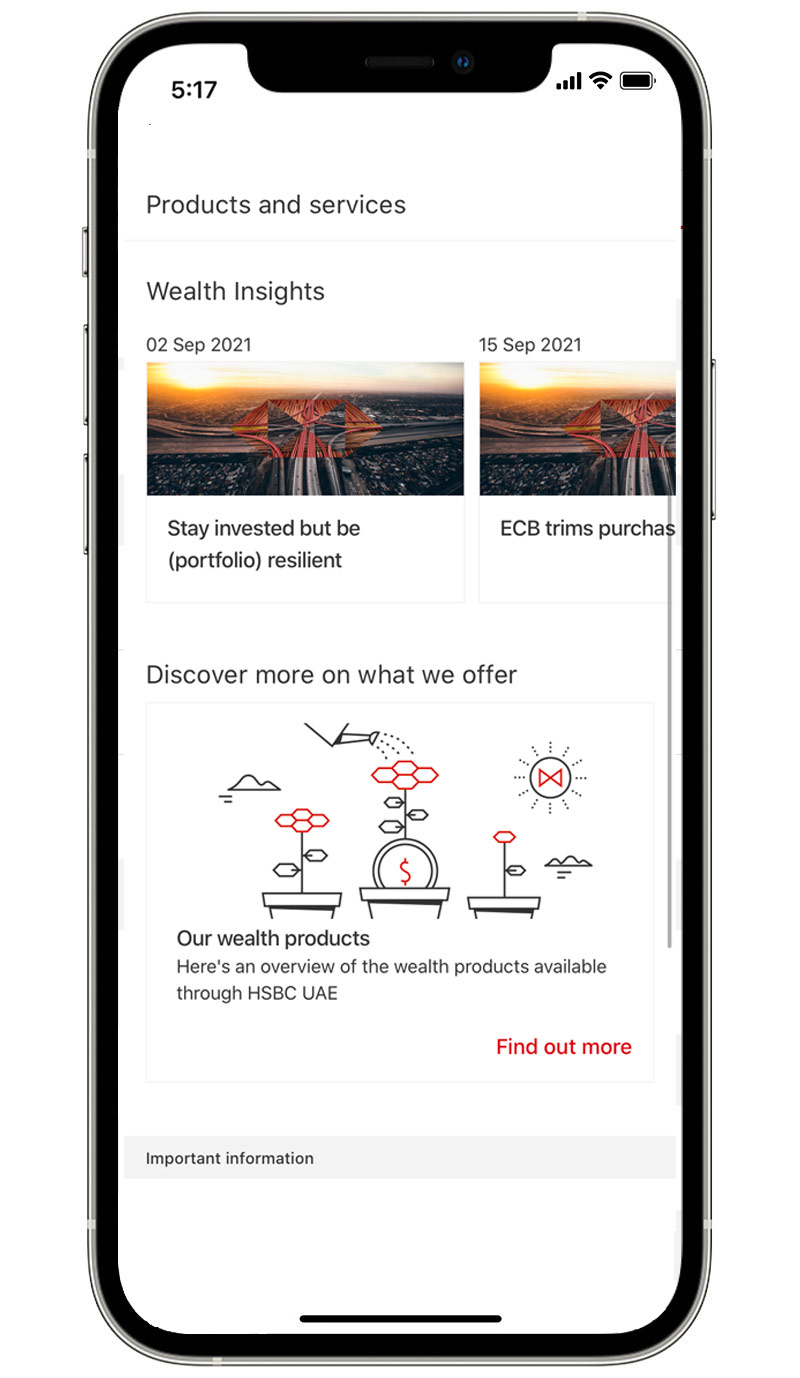

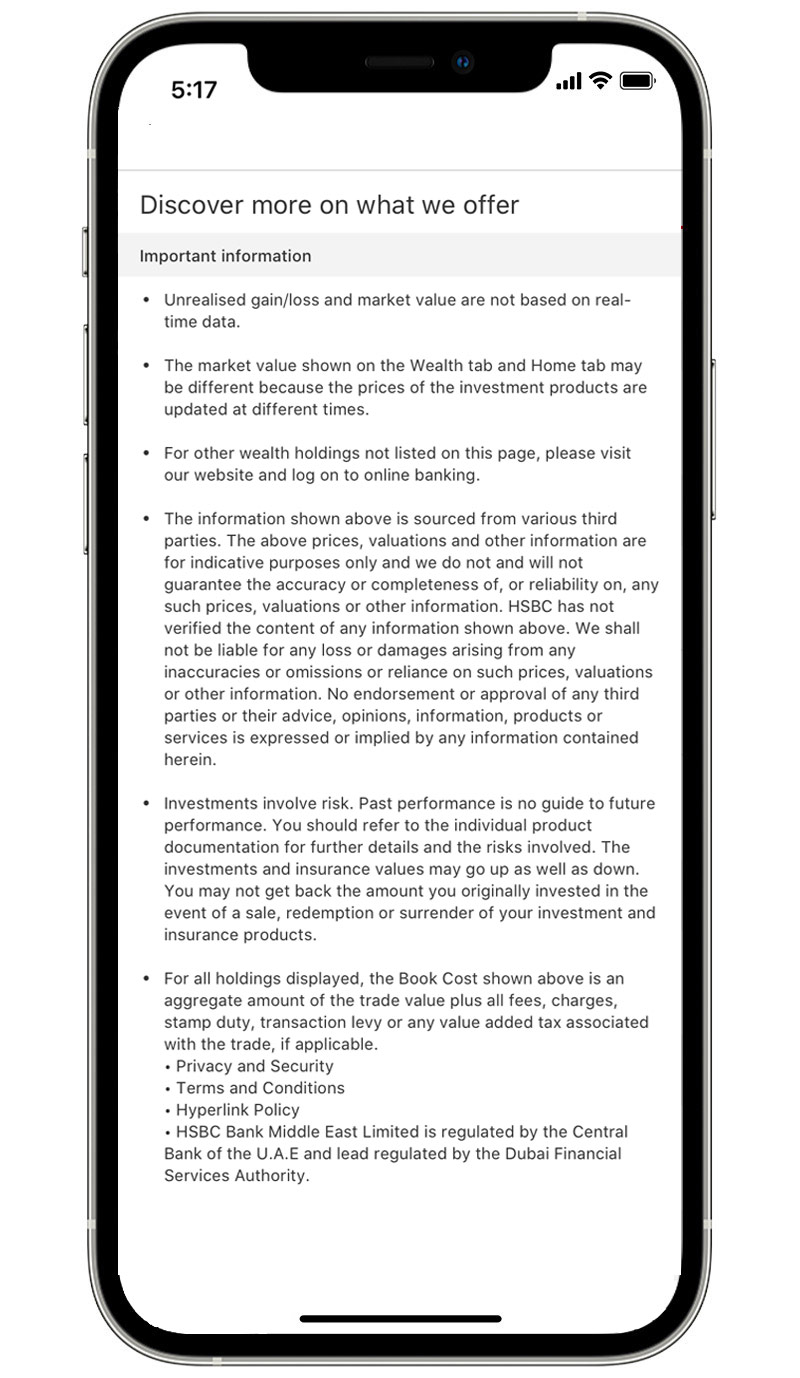

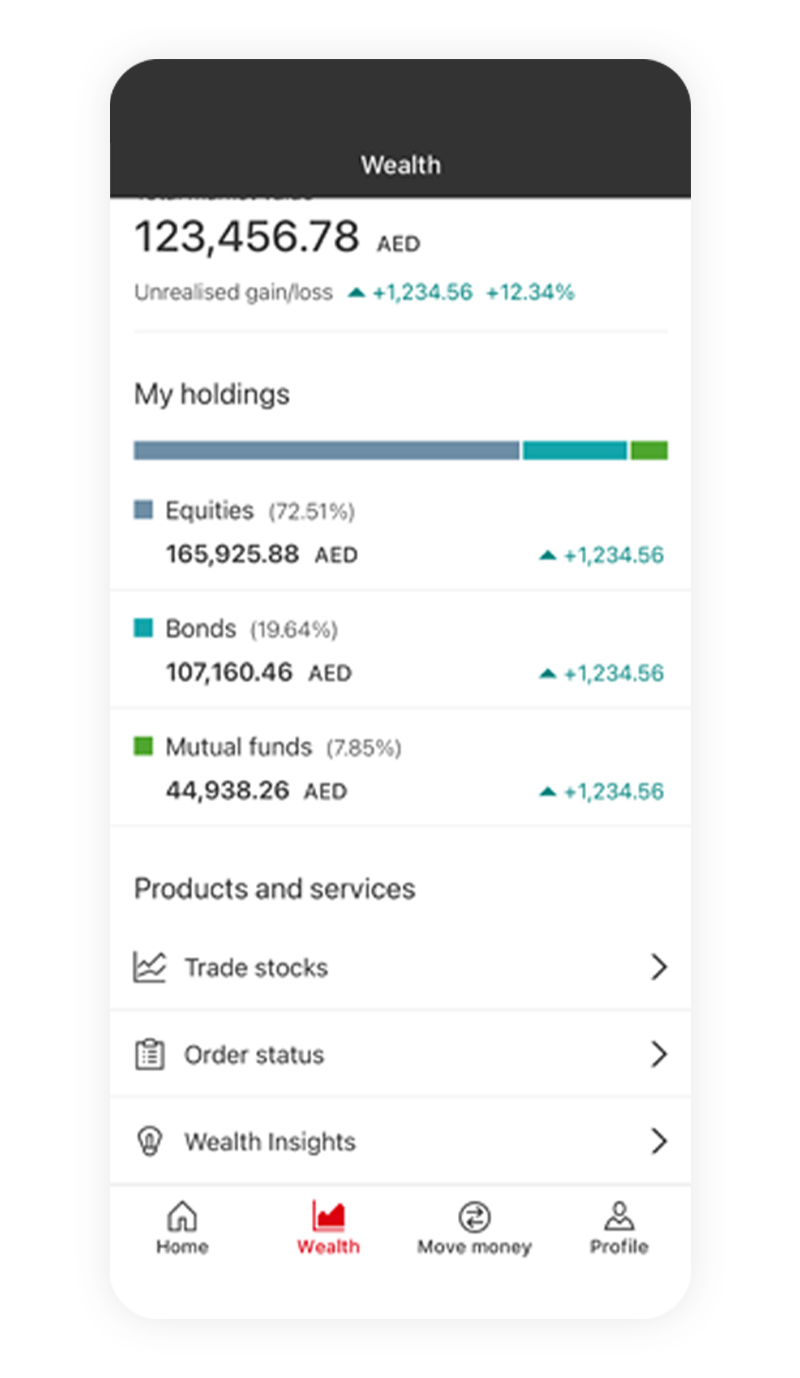

Wealth Dashboard

View you current investment holdings.

Step 1:

Log on to your HSBC UAE Mobile app and tap on the ‘Wealth’ tab.

Step 2:

You can now view your investment holdings, including the total asset value and unrealised gain/loss.

Step 3:

Swipe up to view wealth insights, discover more about our wide range of investment products and find important information.

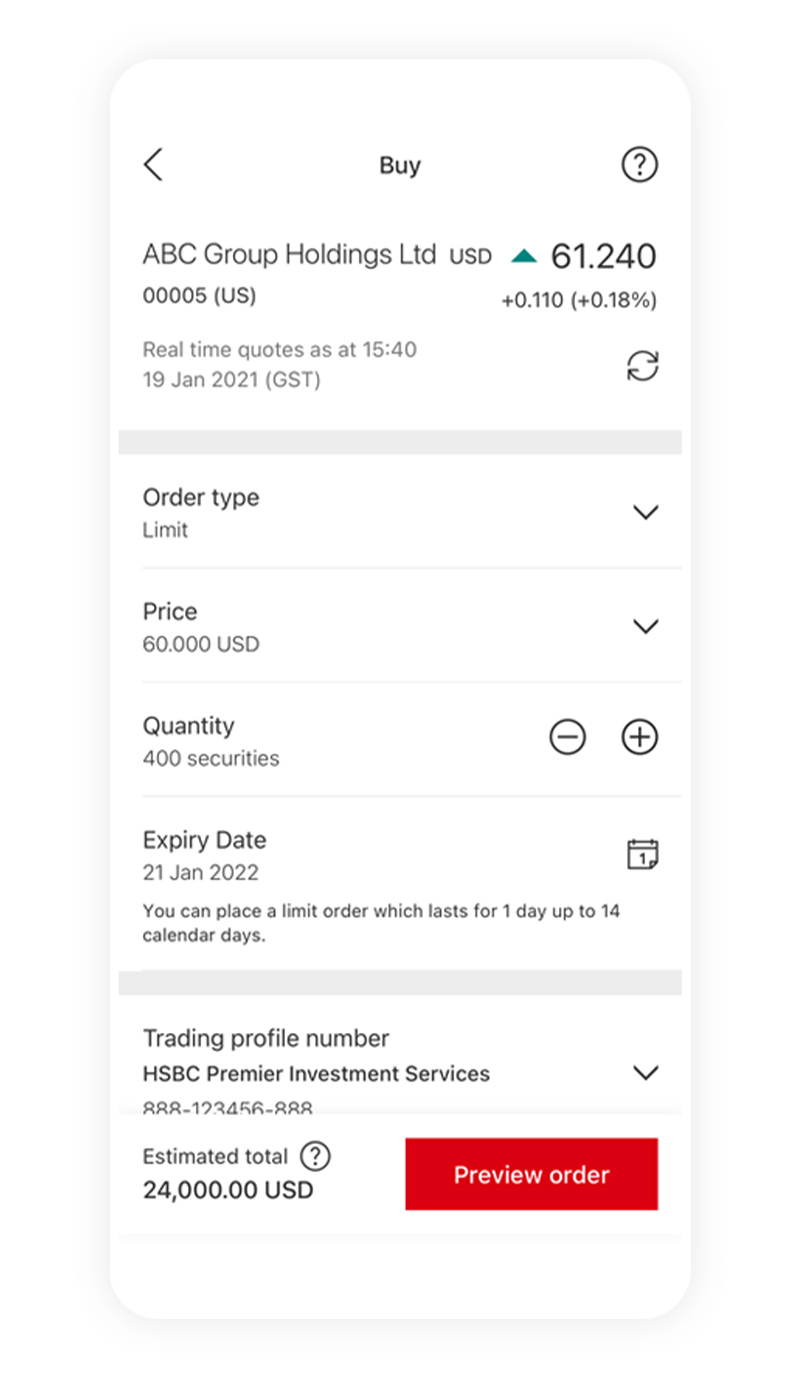

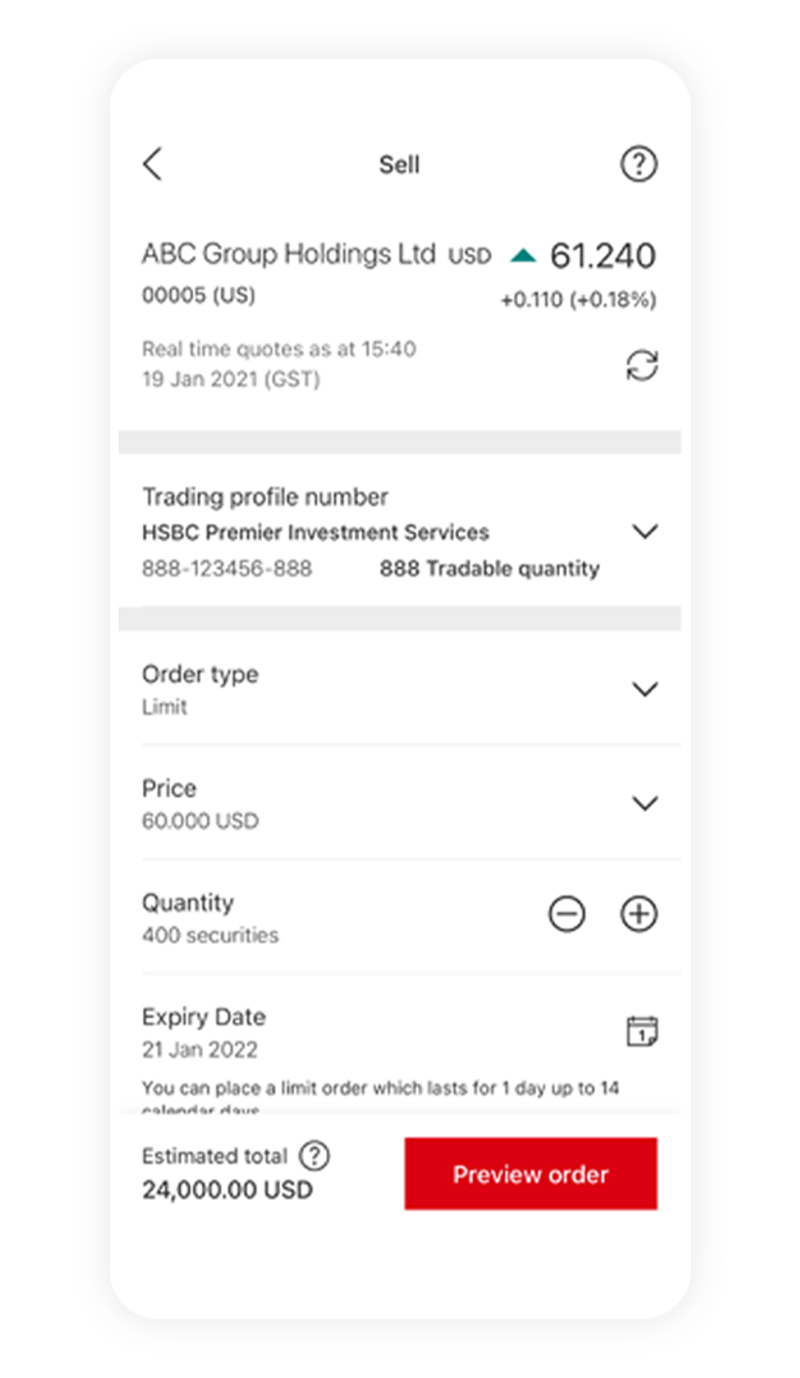

Mobile Equities

Step 1:

Log on to your HSBC UAE Mobile app and tap on the ‘Wealth’ tab.

Step 2:

View your holdings and performance updates.

Step 3:

Place your order in the world's biggest markets.

Step 4:

Place your sell order.

Premier Relationship manager contact details

Find your Relationship Manager's contact details

Log on to the HSBC UAE app, then select the 'Support' tab. Next, select 'Your HSBC Premier Team' to find your Relationship Manager's contact details.

If you can't find your Relationship Manager's details, or there's a problem with them, please contact Premier phone banking