5 August 2024

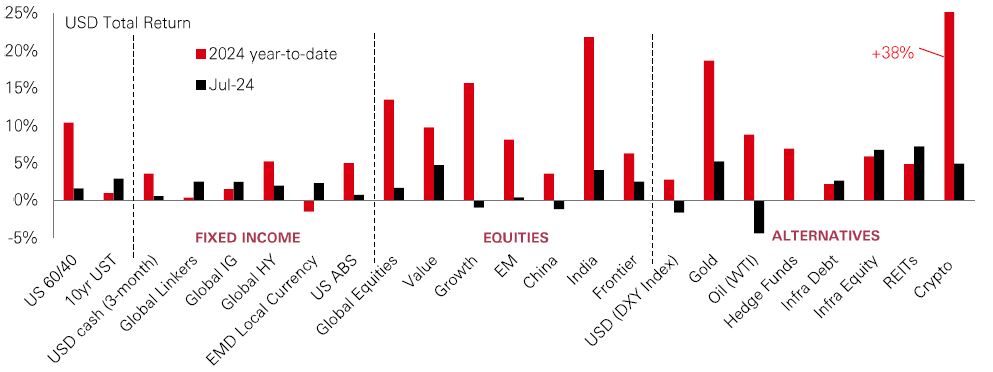

From the aeroplane window, the ground below can look flat, at least until you start the descent. So it goes in investment markets in July – global stocks are little changed for the month. But, when you get closer, there has been a lot going on.

First, there has been the material correction in the US tech sector. The Philadelphia Semiconductor Index plunged -11% from its peak during the month, with the sell-off extending into August. And the closely-watched Magnificent Seven (Mag7) stocks slipped, with stretched valuations, uncertain profits guidance, and geopolitical tensions all bothering investors. That had consequences for tech-sensitive markets in Asia, too, with prices falling in Japan, Taiwan, and South Korea.

Second, while most momentum trades faltered (except India and gold), unloved value and small-cap stocks rallied. Other defensive sectors, like infrastructure and real estate, also benefitted. This rotation – a broadening of market performance – is a healthy development for the stock market. But it will need to keep going to cover the lost Mag7 index points.

Third, encouraging news on disinflation, a renewed prospect of interest rate cuts in H2, and the soft landing coming into view, suggest the sector rotation story can continue. Equally, the rally in US government bonds helps bolster equity risk premia across the board. And while tech valuations are stretched, they are not historically-extreme.

A number of developments are set to create a more volatile ride in markets during H2. Nominal growth is slowing, and could slow faster – something that has weighed on China’s stocks in July. Geopolitical stresses and US elections will matter too.

Securitised credit has been one of the best-performing areas of the fixed income universe over the past two years – and that’s expected to continue through 2024. Pivotal to its outperformance is that it’s a floating-rate asset class. That means income returns have been bolstered by higher central bank policy rates. Resilient economic conditions have played a part too, with falling spreads driven by robust credit fundamentals proving ideal conditions for capital growth.

Despite expectations of near-term US rate cuts – and the Fed easing could start from September – securitised credit should still hold appeal. Some investment specialists expect US policy to gradually shift towards a terminal rate of around 3.5%, a level where income from the asset class would remain high. Plus, there are added advantages for portfolios. Over the long term, securitised credit offers low correlation and low volatility versus other fixed income sub-asset classes. It also has a lower correlation to US equities than corporate bonds, making it an attractive diversifier for multi-asset investors.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way.

Source: HSBC Asset Management. Macrobond, Bloomberg. See page 8 for details of asset class indices. Data as at 11.00am UK time 05 August 2024

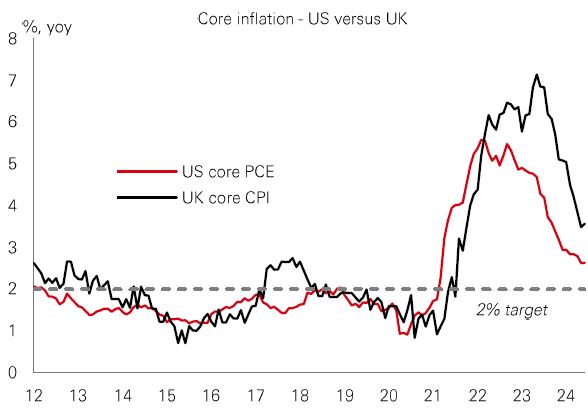

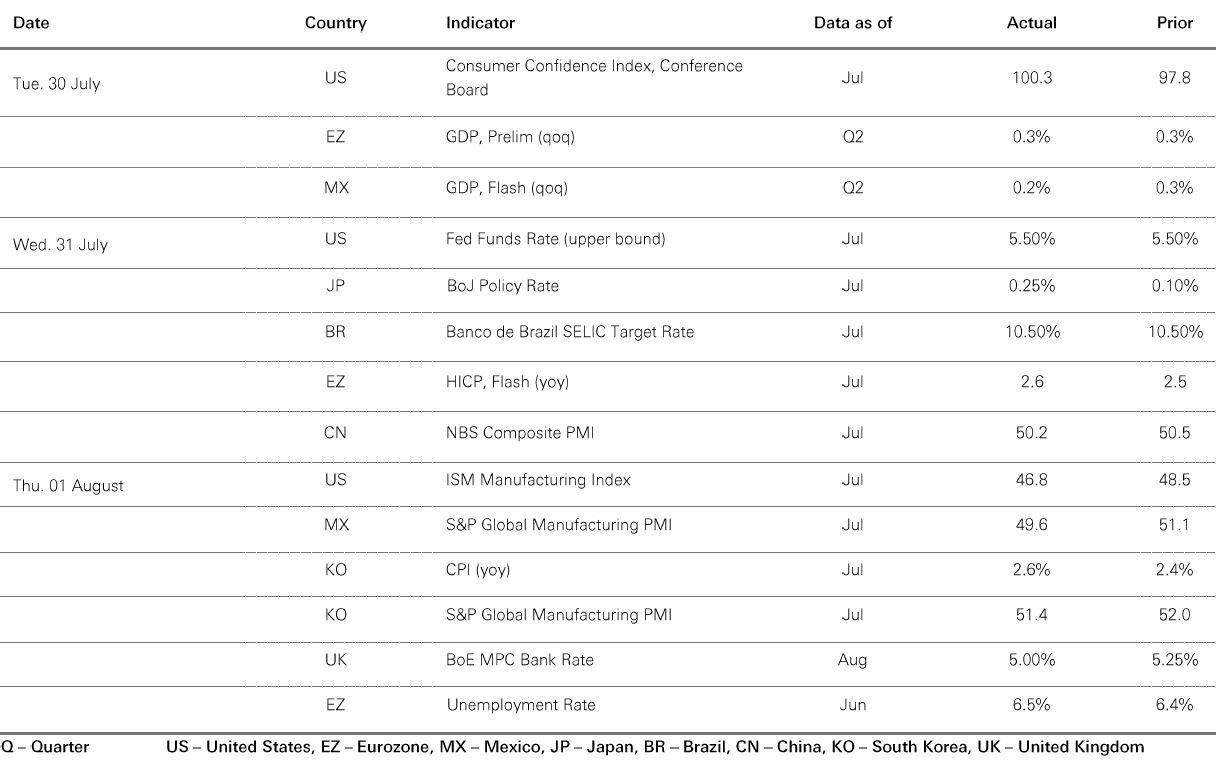

Both the Fed and the Bank of England (BoE) did what markets expected at their latest policy meetings – the Fed standing pat and the BoE cutting by 0.25%.

Core inflation is much closer to the target in the US than the UK and wage growth is more clearly moderating, which are consistent with a wide range of indicators showing that the US labour market is cooling. Moreover, the Fed has a dual mandate – inflation at target and full employment – whereas the BoE targets only inflation.

Looking ahead, the Fed may need to avoid further delaying rate cuts if it wants to secure the much talked of ‘soft-landing’. Gradual US slowdowns – such as those are seen at present – can morph into sharper slowdowns with little warning, and by that time, it is too late for policy makers to rescue the situation. The BoE, however, needs to stick to its guidance that it “will not cut rates too much or too quickly” given inflation is proving stickier in the UK than elsewhere.

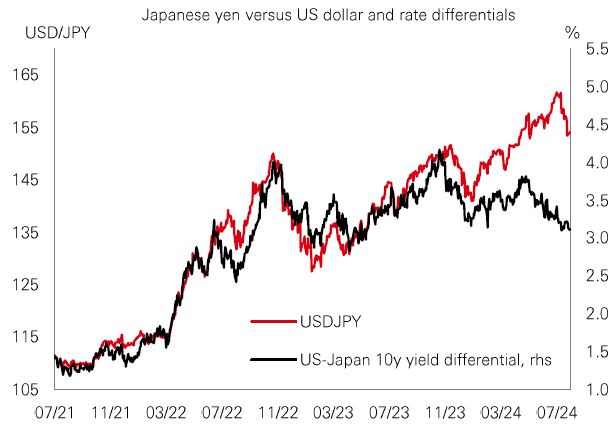

The recent sharp recovery in the Japanese yen is a big development for markets. The yen has been a major funding currency for carry strategies in recent years (where traders borrow yen to invest in higher-yielding currencies). But a strengthening yen – amid intervention by Japanese authorities – undermines the profitability of these trades, thus seeing them unwind. These carry trades may have also funded positions in other risk assets, possibly exacerbating the recent global tech sell-off. And a stronger yen potentially weakens domestic corporate profits, which is one reason why Japanese stocks sold off sharply last week.

While the pace of the yen rally looks unsustainable, there are good reasons to expect further recovery in the coming months.

The Bank of Japan’s gradual policy normalisation is important. But the more meaningful propulsion for the yen is likely to come from continued global disinflation. This could see interest rate differentials falling further in favour of the yen. 2024 promised to a be a good year for the yen – but maybe it’ll just be the second half?

The Q2 earnings season continues in the US, and the broad picture so far is positive. Profits across the largest stocks are on course to grow at an annual rate of 10% this quarter. Further out, the consensus view is that there will be similar growth for the year as a whole. Those sectors reporting the strongest growth last quarter include communication services, IT, financials, and healthcare.

But there have been some disappointments. ‘Big tech’ sectors are set to drive the bulk of profits growth this year. Yet, stocks on high valuations – like many in the tech sector – have been battered on any hint that blistering profits growth is at risk. That’s extended to some Magnificent Seven stocks – which have wobbled at times.

More broadly, restrictive rates and signs of economic stress – particularly in the consumer sector – are causing pain in places. Consumer staples has been lacklustre in Q2, and when you adjust-out the influence of Mag7 stocks, the same goes for consumer discretionary, too. The cooling growth and weary consumers could pose a risk to profits in places near-term.

Past performance does not predict future returns. The views expressed above were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 11.00am UK time 05 August 2024.

Source: HSBC Asset Management. Data as at 11.00am UK time 05 August 2024.

Global equities endured a sharp sell-off late in the week as markets digested disappointing economic data on US employment and manufacturing. It came after the Fed held rates steady ahead of expected policy easing from September, which triggered a fall in 10-year US Treasury yields. Mixed earnings news also played a part in the market-wide volatility, with ‘big tech’ stocks under pressure. Globally, the spillover was worst felt in Japan where the Nikkei 225 suffered a sharp reversal from recent all-time highs. Earlier last week, the Bank of Japan raised its policy rate to 0.25%. Elsewhere in Asia, India’s Sensex fell for the week, but China’s Shanghai Composite managed a modest gain. In commodities, the oil price was on course for its fourth consecutive weekly fall on signs of weak demand. Gold prices rebounded back towards record highs.

Note: Asset class performance on Page 1 is represented by the following indices:

US 60/40: Bloomberg EQ:FI 60:40 Index, Cash: JP Morgan Cash Index (3month), 10yr UST: ICE BofA 10yr US Treasury Index, Global Linkers: ICE BofAGlobal Inflation-Linked Government Index, Global IG: Bloomberg Barclays Global IG Total Return Index unhedged. Global High Yield Index: ICE BoFaUS High Yield Index, EMD Hard currency: US ABS: Bloomberg US ABS Floating Rate Total Return index; Bloomberg Barclays Global Aggregate Treasuries Total Return Index. EMD local currency JP Morgan EMBI Global Total Return local currency. Global Equities: MSCI ACWI Net Total Return USD Index. Value: MSCI Value Index, Growth: MSCI Growth Index, Global Emerging Market Equities: MSCI Emerging Market Net Total Return USD Index. China: MSCI China Index, India: MSCI India Index. Frontier: MSCI Frontier Markets Total Return Index, Alternatives: USD: DXY Index, Gold Spot $/OZ, Oil: WTI crude oil, Hedge funds: Credit Suisse Hedge Fund Index, Leverage Loans: JP Morgan liquid Loan Index, Infra Debt: iBoxx USD Infrastructure Total Return Index, Infra Equity: Dow Jones Brookfields Global Infrastructure Total Return Index, REITS Real Estate: FTSE EPRA/NAREIT Global Index TR USD. *Crypto: Bloomberg Galaxy Crypto Index.

This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (the "Bank") in the conduct of its regulated business in Hong Kong and may be distributed in other jurisdictions where its distribution is lawful. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks. You should read all scheme related documents carefully.

Copyright © The Hongkong and Shanghai Banking Corporation Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Issued by The Hongkong and Shanghai Banking Corporation Limited