23 September 2024

With the market pricing in a high probability of an outsized rate cut, the Fed decided it could be bold and deliver a 0.50% move at its September meeting. It reflected greater confidence that inflation is now in the rear-view mirror, and it is time for the Fed to switch its focus to maximising the chances of a soft landing.

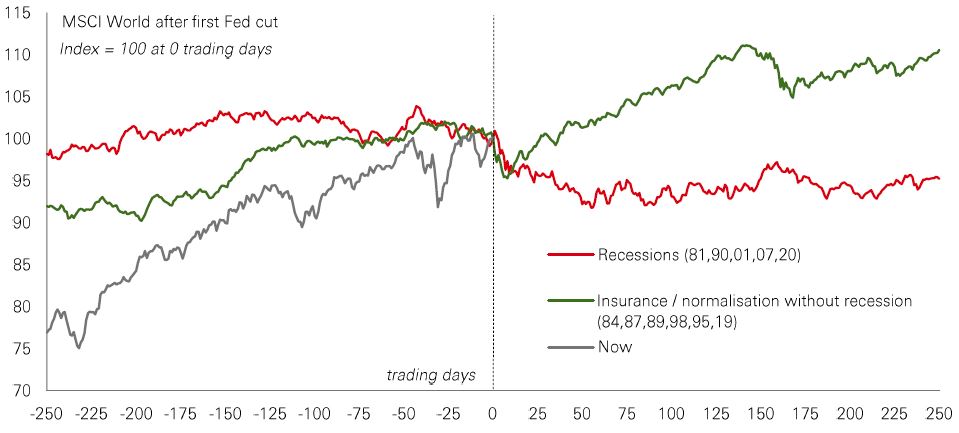

If delivered, the soft landing would be positive for risk assets. Globally, equities typically perform well in the year following the first Fed rate cut, so long as the US economy avoids a recession. The playbook for a soft landing is a ‘great rotation’ in markets, with value, small caps, and emerging markets outperforming while Treasury yields drift lower, the yield curve ‘structurally steepens’ and the USD weakens.

However, while the Fed has embarked on a cutting cycle, policy is likely to remain restrictive for some time yet. Combined with the current cooling trend in the labour market, this means recession risk could remain elevated heading into 2025. Additional sources of risk, such as election uncertainty or geopolitical stress, can also come into play. There could be a more volatile phase for investment markets. And if the much-vaunted soft landing turns into a hard landing, risk assets will struggle even if the Fed loosens policy by far more than currently expected.

Private credit has surged in popularity among investors in recent years. And with an average yield of nearly 12%, it continues to offer a return in excess of other credits, as well as the 9.5% average 10-year total return from stocks.

With traditional banks continuing to retreat from parts of the lending market – a trend evident since the financial crisis – private credit managers have stepped in. This has given both borrowers and lenders more flexibility on terms, with investors benefitting from the asset’s relatively low volatility and eye-catching returns.

New private credit fundraising slowed in 2023 and early 2024, with elevated rates putting pressure on some borrowers and reducing demand in places. But last week’s move by the US Fed to kick off its easing cycle could boost the environment for both fundraising and lending. And while lower base rates will inevitably trim returns over time, private credit is expected to remain a high yield asset class (on both an absolute and relative basis) – and one that offers an illiquidity premium that suits long-term investors. It also serves as a useful portfolio diversifier.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 20 September 2024.

As global policy easing accelerates, EM hard currency bonds are in a plum position. Although EM sovereign spreads remain historically tight, they have widened relative to DM high-yield spreads – a comparable asset class. This is puzzling given that EM sovereign bonds are a high-duration asset class, with average index duration nearly double that of global high yield and exceeding that of even US Treasuries.

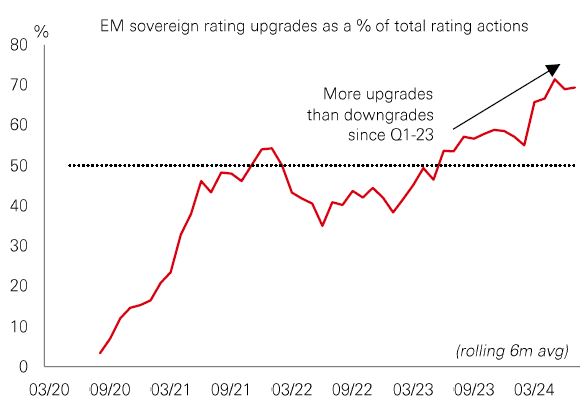

And according to some EM debt analysts, the story around fundamentals is also very favourable. After a decade of ratings downgrades, EM sovereigns have turned a corner. Since early last year, upgrades net of downgrades have turned positive and continue to trend up. Turkey is notable among large EMs for its upgrade momentum. There have also been ratings improvements in several frontier markets, notably Azerbaijan, Paraguay, Morocco, Namibia, Costa Rica, the Dominican Republic, and Serbia. This furthers the structural shift towards a better-quality index with more investment grade ratings, implying the potential for superior returns with lower risks.

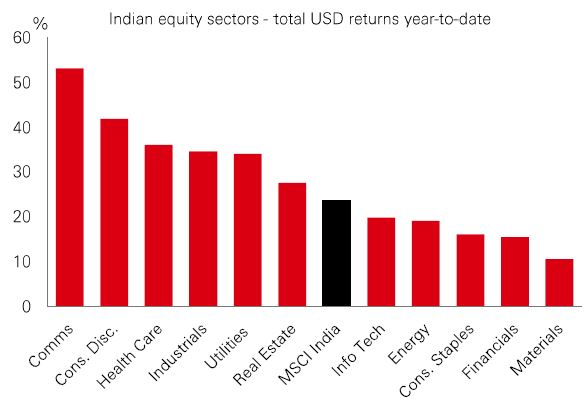

Indian stocks have outpaced most global markets this year, with the MSCI India index rising by 23%. After a bout of post-election volatility in Q2, foreign investment inflows have picked up in Q3, with investors gravitating to India’s relatively low dependence on external demand, expectations of policy continuity, and exposure to secular growth trends – especially in manufacturing, infrastructure, and consumption.

At the sector level, all areas have notched-up double-digit percentage gains this year. Communications and consumer discretionary have led with returns of 53% and 42% respectively. There have also been 25%-plus rises in the healthcare, industrials, utilities, and real estate sectors.

In terms of valuations, parts of the Indian market arguably look richly-priced. Small and mid-cap stocks, in particular, currently trade on a forward 12-month price-earnings ratio of 31.5x. But large-caps trade on a more modest 22.5x. Sector-wise, the valuations for financials are less stretched; healthcare, which is seeing multi-year demand growth; and real estate, which is benefitting from improving demand and supply dynamics.

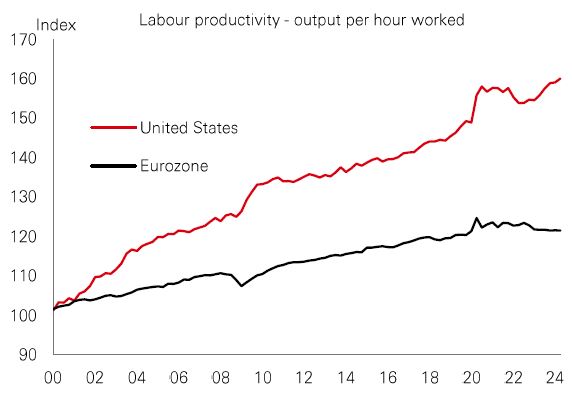

A recent report by ex-European Central Bank president Mario Draghi into the EU’s poor competitiveness, has blamed a yawning EU/US productivity gap over the past 20 years.

The eurozone’s structural problems are well documented. Draghi mentions three: (1) low investment, outright and relative to the US; (2) the innovation gap with the US and China, with EU firms stifled by regulation, and (3) fragmented capital markets.

Draghi’s recommendations range from importing foreign technologies to completing a banking union and ensuring the green transition continues. The report estimates the additional investment needs a hefty Eur750-800bn per year (around 4.5% of EU GDP).

But implementation is a tall order given rising EU political fragmentation. Not only is Germany’s enthusiasm for joint bond issuance cooling but a new French government is unlikely to welcome further EU integration.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. Diversification does not ensure a profit or protect against loss. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream, BofA Global Research. Data as at 11.00am UK time 20 September 2024.

Source: HSBC Asset Management. Data as at 11.00am UK time 23 September 2024. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice.

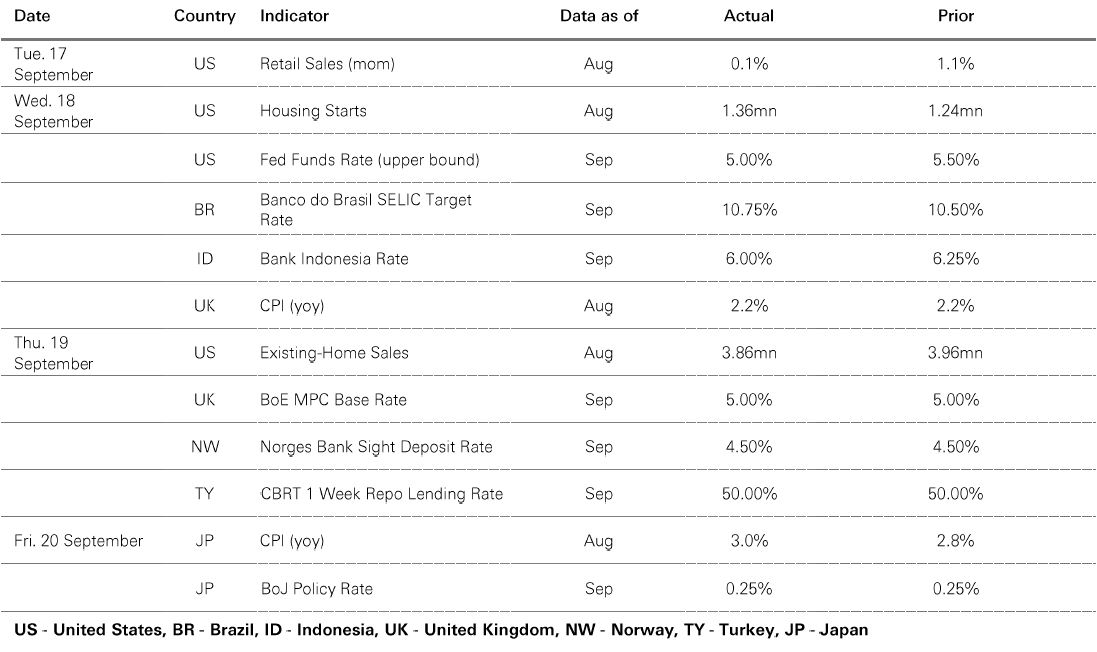

The Fed’s bold 0.50% rate cut boosted risk appetite, with credit spreads tightening. US Treasuries underperformed German Bunds, with the US yield curve steepening further on higher 10-year yields. Fed Chair Powell stated: “it is time to recalibrate policy”, with the FOMC’s median 2024 and 2025 interest rate expectations marked down by 0.75%. In the US, the S&P 500 powered to a fresh high, with the rate-sensitive Russell 2000 index also performing well. The Euro Stoxx 50 index posted strong gains, while Japan’s Nikkei 225 was boosted by a softer yen as the BoJ left policy on hold amid “high uncertainties”. In emerging markets, Hong Kong’s Hang Seng outperformed in a holiday-shortened week, and Brazil’s Bovespa index fell as the Banco de Brasil raised rates by 0.25%. In commodities, rising geopolitical tensions lifted oil prices. Gold reached an all-time high, and copper strengthened.

This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (the "Bank") in the conduct of its regulated business in Hong Kong and may be distributed in other jurisdictions where its distribution is lawful. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks. You should read all scheme related documents carefully.

Copyright © The Hongkong and Shanghai Banking Corporation Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Issued by The Hongkong and Shanghai Banking Corporation Limited