10 March 2025

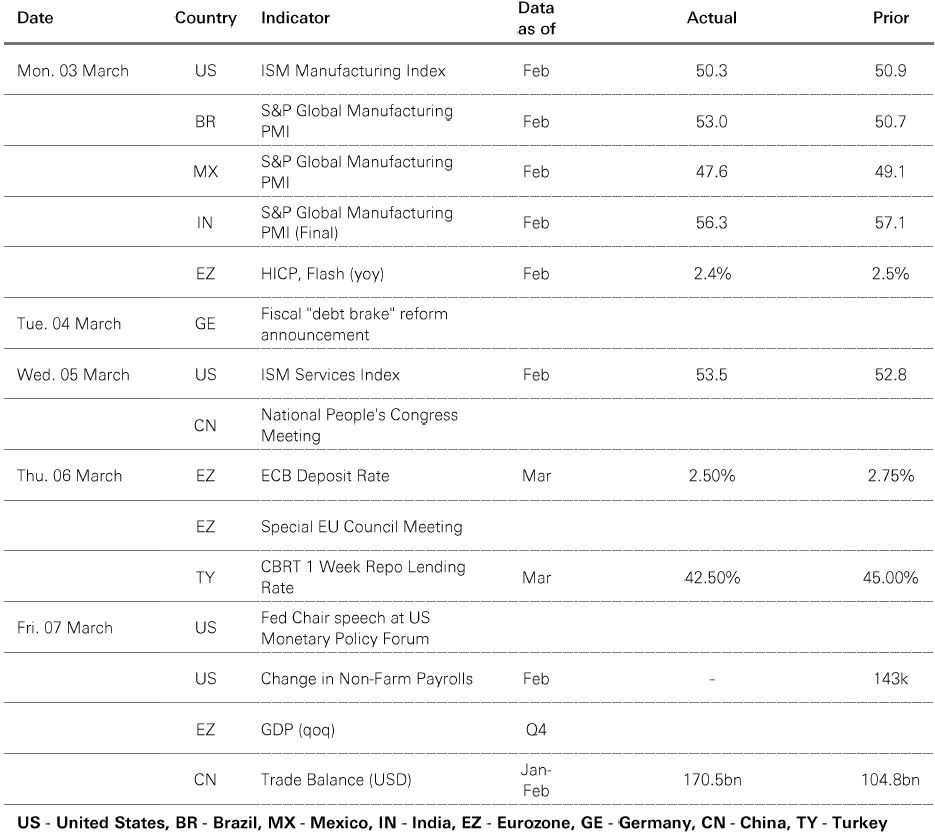

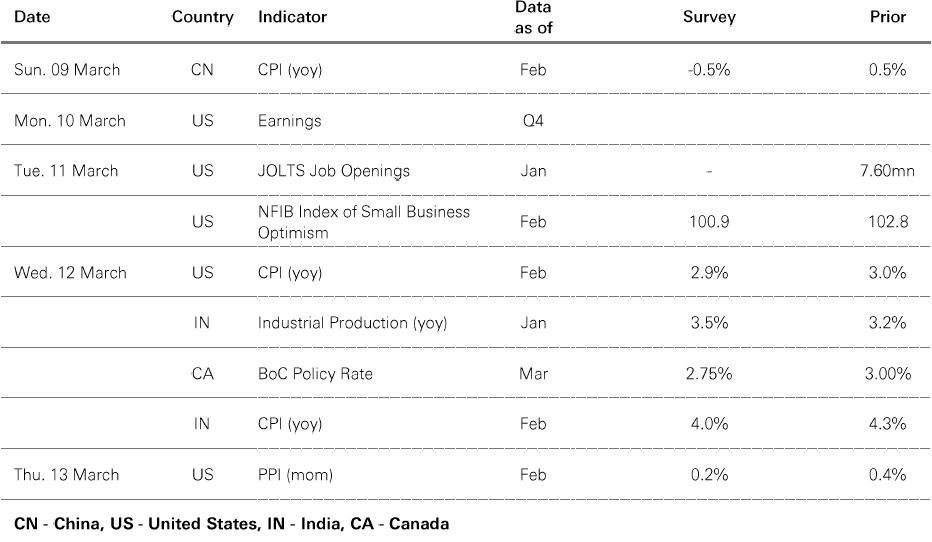

China’s annual National People’s Congress got underway in Beijing last week. Against a backdrop of trade tensions and economic headwinds, all eyes were on further policy support. Premier Li Qiang delivered the government work report outlining fiscal targets and policy priorities for 2025. China is once again targeting GDP growth of “around 5%” this year and has lowered the inflation target to 2%, from 3%, reflecting the country’s low inflation reality.

The overall tone was growth-supportive and market friendly, with the reiteration of “more proactive” fiscal policy and “moderately accommodative” monetary policy. Rather than new stimulus, the emphasis was on policy execution and clearing implementation hurdles (especially for the property sector and local government debt management). For now, China looks set to take a wait-and-see approach to elevated global economic and trade policy uncertainty.

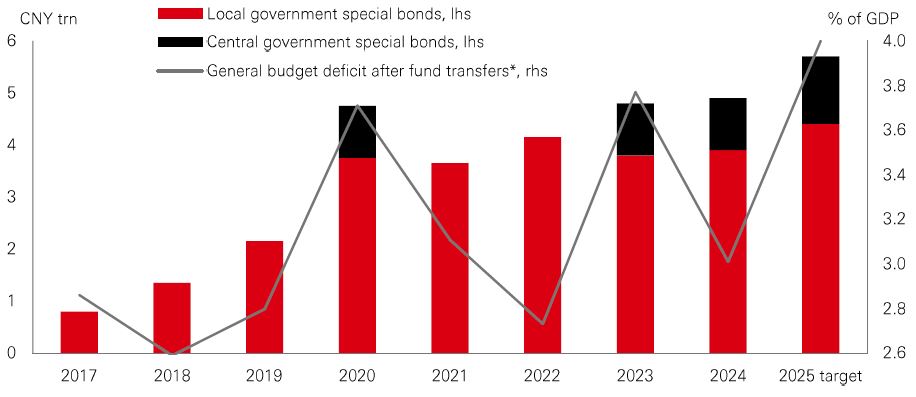

Chinese policymakers have significant policy space to boost domestic demand, if needed. On fiscal targets, the government raised its general budget deficit target to 4.0% of GDP, the widest in decades (up from 3.0% of GDP in 2024). It also plans to issue CNY 1.3trn in ultra-long special treasury bonds (CGBs) this year (up from CNY 1trn in 2024). Local governments will be allowed to issue CNY 4.4trn of new special bonds, up from CNY 3.9trn in 2024.

In terms of policy direction, boosting consumption is now a top priority. There is also a focus on technology innovation and upgrading industry, especially through AI and digital tech. The government also pledged more support for the property sector and the stock market. Overall, the plans confirm a Chinese policy put to support growth. In a global context, it comes amid a fiscal sea change in Europe (see next page) and fading US exceptionalism.

Asian manufacturing PMIs have remained in expansionary territory in recent months, partly reflecting export front-loading ahead of potential US tariffs and some seasonal effects. However, recent surveys also reveal some important country differences. In some cases, the latest sentiment indicators are at odds with stock market performance.

In India, for instance, a composite PMI of 58.8 in February remained firmly in expansion territory, boosted by services activity. Yet the MSCI India index has been Asia’s worst performer in Q1. Other Asian economies like Taiwan and Indonesia have also posted modestly improving +50 PMIs, and they too have seen their stock markets in retreat.

By contrast, PMI data for South Korea showed a shift to contraction territory in February, despite its stock market delivering positive returns this year. While in mainland China, the average January-February manufacturing and composite PMIs, albeit above 50, were marginally lower than their Q4 averages. But mainland Chinese stocks have rallied hard in 2025. Hong Kong equities have also performed well, despite weaker recent PMI readings. So, while PMIs are a useful check on business sentiment, stock markets are driven by more than just macro momentum – sectoral developments, valuations, profits trends, embedded risks, investor sentiment, and even global fund flows all play a part.

* Fund transfers include withdrawals from the stabilisation fund, leftover funds carried forward from past year(s), and transfer from state capital budget and government funds. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 07 March 2025.

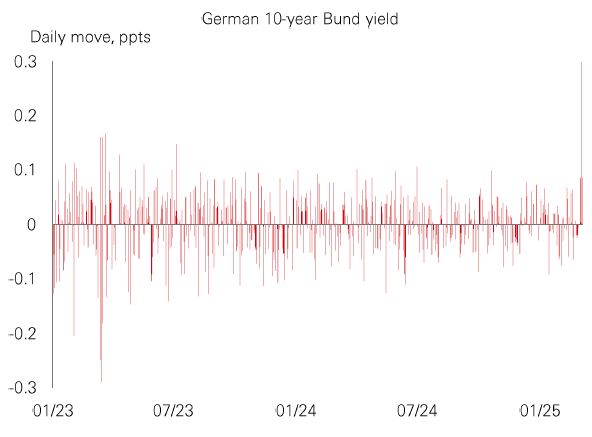

The ECB’s delivery of its widely anticipated sixth 0.25% cut of this cycle was overshadowed by German fiscal developments last week. Borrowing a famous line from the former ECB President Draghi, Chancellor-in-waiting Merz vowed to “do whatever it takes” to defend the country. While proposed changes to the German debt brake to allow for more defence spending are part of the package, the potential game changer is a EUR500bn (c. 12% of GDP) special infrastructure fund. This will be spent over 10 years and is not subject to the debt brake. |

The proposals imply much looser German fiscal policy over the coming years, which should support growth from 2026 (it will take some time for investment projects to get up and running). Bund yields surged by over 0.2% on the announcement, diverging dramatically from the trend in UST yields. Despite this, the Euro Stoxx 50 also jumped by over 2%. Low eurozone growth expectations and eurozone equities trading at a significant discount to the US create a low bar for positive economic and policy surprises to drive further eurozone equity outperformance.

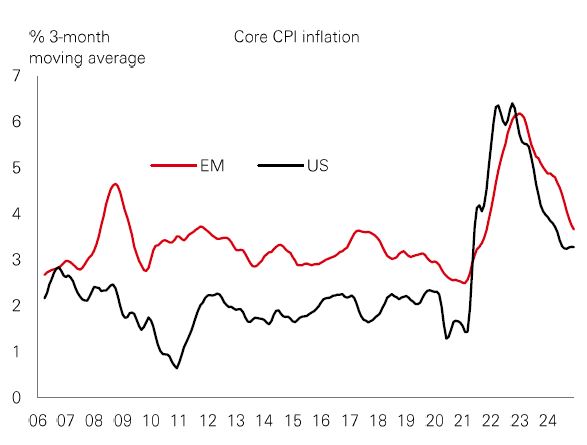

Amid all the recent noise around global trade policy shifts, there has been some positive macro and market developments for the emerging markets universe. First and foremost, in a reversal of well known “Trump trades”, the US dollar has lost ground since the start of the year and US bond yields fell sharply last month. This eases global financial conditions and dollar-denominated debt burdens, and buoys EM currencies. Increasing speculation of a “Mar-a-Lago accord” to weaken the dollar is a reminder that the direction of the greenback isn’t a one-way bet in 2025. Meanwhile, EM underlying inflation continues to freefall, in contrast to US price trends which are displaying signs of stickiness. EM and US inflation could cross paths later this year. Outside of the covid pandemic, this was last seen in 2006 just before “the age of austerity” in the west contributed to keeping inflation rates depressed. |

Overall, these factors provide breathing space for EM central banks to enact further rate cuts, providing a bulwark against external shocks, while helping to unlock value in many EM asset classes. But as usual, a one-size-fits-all approach to assessing the outlook for EMs risks over-simplification, and a selective approach will be crucial.

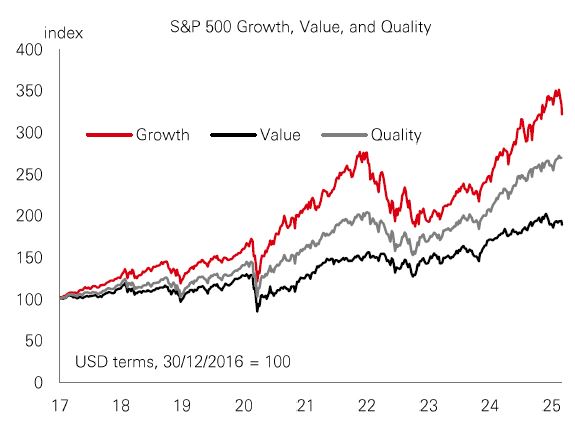

Another bout of episodic volatility in global markets last week continued to weigh on US growth stocks. After a rip-roaring run over 2023 and 2024, the S&P 500 Growth index is down 2.5% year-to-date. Recent Growth weakness is not as extreme as it was in late 2022. Back then, US tech was pummelled by the ramp up in interest rates and the dollar rally that weighed on foreign revenues. The post-pandemic run-up in prices rapidly unwound, with Value proving to be the superior factor, benefiting from higher inflation and rates. So where next for the factors in 2025? While the growth-heavy IT and communication services sectors have seen earnings optimism weaken recently, it could be too early for a material retracement in Growth. AI is likely to remain a significant driver of earnings momentum and interest rates remain on a downward trajectory. |

But recent trends are a reminder that expensive valuations can be a precursor to market volatility. It may also hint at a potential pick-up for left-behind Value. What’s more, in a complex environment where the only certainty is uncertainty, maybe the more resilient and dependable Quality factor could be the winning style in 2025.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 07 March 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 07 March 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets traded mixed amid ongoing concerns regarding US trade policy, with the US dollar index weakening on questions over US “exceptionalism”. In Europe, the ECB lowered rates by 0.25%, with president Lagarde stating that monetary policy was becoming “meaningfully less restrictive”. While US Treasuries were range-bound, a significant shift in German fiscal policy prompted a surge in 10-year German Bund yields, bear steepening the curve, driven by rising supply worries. Among the stock markets, the US saw widespread weakness and underperformed its global peers. The Euro Stoxx 50 index edged higher, as the German DAX rallied and reached a new high. Japan’s Nikkei 225 edged lower as the Japanese yen strengthened. In emerging markets, Asian equities mostly rose, led by the rallies in Chinese equities as policymakers signalled a pro-growth stance at the 2025 NPC meetings. Major Latin American stock markets were up modestly. In commodities, oil fell on rising supply worries, while gold and copper rose.

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available, HSBC Bank (China) Company Limited, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, HSBC Investment and Insurance Brokerage, Philippines Inc, and HSBC FinTech Services (Shanghai) Company Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high-level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third-party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

Important information on ESG and sustainable investing

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.